Acrylonitrile Production in the Americas in Jeopardy Amid Financial Headwinds and Operational Challenges

Acrylonitrile Capacity Closures in the Americas

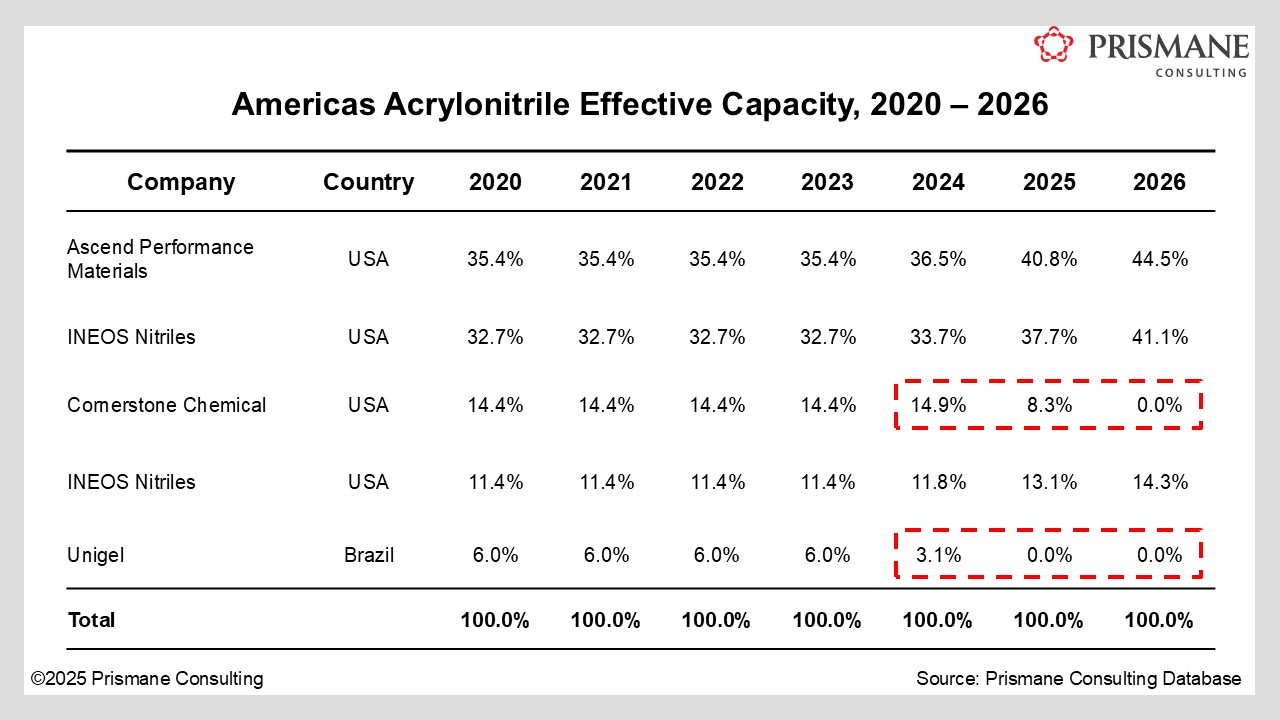

Last week, Cornerstone Chemical confirmed it would cease production at its acrylonitrile plant at Waggaman, Louisiana, by the end of June 2025, citing escalating feedstock costs and the ongoing oversupply in the market. The plant has a production capacity of 240 kilo tons/year. Between Unigel’s shutdown of its Bahia, Brazil, facility with a capacity of 100 kilo tons/year, this is a more than 20% reduction in the effective acrylonitrile capacity of the Americas region (see Exhibit 1).

Ascend Performance Materials and INEOS Nitriles are among other acrylonitrile producers in the USA. Ascend operates its facility at Chocolate Bayou, Texas, while INEOS Nitriles operates two plants: one at Calhoun County in Texas, and another at Lima in Ohio. Unigel, meanwhile, is the sole acrylonitrile producer in Brazil.

Acrylonitrile Operating Rates

The continued build-up of excess capacity in Asia Pacific, particularly in China, has led to a sequential decline in global acrylonitrile operating rates in recent years; from hovering in the mid-80s pre-COVID, utilization levels have since dropped to the low 70s. Plant closures, such as INEOS’ Seal Sands, UK facility in 2020 and Mitsubishi Chemical’s more recent closure at Hiroshima, Japan, in mid-2024, have offered little respite, as operating rates remain under pressure.

Americas Acrylonitrile Trade Dynamics

Unigel has attributed the halt in its operations to falling prices driven by acrylonitrile market oversupply. The company is currently undergoing a significant restructuring process and “expects to resume operations should market conditions improve.” However, if the plant were to shut down permanently, Brazil would become a net importer of acrylonitrile, given there are no other manufacturers. Acrylonitrile produced by Unigel are exported primarily to Mexico, Turkey, and India.

Impact on Acrylonitrile Market

Acrylonitrile-Butadiene-Styrene (ABS), Adiponitrile and Acrylamide are among the key applications for acrylonitrile demand in the Americas. Exhibit 2 illustrates the derivative capacity for acrylonitrile in the region. Prismane Consulting forecasts a significant decline in the Americas acrylonitrile market in 2025 owing to these developments, as well as shifts in trade dynamics.