Linear Alpha Olefins (LAOs) are straight-chain hydrocarbons characterized by a double bond in the terminal or alpha positions. The production of LAOs can be divided into either full-range LAOs or on-purpose or major fraction LAOs like butene-1, hexene-1 and 1-octene. The production of LAOs yields an entire range of even-numbered carbon chain-length linear alpha olefin rather than a single product. LAOs include a range of industrially important alpha-olefins, including butene-1, hexene-1, octene-1, decene-1, dodecane-1, tetradecene-1, 1-hexadecene, and octadecene-1.

There are also many other higher blends of C20-C24, C24-C30, and C20-C30 range LAO fractions. All C10+ LAOs are classified as higher LAOs and none of the higher LAOs are used as polyethylene comonomers. Almost all of the higher LAOs are produced in the full-range LAO plant and their yield varies depending on the process technology. At a global level, most of the LAO plants are based on the ethylene oligomerization process.

The biggest outlet for LAOs are their use as co-monomers for polyethylene(HDPE and LLDPE) production while other important applications include synthetic lubricants, detergent intermediates, plasticizers, oil-field, paper sizing chemicals and other applications. Each of the end-use of the application market has different characteristics and follows different trends in terms of growth, per capita consumption, regional/ country coverage, customer base, quality requirements, selling channels and off-take volumes. This makes the LAO business challenging and complex one where producers have to balance the requirement of serving the LAO end-used markets as well as optimizing the revenue across the complete spectrum of all fractions of LAO products. The higher LAO demand shows regional variations in terms of market size and the ratio of higher Linear Alpha Olefins for detergents and Lubricant applications.

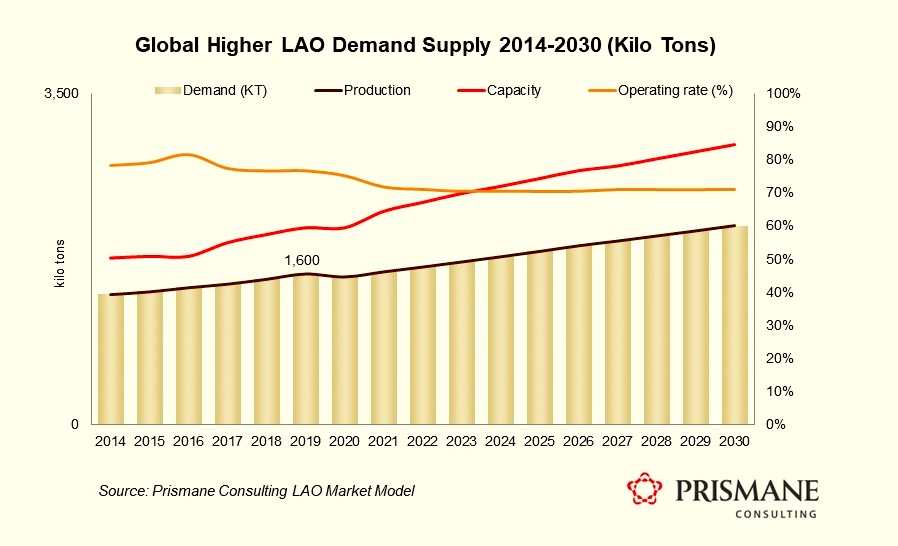

The global demand for total higher LAOs was estimated to be around 1600 kilo tons in 2019, growing by almost 1.2 times from 2014 onwards. The overall demand witnessed an aggregate average growth rate of 3.0% in this time period, mainly supported by the strong demand from surfactant & detergent, lubricants and oil-filed chemicals. In the short-term forecast till 2025, it is expected that the total demand for higher LAOs will increase by an average of 2.3%.

Higher LAOs market share in the overall LAOs demand has decreased mainly because of the higher demand of hexene-1and octene-1 from polyethylene applications. The higher LAOs find applications in the production of lubricants and detergent alcohols but are not used as co-monomers for polyethylene. In the forecasted years, it is estimated that the share of Higher LAOs will reduce further while that of hexene-1 is expected to rise till the end of the forecast period till 2030.

The Higher LAOs operating rates are again mostly dependent on the demand for polyethylene comonomers (Butene-1, Hexene-1 and Octene-1 are used a feedstock to produce polyethylene comonomers). The utilization rates of higher LAOs depend on the production optimization (for Butene-1, Hexene-1 and Octene-1) and this decides the operating rate for full range LAOs. Depending on the technology Higher LAOs are produced in each of the full range LAO plants. Some of the major fraction hexane-1 plants also produce very small amount of higher LAOs, especially C20+.

For market information on Linear Alpha Olefins or any other petrochemical/engineering plastics write to sales@prismaneconsulting.com