The methanol market has benefitted from large-scale production units, typically exceeding 1 million tons per year, due to economies of scale, engineering efficiencies, and low-cost feedstock. In line with decarbonization efforts, however, several “greener” routes have developed in recent years, albeit with their own set of challenges.

Green Methanol Production Challenges

Unlike traditional grey or brown methanol, renewable/green methanol production is produced on a much smaller scale, and is the primary contributor to its high production cost – ranging between USD 350-800 per ton for renewable methanol and USD 800-1,600 per ton for e-methanol, versus just USD 100-250 per ton for conventional methanol. Although the widespread deployment of carbon capture technologies and availability of green hydrogen is expected to narrow this price differential by 2050, this remains a critical consideration currently, not to also mention the various complexities associated with asset development, standardization, and ensuring long-term commercial viability. Overcoming this would require strategic technological partnerships, particularly with catalyst developers. While there remains ample room for innovation for all market entrants, commercial success at this stage is expected to belong to projects led by established players in the grey methanol market, given their scale, resources, and existing infrastructure. Currently, only a handful of assets are capable of producing green methanol, with several new units slated to come online over the next decade.

Although currently in its infancy, the green methanol market is augmenting rapidly from a modest base. Unlike traditional methanol, which is traded globally and consumed across geographies, green methanol output is more localized, with much of the production targeted at specific end-use applications. Legislative impetus and government mandates will likely a key role in boosting green methanol demand, as countries tighten environmental regulations and work toward achieving their set emission targets.

