Another EU Asset Succumbs to Ongoing Restructuring: Caprolactam Gets the Axe This Time

Mounting production costs and contracting demand continue to weigh on chemical assets in the European Union, driving a wave of plant closures and supply downsizing. For caprolactam (CPL), the situation remains largely unchanged since my last point-of-view back in October 2023 [Caprolactam Market: Increasing Capacity and Weak Demand], as output continues to face persistent struggles without any meaningful reprieve. Back then, it was BASF's Ludwigshafen facility in Germany; now, it's Spolana's Neratovice plant in the Czech Republic. The ORLEN Unipetrol Group subsidiary was the country's sole PVC and CPL manufacturer, and the management has now decided to cease operations for both. Muted demand, with no recovery prospects in sight, has been blamed for this restructuring. Post its full implementation by H1 2025, the move will eliminate more than 70%, or 500 employees, from the company’s workforce.

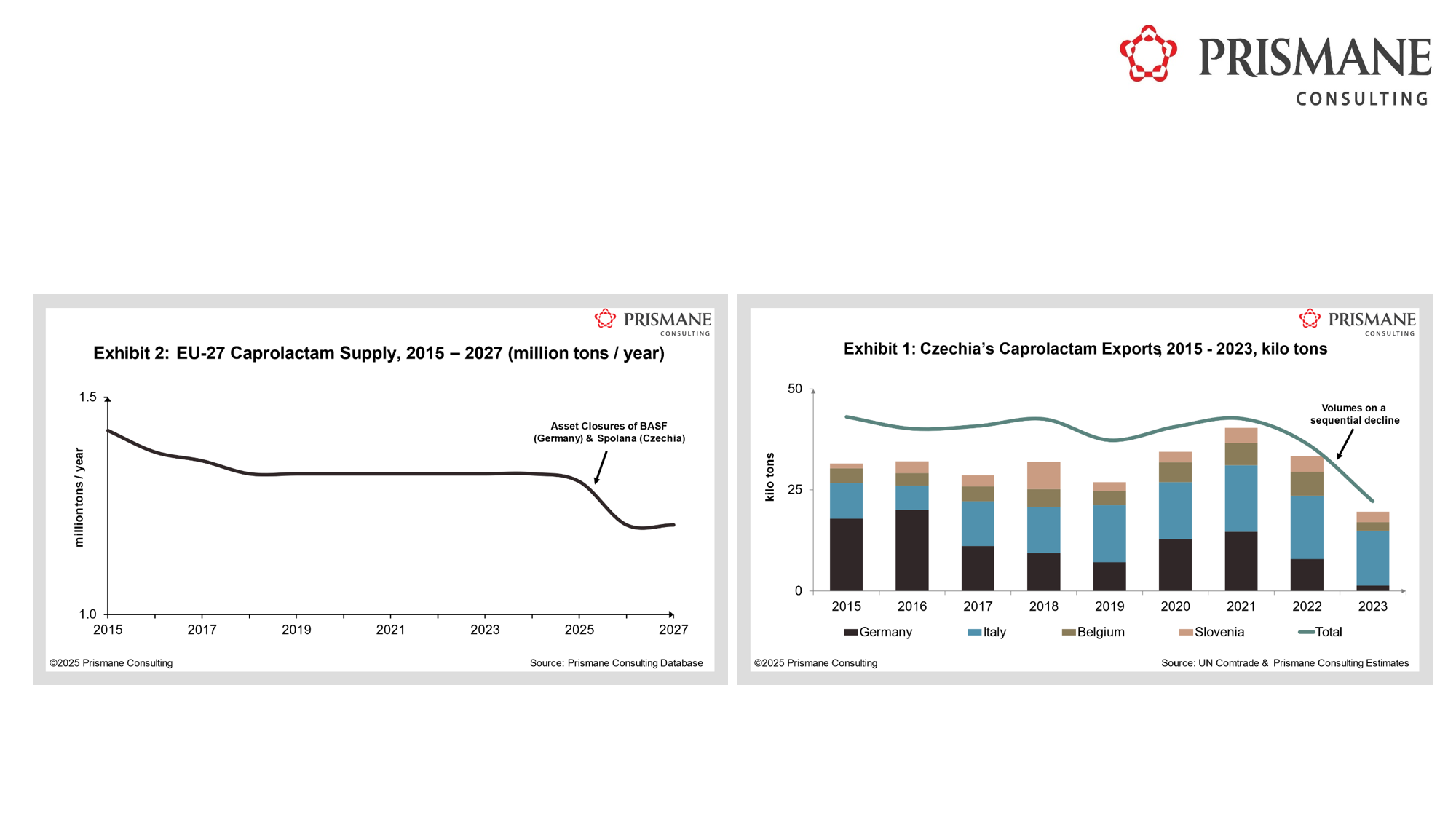

The plant’s relatively small scale was another key contributor to this decision, rendering it uncompetitive compared to other, typically bigger units operating in the EU. As such, the Neratovice CPL plant was heavily export-oriented; as illustrated by Exhibit 1, output volumes were predominantly purchased by Nylon manufacturers in Italy, Germany, Belgium, Slovenia, Switzerland, and Poland. Shipments, however, have been on a sequential decline in recent years, with volumes halving in 2023 from 2021 levels, reaching 22 kilotons.

Both Spolana and its parent company ORLEN Unipetrol have long struggled with high costs and operational inefficiencies. Despite efforts to shift focus towards manufacturing high-margin and high-value products, the balance sheet has been consistently in the red.

Factor in BASF’s closure at Ludwigshafen with this, and you would have 9% of CPL supply that will be taken off the EU-27 market by the end of 2025 (see Exhibit 2). This is increasingly indicative of dire straits the European chemical industry is currently in. Energy costs, while reduced from the wartime peaks, remain elevated and continue to burden margins. Meanwhile, stringent regulations and escalating bureaucracy have thwarted any meaningful demand recovery. Although recent peace talks are a step in the right direction, lingering barriers like tariffs and sanctions are expected to continue weighing on demand. For the chemical sector, Europe’s aging asset base, together with the massive capacity build-up in China are structural issues that demand urgent attention. Countries like Germany, already vulnerable due to sky-high energy costs and chemical output still lagging behind pre-pandemic levels, are particularly at risk. Meanwhile, China—despite its own struggles in sectors like real estate—has continued to add excess chemical capacity, with much of it now finding its way into the European market.

Overall, the EU chemical industry is teetering on the edge of thin margins, and the regulatory landscape has been anything but supportive. More rationalizations are expected in the near term, as an overall cloud of uncertainty looms over the industry. Market participants, alongside policymakers, must act proactively to prevent further disruptions.