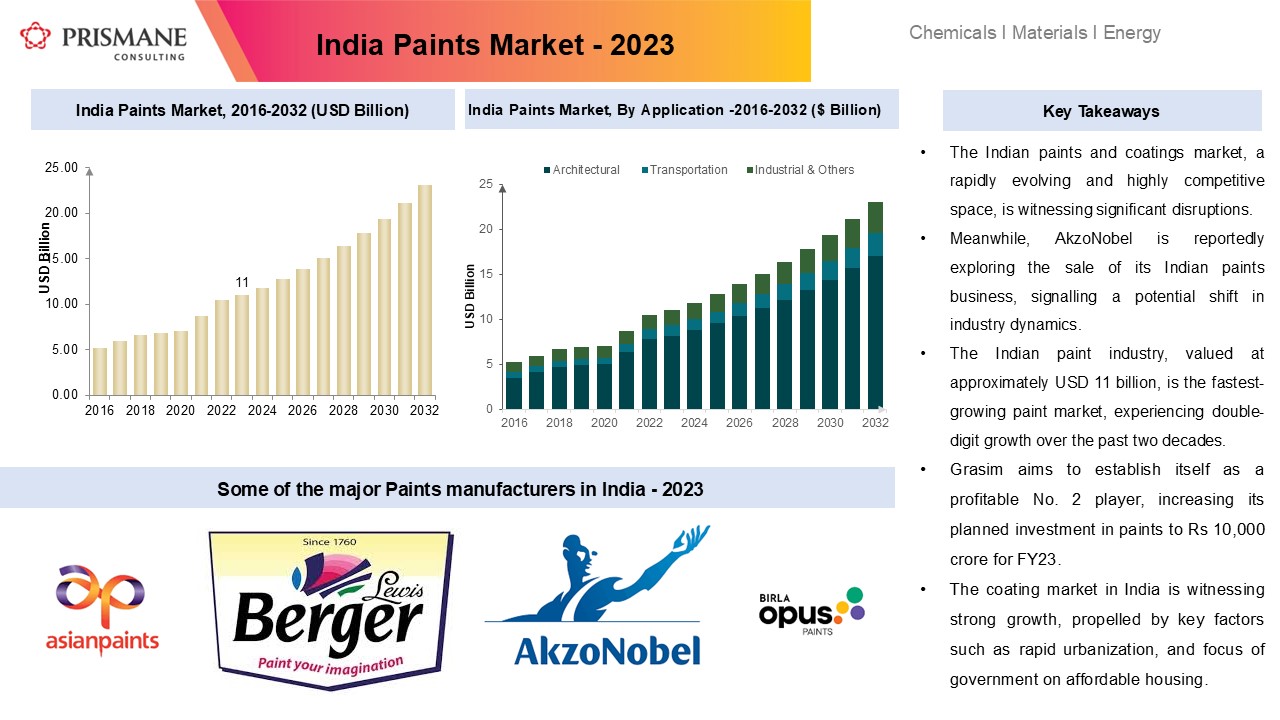

India Paints Market Overview

The Indian paints and coatings market, a rapidly evolving and highly competitive space, is witnessing significant disruptions. Asian Paints, the industry leader for decades, is experiencing a notable decline in market share, while new entrants like Grasim's Birla Opus and JSW are reshaping the competitive landscape. Meanwhile, AkzoNobel is reportedly exploring the sale of its Indian paints business, signaling a potential shift in industry dynamics.

Paints & Coating Market in India, Organised Sector Revenue – 2023 (INR 56,600)

Source: Secondary & Prismane Consulting estimates

Market Share Erosion for Asian Paints

Asian Paints, which once commanded a robust 60% market share, has seen this decline to 55%. This decrease underscores the impact of intensifying competition, particularly from Grasim Industries' and JSW foray into decorative paints. With a massive investment, entry of Birla Opus and JSW is poised to challenge Asian Paints’ dominance significantly.

Grasim's aggressive strategies include:

• Presence in 6,000 towns by FY24, backed by a direct dealership model and 50,000 enrolled dealers.

• Introduction of free tinting machines, loyalty benefits for contractors, and a unique one-year warranty for enamels and wood finishes.

• A portfolio of 145 products and 1,200 SKUs catering to economy, premium, and luxury segments, alongside waterproofing, wall finishes, and wood coatings.

These efforts have resonated strongly with contractors and dealers, many of whom report a marked increase in Grasim’s on-ground presence and promotional schemes.

Pressure on Margins for Paint Majors

Asian Paints, Berger Paints, and Kansai Nerolac are responding with countermeasures such as increased trade discounts and consumer offers. However, this price competition threatens to compress margins. With a narrowing profit buffer, the industry leader faces challenges in maintaining profitability amidst growing price wars.

AkzoNobel: Possible Exit from Indian Paints Market

Since establishing its presence in 1954, AkzoNobel has been a key player in India's paint and coatings market. The company operates with a significant production capacity of over 300 million liters per year, holding around 7% share in India organised paints & coating market. Over the years, the company has been known for its focus on quality and innovation, gaining substantial customer loyalty.

The company is reportedly considering divesting its Indian paints business. While the company has a strong portfolio in premium decorative paints and industrial coatings, it has struggled to compete with the increasingly localized and dynamic strategies of Indian players.

India Paints & Coating Market Share of Organised Players- (2021-2023)

Source: Secondary & Prismane Consulting estimates

If AkzoNobel exits, it could pave the way for new investments or consolidation in the market, potentially benefitting competitors like Berger or Grasim, who may seek to acquire assets or market share.

Kansai Nerolac’s Strategic Moves

Kansai Nerolac, a smaller but established player, is taking strategic steps to strengthen its foothold. With new product launches, expansion in waterproofing and allied products, and a focus on industrial paints, the company is diversifying its revenue streams. Kansai’s leadership in industrial paints (45% of sales) offers it some resilience amid heightened competition in decorative segments.

Grasim’s Rising Star: Birla Opus

Grasim’s entry into decorative paints is poised to be a game-changer. With its bold approach to pricing, distribution, and contractor engagement, Birla Opus has already captured the attention of the market. The company’s ambitious goal of achieving a high single-digit market share by FY24 underscores its disruptive potential.

In March 2025, Grasim Industries, part of the Aditya Birla Group, commenced production at its state-of-the-art 'Birla Opus' paints plant in Mahad, Maharashtra. This facility will produce around 180 mlpa of water-based paints, 30 mlpa of solvent-based paints, and 20 mlpa of distemper. The company currently sources resins from Birla Opus's other plants for the production of solvent-based paints, as the resin manufacturing unit at the Mahad plant is yet to be commissioned.

With the addition of the 230 mlpa capacity at Mahad, Birla's total paint production capacity has reached around 1,096 mlpa. This is a major milestone, as five out of the company’s six new paint plants are now fully up and running.

Key factors driving Birla Opus’ success include:

• Consumer Incentives: Offering 10% additional volume on water-based paints and free tinting machines.

• Contractor Benefits: Loyalty programs and competitive pricing for improved profitability.

• Expanding Footprint: With trial runs underway at five plants and a sixth plant scheduled for Q4 FY25, Grasim is rapidly scaling production capacity.