Global Shift Towards Sustainability and Green Methanol’s Role

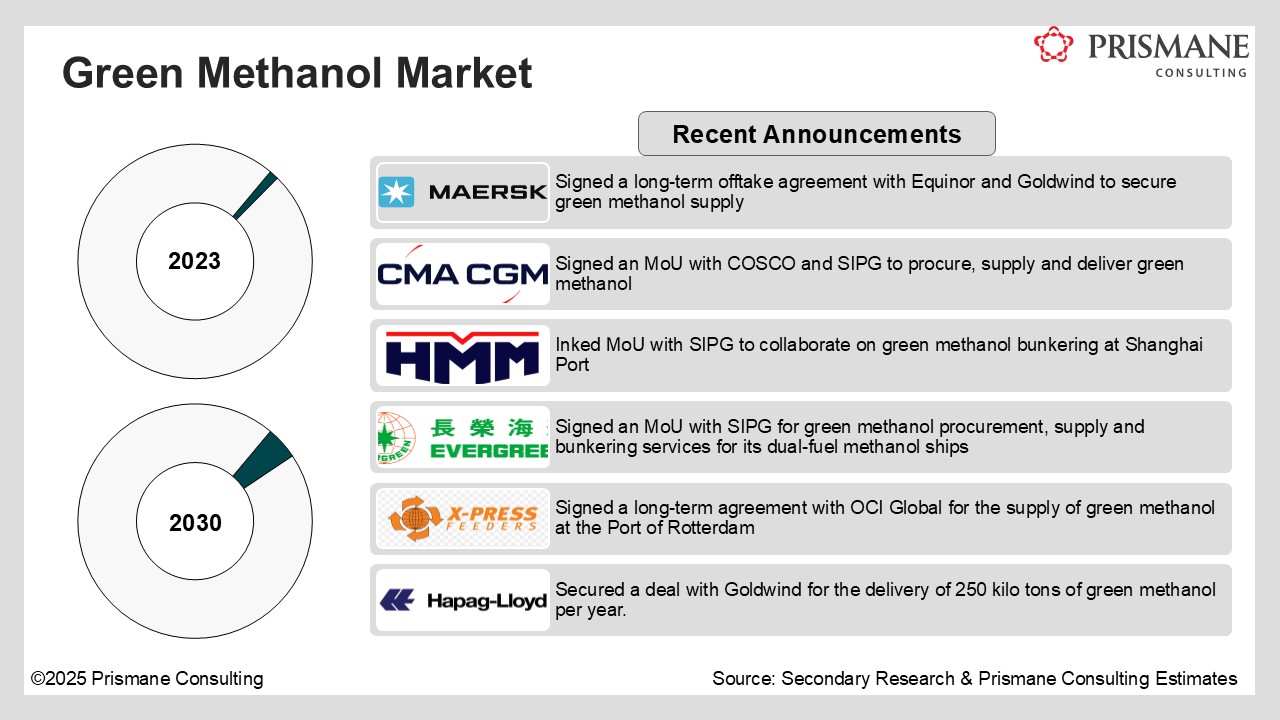

Green methanol market growth is also predicated on its rising adoption as a marine fuel. Per the Organisation for Economic Co-operation and Development (OEDC), the global shipping industry emitted approximately 858 million tons of CO2, 16% more than that from air transport. Shipping companies are increasingly under pressure to decarbonize their operations. Regulations such as the European Union’s FuelEU Maritime framework call for a 2% reduction in greenhouse gas (GHG) emissions by 2025, and an 80% reduction by 2050. While grey methanol is currently the most prevalent in bunker fuels, it is clear that companies will have to rely on a more sustainable version to meet these net zero goals. Majors like Maersk, CMA CGM, HMM, Evergreen Marine, and Hapag Lloyd are already inking long-term commitments to secure green methanol supplies (see Exhibit 1).

Hapag-Lloyd recently entered into a long-term agreement with Goldwind, a prominent Chinese producer, to secure over 250 kilo tons of green methanol annually, which will comprise a blend of bio- and e-methanol. The company is looking at saving up to 400 kilo tons of CO2 emissions each year, and hopes this move will help achieve its Strategy 2030 of cutting absolute GHG emissions by one-third. Prismane Consulting expects more such ad hoc commitments from shipping companies over the forecast. It is important, however, to note that compared to its oil counterpart, volumes here would be relatively expensive, flammable, and would require double the fuel tank size.

Exhibit 1: Green Methanol Announcements

Shippers say methanol-powered ships with dual-fuel options cost about 10-12% more than conventional ships, but remain optimistic that the price differential will narrow as investments increase and economies of scale come into play. Industry executives do caution, however, about the supply-demand gap. Producers are hesitant to invest in large-scale facilities without guaranteed demand, while consumers are reluctant to commit without the assurance of supply. Shipowners like Maersk are securing offtake agreements to bridge this gap.

While several new green methanol capacities have been announced, they remain concentrated in a few key regions like North America, Western Europe, and China, leaving them far away from major bunker hubs like Singapore and the UAE, creating logistical challenges. Further, the scale of existing production units is still relatively small. There has been improvement in that regard, however; typical plant size being announced presently has grown less than 10 kilo tons/year previously to as much as 250 kilo tons/year. By 2027, global capacity for bio-methanol and green methanol is projected to exceed 8 million tons.

With a record number of methanol-powered ships ordered in 2023, it seems like the industry is gearing up for a major shift. However, green methanol’s successful adoption will hinge on addressing key infrastructure and scalability challenges. It is critical for producers to scale up their operations in tandem with growing demand, as any lag in production could result in a mismatch that hampers industry progress. While some grey methanol might help provide some reprieve in that case, this would go against the whole aim of the industry’s transition towards GHG emissions.

Concluding Thoughts

Growth in the green methanol market over the near-term will thus depend on consumers actively pursuing offtakes to support downstream markets, along with a willingness to pay the “green premium”– the price differential between low-carbon and conventional methanol. Evolving governmental support, including legislative schemes like the Emissions Trading System (ETS) and Carbon Border Adjustment Mechanism (CBAM), are likely to play a major role in the green methanol market. For traditional methanol producers concerned about the potential cannibalization of their existing products, the key will be to focus on premium customers who are willing to pay for a more sustainable product.

Overall, we are likely transitioning from a methanol market with little differentiation among producers and uniform pricing, to one that offers variation in carbon footprints, production methods, and pricing. For countries that had little chance of competing in the traditional methanol market, the emerging green methanol market may open up new growth avenues.