Acrylonitrile Capacity Overview

In 2022, the global acrylonitrile capacity stood at 8600 kilo tons with Asia Pacific accounting for almost 70% of the global installed capacity of acrylonitrile, which translates to around 5960 Kilo tons, followed by North America at 18%, Western Europe with 7% share, and rest of world accounting for nearly 5%. According to Prismane Consulting estimates, the global acrylonitrile capacity is anticipated to cross 12,600 Kilo tons by 2032 with majority of capacity addition expected mainly in China. Between 2016 and 2021, acrylonitrile capacity utilization rates in the region averaged at 85% and are expected to remain in the 70s during the forecast period owing to major capacity addition in Asia Pacific.

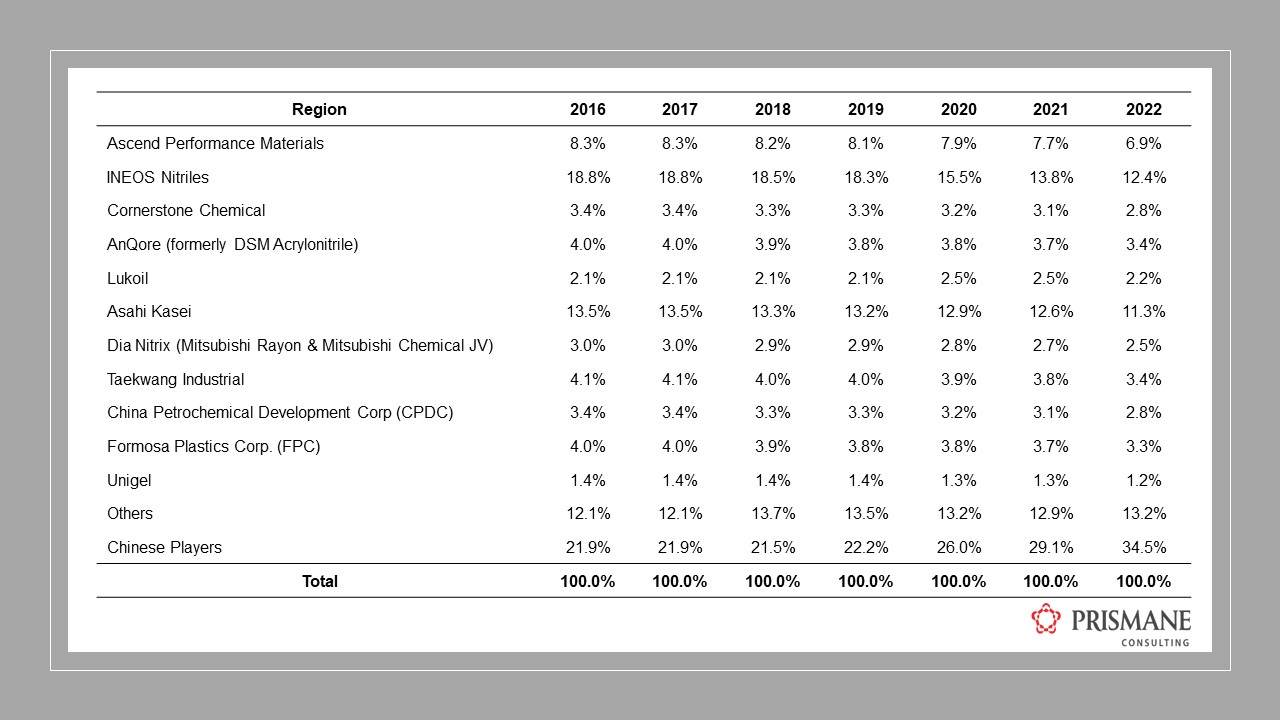

Acrylonitrile Capacity By Company

As of 2022, INEOS Nitrile is the largest global producer of acrylonitrile operating 4 plants with an installed capacity of over 1050 kilo tons, accounting for over 12% of the global acrylonitrile capacity. Asahi Kasei is the second-largest producer, accounting more than 11% of the global acrylonitrile capacity, followed by PetroChina Petrochemical and Jiangsu Sailboat Petrochemical, which have a combined share of over 17% with production facilities located in China.

Global Acrylonitrile Capacity, By Company - 2022 (Kilo Tons)

Source: Prismane Consulting Capacity Database

Asia Pacific Acrylonitrile Capacity

Asia Pacific is the largest producer and consumer of Acrylonitrile in the world. Total capacity in the region stood at 5,960 kilo tons in 2022, split between China, Japan, India, South Korea, Taiwan, and Thailand. More than 5,960 kilo tons of the regional Acrylonitrile capacity resides in China, accounting for a 64% and a 44% share of global Acrylonitrile capacity. Several Acrylonitrile producers operate in the country, with Shanghai SECCO, Zhejiang Petrochemical and PetroChina Jilin, collectively representing more than 60% share.

Asahi Kasei and Dia-Nitrix are major Acrylonitrile producers in Japan, while Tong Suh Petrochemical (subsidiary of Asahi Kasei) and Taekwang Industrial are the only Acrylonitrile producers in South Korea.

Taiwan is home to two Acrylonitrile producers, China Petrochemical Development Corp (CPDC) and Formosa Plastics Corp. (FPC), together with a capacity of 520 kilo tons.

Thailand and India have one domestic Acrylonitrile producer each. India also has small capacity of 41 kilo tons operated by Reliance Industries.

South Korea is second largest Acrylonitrile producer in Asia Pacific with capacity share of 14% translating to 850 kilo tons. Tung Suh Petrochemical subsidiary of Asahi Kasei and Taekwang Industrial are two producers with capacity of 560 kilo tons and 290 kilo tons respectively.

Japan and Taiwan have Acrylonitrile capacity share of around 9% each. Asahi Kasei, Dia Nitrix, CPDC and Formosa are prominent Acrylonitrile producer in these countries.

Acrylonitrile Capacity Additions

By 2032, around 3000 kilo tons of new acrylonitrile capacity is projected to be added in the Asia Pacific, mainly in China. Among present large acrylonitrile producers in China, PetroChina Petrochemical, Zhejiang Petrochemcial and Jiangsu Sailboat Petrochemical are planning to add a total capacity of 1700 kilo tons by 2032. Multiple new capacities are expected to get started between 2023 to 2027 with average capacity size of 260 kilo tons. Some other prominent players planning to add capacity are Kinga, CNOOC, and Tianchen Qixiang New Material.