Asia Pacific Calcium Chloride Market

Calcium Chloride (CaCl2) is an inorganic compound produced from the reaction of calcium carbonate and hydrochloric acid. Additionally, it is also synthesized from natural brines and as a co-product during the production processes of soda ash and sodium carbonate. CaCl2 has a very low freezing temperature, and it is soluble in water.

The Asia-Pacific calcium chloride market is segmented into the following applications:

- Dust control: Calcium chloride is used to suppress dust on unpaved roads and in construction sites, helping to improve air quality and safety.

- De-icing: During winter seasons, calcium chloride salt is used to melt ice to remove the snow or frost from various surfaces, including roads and sidewalks.

- Oil & gas: With its ability to control and stabilize drilling muds, calcium chloride is used in oil & gas operations including drilling fluids and well completions.

- Construction: In construction, it is employed as a curing agent for concrete, helping to enhance its strength and durability.

- Industrial processing: Calcium chloride is utilized as a desiccant for moisture-sensitive chemicals, in refrigeration systems, and in the food industry as a firming agent.

- Others: Other applications include agriculture, wastewater treatment, and pharmaceuticals.

Major manufacturers of calcium chloride operating the region include Sinochem Holdings, Qingdao Huadong, Tangshan Sanyou, Weifang Haibin, and Ward Chemicals.

Trade Dynamics

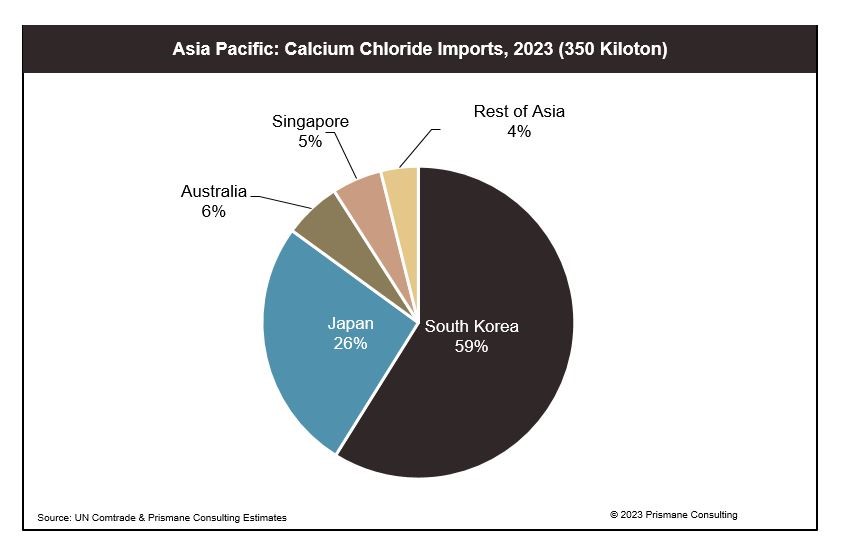

Asian imports of calcium chloride stood at 350 Kiloton in 2023. South Korea was the largest importer, representing a 59% share of the region’s total imports. Almost all the shipments imported by the country came in from suppliers in China. Japan constituted for a quarter of the regional imports, sourcing nearly 96% of supplies from China. Out of the 19 Kiloton of shipments imported by Australia, more than 90% came from China. Singapore is another notable importer in the region, responsible for 5% of the total shipments.

Asia Pacific calcium chloride export volumes totaled at 1,100 Kiloton in 2023, with China constituting for a 91% share. With the presence of enough supply to suffice domestic demand, China is the largest exporter of calcium chloride in Asia Pacific, representing 91% of the region’s total export volumes. Shipments from the country were primarily destined to Saudi Arabia, accounting for a 41% share, followed by South Korea at 18% and Japan at 8.8%.

India accounted for 8% of the total export volumes in the Asia Pacific. Nearly half the supplies were sourced to the UAE, followed by Vietnam and Saudi Arabia at 10.8% share each. Leading manufacturers in the country include Surya Fine Chem, Vinipul Inorganics, Meru Chem, K.J.Pharmachem, and Parshvachem Enterprises.