U.S.Producers Urge Anti-Dumping Measures on Chinese MDI: Implications for theGlobal Supply Chain

TheImpact of Chinese Imports on U.S. MDI markets

The Ad Hoc MDI Fair Trade Coalition, comprising Dow Chemical and BASF, made headlines in February 2025 when it filed a petition with the U.S. Department of Commerce to initiate anti-dumping and anti-subsidy investigations against the pouring of methylene diphenyl diisocyanate (MDI) imports into the USA from China. Alleging dumping margins of 306% to 507%, the petition named the following producers: Wanhua Chemical, Shanghai Lianheng Isocyanate, BASF, and Covestro. Accordingly, the US International Trade Commission (ITC) will conduct a preliminary anti-dumping probe and will make a preliminary determination by the end of March.

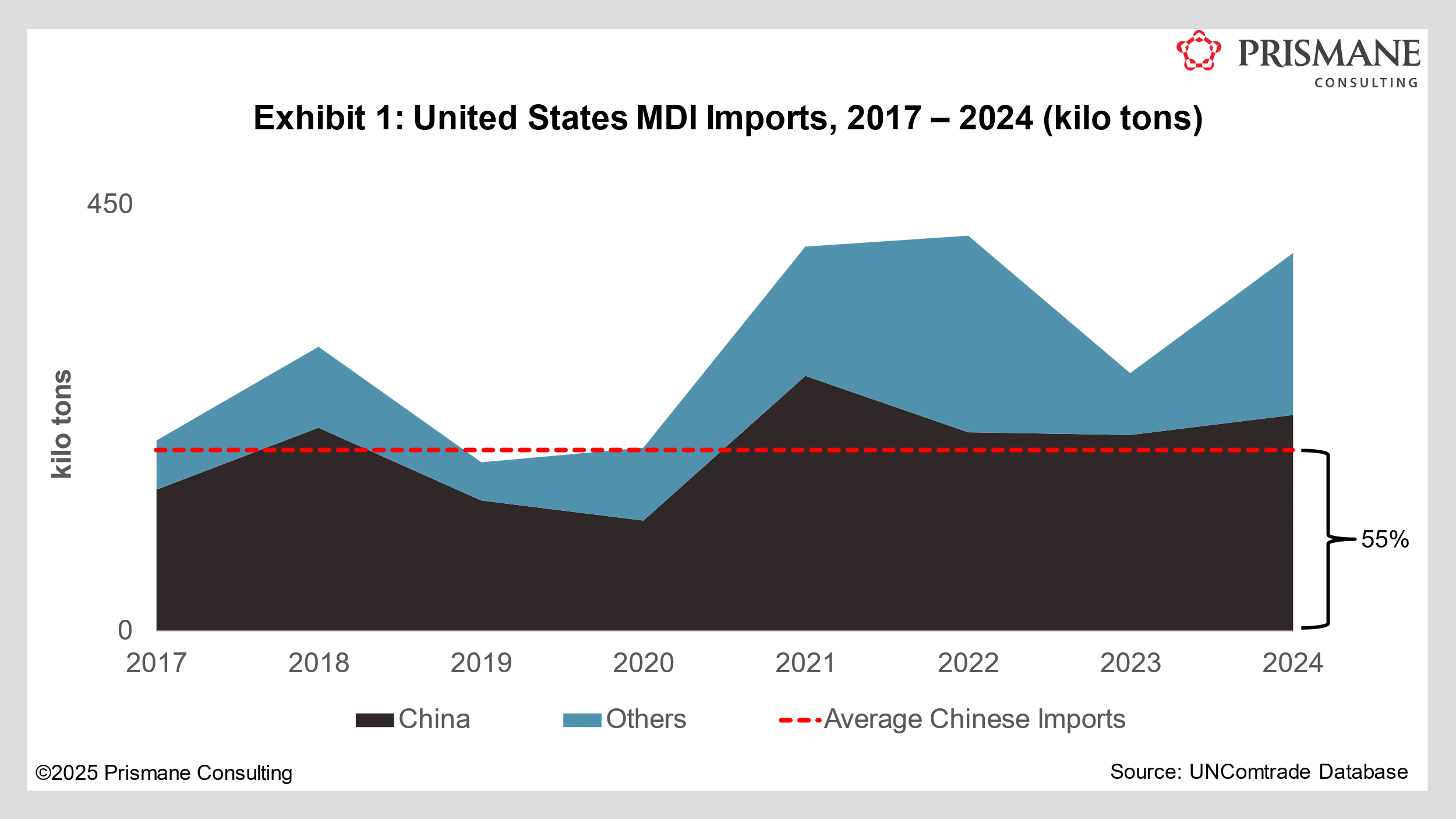

MDI volumes originating from China are currently subject to a 35% tariff in the USA, 25% imposed in May 2019 during President Donald Trump's first term, and an additional 10% announced in early February this year. China is the largest trade partner for U.S. MDI imports, representing on average 55% of total bought volumes (see Exhibit 1). Meanwhile, American MDI exports to China face a 31.5% tariff. This is of little consequence, however, since negligible volumes are sent to China by the USA.

With its widespread use in the manufacturing of rigid & flexible foams, polyurethane elastomers, coatings, and insulation materials, the aromatic diisocyanate is widely employed across the construction sector. Besides BASF and Dow Chemical, other MDI producers in the USA include Covestro and Rubicon (JV between Huntsman & LANXESS). Both BASF and Dow have seen major investments in the country’s MDI supply chain. The former is currently in its last phase of expanding its MDI facility at Geismar, Louisiana, a nearly USD 1 billion investment that would augment total capacity to over 600 kilo tons/year post-completion. The latter, meanwhile, commenced operations at its MDI distillation and prepolymers facility at Freeport, Texas, in 2023.

Exhibit 2 illustrates the MDI Supply/Demand in the United States between 2017 and 2024.

China is the largest manufacturer of MDI in the globally, representing a 43% share in the world supply in 2024, per Prismane Consulting Database. Owing to bouts of capacity that came onstream in the country, it turned into a net exporter of MDI in 2014, and net volumes have grown since. Currently, China exports more than 1.2 million tons of volumes. Wanhua Chemical is the largest operating player in the country, which is the world's largest manufacturer, operating facilities at Ningbo (Zhejiang), Yantai (Shandong), and Fuzhou (Fujian).

Overseas, it operates an MDI facility at Kazincbarcika, Hungary, together with its joint-venture partner BorsodChem. The Group has plans to further bring onstream new capacity in Xinjiang, via its subsidiary Xinjiang Heshan Juli Chemical. This is expected to lead to increased competition in the Asian Pacific and excess volumes are expected to flow towards the East, where the company will leverage its cost advantages. Per the petition, Wanhua Chemical Group and its affiliates constituted for 97% of USA’s imported MDI volumes in H2 2024, with most of the shipments bought by its U.S. subsidiary Wanhua Chemical America.

Dow and BASF allege that MDI is currently being sold in the USA at less-than-fair value, heaving pressuring domestic margins. Authorities must urgently act to protect further injury and ensure fair practices.