China and India dominated the P-Nitrochlorobenzene market in 2019, and witnessed high growth in demand from dyes & intermediates applications

P-Nitrochlorobenzene is pale yellow, solid organic compound having molecular formula ClC6H6NO2. It is also known as 1-Chloro-4-nitrobenzene, 4-Chloronitrobenzene, PNCB, and Para-Nitrochlorobenzene. P-Nitrochlorobenzene can be produced by nitration of mono chloro benzene. It is used as an intermediate in the manufacturing of various products including P-Nitroaniline (PNA) and other end use products. The major application of P-Nitrochlorobenzene includes dyes & pigments, pharmaceuticals, agrochemicals, chemicals & polymers and others.

Dyes & pigments is the major application of P-Nitrochlorobenzene, followed by pharmaceutical applications. Dyes & pigments accounted for more than 38% of the global P-Nitrochlorobenzene market. Pharmaceutical application followed dyes & pigment application in terms of demand. It is mainly consumed in production of paracetamol, phenacetin & other drugs.

Global P-Nitrochlorobenzene market is mainly driven by Asia-Pacific region owing to strong demand from end use applications in China & India. China is major producer as well as consumer of the P-Nitrochlorobenzene and accounts for more than 75% global capacities for P-Nitrochlorobenzene. Indian P-Nitrochlorobenzene market has grown with significant growth rate in two last decades. All the other regions except Asia-Pacific will grow below the average growth rates.

P-Nitrochlorobenzene market Drivers

Rising Capacity Additions in the Applications Industry

India witnessed additions in the existing capacities of P-Nitrochlorobenzene, which indicated a strong growth in its demand. Various new environmental clearance applications have been approved in recent years for future capacity expansions or new plant set up in India. This shows new upcoming capacity additions by various players in the P-Nitrochlorobenzene market. Rising demand for PNCB from dye manufacturers, API manufacturers and other chemical producers is pushing the new capacity additions in the country. Leading P-Nitrochlorobenzene producers are integrating their production facility to increase their profit margin and also to cope up with the increasing competition from Chinese players. Conclusively new and upcoming capacities in India are bolstering the P-Nitrochlorobenzene market growth.

-Increasing Demand for Intermediate Chemicals in Dyes & Pigments and Rubber Chemicals

-Rapid Growth of Pharmaceutical Industry in the Developing Countries, mainly in China & India. (Manufacturing of Paracetamol)

Restraints

- Carcinogenic Hazardous Nature & Stringent Environmental Norms

- Transportation and Storage is one of the Major Challenge, as Molten Form requires Heated Tanks

- Volatility in Raw Material Prices & Fluctuations in Currency

Opportunities

- Increasing Populations and Per Capita Expenditure in Asian Countries

- Increasing Textile Market Provide Further Scope for Capacity Expansions

- Pollution & Effluent Problems and Need for Innovative Techniques

- Robust Growth in End Use Industry

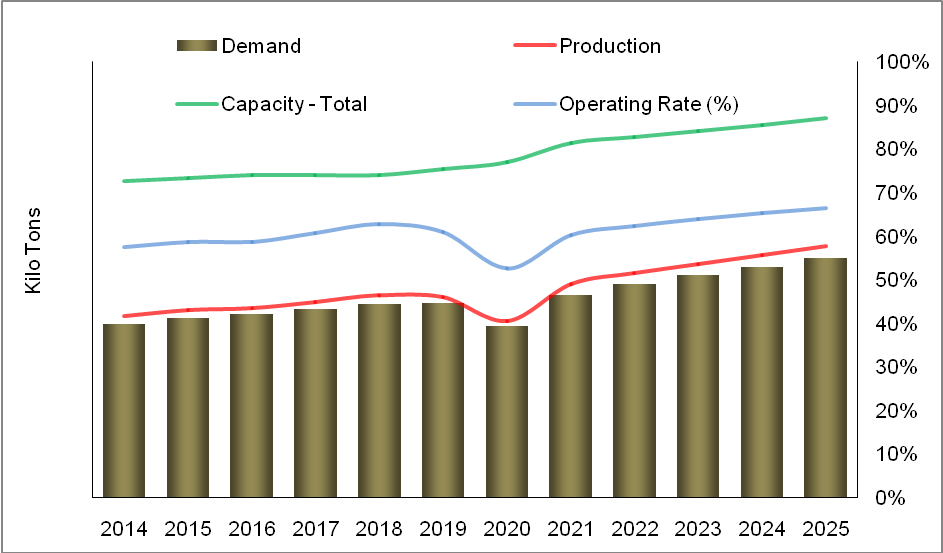

Historically in 1960 the P-Nitrochlorobenzene production was at its peak in the United States and Western Europe. After 1990 the shift of capacities was towards the Asia-Pacific region mainly to China. The utilization rate in 2019 was around 61%, on account of low operating rates in China.

Anhui Bayi Chemical Industry Co., Ltd. is the major producer of P-Nitrochlorobenzene. Top 5 producers together accounted for a market share of more than 70%. China & India are the only producing countries owing to strict government norms for effluents and environmental concerns in the developed countries. India has potential to grow rapidly in specialty chemicals and many players in specialty chemicals such as Aarti Industries Ltd, Seya Industries, Hemani Group and Bodal chemicals have invested in expanding their existing specialty chemicals production capacities.

In last few years, stringent government norms have caused the growth of P-Nitrochlorobenzene and its end-use industries in China to slow down. Some of the companies have reduced operating rate while other companies are already on the urge of closure. If the same trend continues, it will be a great opportunity for India to increase its market share and for other Southeast Asian countries to enter the P-Nitrochlorobenzene market.

The global operating rates were around 60% during 2014-2019, mainly as a result of overcapacities in China. The demand for P-Nitrochlorobenzene is expected to be slightly affected in 2020 with market contracting by an average of 11%; however, the demand will recover steadily after 2021.

In our long term forecast to 2025, we expect operating rates to remain around 60% as new P-Nitrochlorobenzene capacities are expected to come on stream and demand continues to gradually increase. All the capacity additions are expected in the Asia-Pacific region and majorly in India. Company like Aarti Industries is planning capacity additions, while Bodal Chemicals and Hemani Group stepped forward to enter in the P-Nitrochlorobenzene market. There are possibilities of few production capacity additions in Southeast Asian markets mainly in countries like Vietnam, Malaysia or Indonesia. Asia-Pacific accounts for largest share of P-Nitrochlorobenzene demand in 2014 and increased its consumption with around 4% during 2014-2019.

Asia-Pacific P-Nitrochlorobenzene Demand Analysis (Kilo Tons)

Note: all images are for illustration purposes only

Prismane Consulting has considered a higher growth rate in comparison to historical trends for P-Nitrochlorobenzene (PNCB) during the forecast period in the major region due to the following assumptions

- Sudden drop in demand in 2020, due to COVID-19 crisis globally, which is assumed to get balanced during the forecast years.

- Higher growth in India is expected which is witnessed by new capacity additions in the future are in tandem with the forecast view.

- Increasing demand is also witnessed in application industry in India to supply end use product of PNCB globally.

Prismane Consulting’s LinkedIn Posts Click here

For more details on P-Nitrochlorobenzene (PNCB) Market, please contact us at sales@prismaneconsulting.com

For Scope of Report Click here

(0) Comments

Leave A Comment