Introduction to Stearamide

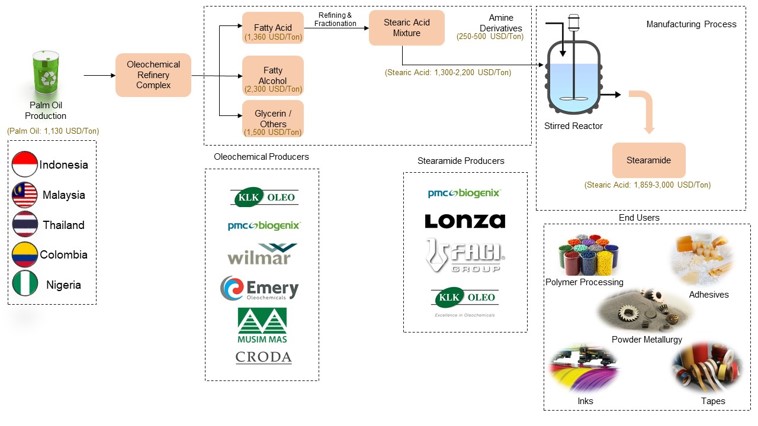

Stearamide is a derivative in the Oleochemicals supply chain known for its remarkable anti-slip properties. It holds significant applications across diverse industries, including plastic and rubber processing, adhesives, metallurgy, and others. Notably, its environmentally friendly nature, non-toxic attributes, and excellent dispersibility make it key lubricant in the polymer processing industry.

In plastic processing, it serves as a lubricant and mould release agent, enhancing external lubrication and mould release capabilities. Stearamide also acts as a slip agent for various materials, while improving additive dispersion and gloss. It finds uses in drilling fluids and metal wire drawing as well. Commercial Stearamide typically contains palmitamide (a primary fatty acid amide), which offers enhanced properties such as moisture resistance and smoothness. This compound has applications as a surfactant, mould release agent, lubricant, and pigment dispersion agent in various industries.

Global Stearamide Demand, By Region (Kilo Tons)

Source: Secondary & Primary Research and Prismane Consulting estimates

Stearamide Market Overview

Global Stearamide Demand in 2022 is estimated to be over USD 690 million which has grown at an aggregate rate of 2% per annum in historical years. Global demand is further expected to surpass USD 1.1 billion by 2032. Prismane Consulting estimates the growth rate to be around 4.9% during the long-term forecast till 2032. The COVID-19 pandemic led to a decline in the demand for Stearamide, attributed to a decrease in plastic and rubber processing activities, causing the market to contract by almost 3%, however, the demand recovered steadily after that and reached its pre-COVID level in 2021.

In terms of regional demand, Asia Pacific constitutes, 56% of the demand, followed by Europe with 26%. North America contributed 16% in the consumption, while Middle East & Africa and Central & South America together constituted about 3 % of the Stearamide consumption.

Key demand drivers for Stearamide have been their increasing application in plastic processing applications especially, in PVC applications. In 2022, Plastic processing applications constituted the largest demand accounting for nearly 42% of the total stearamide demand followed by rubber processing applications accounting for around 26% of the total stearamide demand. Printing inks uses accounted for 10% while adhesives & tapes constituted for 15% of the demand.

Global Stearamide Demand, By Application 2023 (Kilo Tons)

Source: Secondary & Primary Research and Prismane Consulting estimates

Source: Secondary & Primary Research and Prismane Consulting estimates

Stearamide Market Dynamics

Drivers

Safety & Environmental Concerns:

Stearamide, derived from stearic acid, presents a compelling alternative to environmentally harmful chlorofluorocarbons (CFCs) commonly used in release agent applications. Due to environmental regulations, lubricants producers are focusing of CFC and Silicone free based lubricants. Unlike CFCs, stearamide does not contain ozone-depleting chlorine and bromine components, aligning with global regulations to protect the ozone layer. Its superior release and anti-blocking properties cater to industries such as plastics and food processing. Stearamide s versatility, low carbon emissions during production, and alignment with sustainability goals make it an attractive choice. The growing demand for eco-friendly products further accentuates its appeal. This transition not only ensures compliance and performance but also signifies a commitment to both environmental preservation and sustainable industrial practices.

Cost-Effectiveness:

Stearamide stands out as a primary choice for release agents, offering a dual advantage of environmental compatibility and cost efficiency. Unlike costlier alternatives such as fluoropolymers and silicone-based agents, stearamide s cost-effectiveness enhances financial performance and enables competitive pricing. Its adaptability across sectors further extends cost savings, making it an attractive solution for various applications. By seamlessly combining affordability with eco-friendliness, stearamide meets the demand for sustainable practices that align with both financial and ecological priorities.

The surging global demand for stearamide is driven by its diverse applications as a release agent, antistatic agent, and antifoaming agent in various industries. This compound plays a crucial role in producing products such as thermoplastics, wires, and paper. The plastic sector s rapid growth, especially in construction and infrastructure, is a significant driver, further amplified by the expanding construction industry in emerging markets like China, India, Brazil, and Mexico. The widespread establishment of plastic manufacturing facilities and increased usage across industries like automotive, electronics, and construction are key factors propelling the demand for plastics and subsequently, driving the global Stearamide Market.

Challenges

Product Substitution:

Stearamide faces the challenge of establishing itself as a competitive alternative in a landscape dominated by various established product substitutes. In the plastics industry, polyethylene wax has entrenched its role as a versatile slip agent, release agent, and lubricant. Its proven attributes of lubricity, low coefficient of friction, and effective material release have solidified its usage across polyolefin extrusion, injection molding, and blown film processes. Additionally, the cost advantage further bolsters its position, making it an attractive option.

Silicone-based release agents hold sway in rubber and plastics manufacturing due to their capacity to curtail adhesion between moulds and moulded materials. These agents thrive even at elevated temperatures, offering a favourable alternative, particularly in scenarios with significant temperature fluctuations. Within the plastics and polymer sectors, talc serves as a prevalent anti-blocking agent, addressing the sticking tendency of films and sheets. The incorporation of polyolefin-based modifiers further augments surface properties, enhancing slip and anti-blocking features in materials.

For Further Information, Please click here

To View Sample, Please click here

For more details on Stearamide Market, please contact us at sales@prismaneconsulting.com