Americas Maleic Anhydride Market

Increased raw materials and energy costs, disrupted logistics, and shortages of key raw materials continued to affect the maleic anhydride (MHA) market in the Americas in Q4-2022. Harsh destocking was observed in Q4 compared to Q3, combined with competitive pricing. In the USA, the hiking of repo rates by the US Federal Reserve had a braking effect on industrial activity, especially construction, which had performed well until the early second quarter (with the USA housing inventory at record lows and home sales moving towards pre-pandemic levels). As a result, new housing starts fell considerably compared to Q3. Seasonality further exacerbated this situation, as buyers rushed to normalize inventory levels.

In 2022, automotive demand was softer in Latin America compared to North America. While the industry did show improvement in North America, the growth was insufficient to overcome the decline seen in 2020, and the market remained down due to supply chain issues thwarting demand. Light vehicles, in particular, took a big hit in the USA, with sales stooping to record lows. Ripple effects caused by the Russia-Ukraine war sparked a new round of microchip shortages just when automakers were hoping for a gradual easing in the previous supply deficit situation by Q2-2022.

Tight inventories proved to be another restraining factor, especially during the first two quarters. Overall, automotive demand in the Americas improved quarter-on-quarter in 2022, although sales still remained down compared to 2021. Sales of electric vehicles, however, managed to maintain momentum. Tesla, Ford, and Hyundai Motor reported better production and sales in 2022 compared to the previous year. Amid several issues, favourable foreign exchanges were a driving factor for the maleic anhydride markets in 2022. In the USA, currency effects remained positive, largely supported by the appreciation of the US Dollar against the Euro.

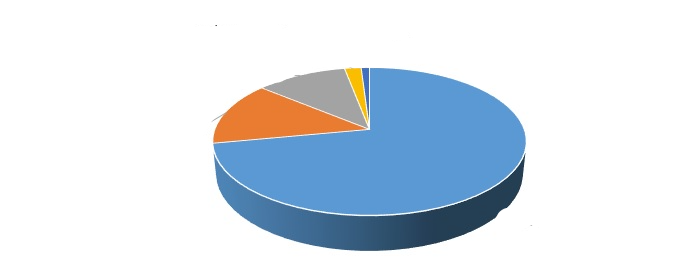

The exports of maleic anhydride from the USA totaled 38.6 kilo tons in 2022. In Q4-2022, the country exported 6.1 kilo tons of maleic anhydride, with Mexico accounting for more than 55% of the shipped shipments. Approximately 22% or 1.3 kilo tons were sourced to Germany, while 9% was exported to Canada. Colombia and the United Kingdom were other notable trade partners, collectively responsible for around 12% of the USA s exports. While the USA is a net exporter of maleic anhydride, it also imports small volumes of maleic anhydride from Canada s Bartek Ingredients plant in Ontario. Between October and December, the USA imported 3.3 kilo tons of maleic anhydride supplies.

In the last quarter of 2022, Brazil imported 4.1 kilo tons of maleic anhydride. In addition to domestic supplies from Elekeiroz s 30 kilo tons/annum plant in Várzea Paulista, buyers in the country primarily imported shipments from China and Argentina. China represented over 70% of the purchased shipments, while supplies from YPF s plant in Ensenada, Argentina, accounted for an 18% share. Nearly 5% or 213 tons of supplies were also sourced from Polynt s two plants in Italy.

No significant changes were observed in domestic supply, and Brazilian imports are thus expected to remain strong during 2023. With no major producers of maleic anhydride, other countries in Central and South America primarily rely on imports to meet demand. Colombia is a notable importer in the region, with import volumes totaling 596 tons in Q4-2022. While the country has imported small volumes of maleic anhydride from other countries such as Argentina and Korea in the past, it primarily relies on supplies from the USA and China.

Two maleic anhydride plants are expected to be added in the North America region, both located in the USA. TCL Specialities, the India-based subsidiary of Thirumalai Chemicals Limited (TCL), began construction of its n-butane based maleic anhydride plant in Marshall County, West Virginia, in January 2023. The purpose of this plant is to meet the growing domestic demand for coatings and reinforced polymers, reduce the country s reliance on imports, and export significant volumes to Western European and Latin American regions. The plant, with a production capacity of 25 kilo tons/annum, is projected to commence production in late 2024.

The status of the 50 kilo tons/year maleic anhydride plant planned by the Polynt-Reichhold Group in Morris, Illinois, remains unclear. The last update provided by the company was in September 2020, stating that they were actively engaged in designing and engineering activities. While the basic design was completed, the detailed engineering phase had commenced. The company initially planned to commission and start up the facility by the end of 2022, but that timeline has not been met. It is likely that the plant will begin production sometime in 2023.

In October 2022, Bartek Ingredients announced the completion of the first phase of its maleic anhydride capacity expansion at its Stoney Creek site in Ontario, Canada. Once fully commissioned, this expansion will add over 22 kilo tons of capacity to the company s existing three reactors, increasing the total production capacity of the facility to 47 kilo tons/annum.

While the impact of higher interest rates and low consumer confidence has continued in Q1-2023, maleic anhydride producers in North America remain hopeful and expect better conditions in the coming months. The easing of destocking has already been reported, which is a positive sign. Another contributing factor to this optimism is the reduction in energy costs, although they are still relatively high.

Our market outlook for North America in 2023 remains mixed. While the rebounding of consumer confidence (according to the Conference Board) due to easing inflation and moderating energy prices is encouraging, there are pressing concerns such as slower GDP growth, weaker consumer spending, and faltering construction activity (due to higher mortgage rates) that could depress the market. Apart from the automotive and oil & gas markets, which are expected to see an uptick, other industries are likely to remain stagnant. While the year-end destocking in 2022 broadens the potential for demand recovery in 2023, a wait-and-see approach and cautious restocking from buyers due to uncertainty could lead to a softening trend in prices.

Political tensions, soaring inflation, and tight monetary policies are currently plaguing the market in Latin America. Countries like Argentina are on the brink of a serious crisis, with severe drought since Q4-2022 and surging inflation heightening market anxiety. Although Mexico and Brazil, both home to maleic anhydride production sites, have a comparatively better outlook, they are not entirely exempt from the regional backdrop either, as issues like growth slowdown and rising living costs persist. With raw material prices already facing elevated pressures due to the global economic slowdown, any future increases in export prices are unlikely to provide strong incentives to these countries. In terms of the end-use industry, demand for the automotive sector is expected to be robust, albeit with weaker growth compared to 2022.

For Further Information, Please click here

To View Sample, Please click here

For more details on Maleic Anhydride market, please contact us at sales@prismaneconsulting.com