The European chemical industry has been subjected to several challenges in recent years. Although trouble was several years in the making, the situation dramatically escalated during the black swan years – from COVID-19 pandemic and later the Russia-Ukraine war. If anything, the disruption exposed EU’s deep structural vulnerabilities within the sector, from heavy Russian energy dependence, high production costs, widening competitiveness gaps, tightening regulations to slowing demand.

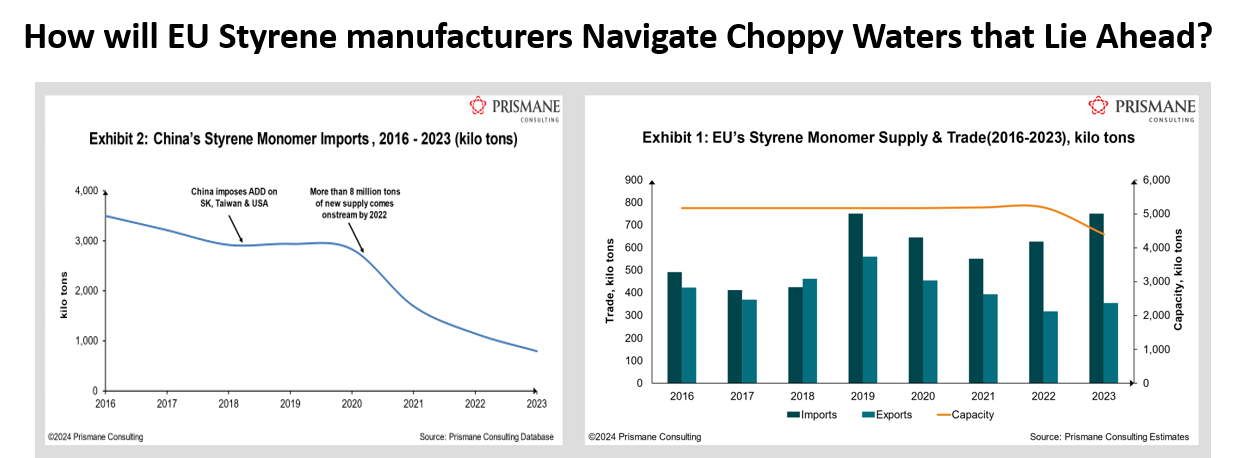

The Styrene Monomer (SM) market in EU has not been immune to this downturn. As a critical intermediate in the production of chemicals like Polystyrene, Expanded Polystyrene (EPS), ABS/SAN, SBR, SB Latex, and UPR, the SM sector has long struggled with issues such as soft demand, oversupply, and inventory drawdowns. After a period of margin improvements over five years, China witnessed a flood of new supply entering its market during the onset of the COVID-19 pandemic, thereby sending margins plummeting into negative territory. China saw a significant surge in exports, with 2022 volumes increasing almost tenfold compared to 2019 levels.

The huge Chinese supply influx disrupted trade flows across the globe. Once a small net exporter, Western Europe switched to a sizeable net importer of SM. Several factors contributed to this shift, not least of which were rising production costs. Raw material and fixed costs in Europe had already been relatively high compared to North America and Asia-Pacific, and the gap immediately widened further following the start of the offensive in Ukraine. By 2024, although costs had somewhat decreased, they remained significantly higher than in competing regions, further disadvantaging European producers.

To minimize losses amid high operating costs and negative margins, EU producers reduced plant operating rates significantly. Meanwhile, others, that could no longer sustain, shuttered operations. One of the most notable closures was Trinseo’s 300 kilo tons/year facility at Bohlen, Germany, at the end of 2022, followed by the shutdown of its 500 kilo tons/year plant in Terneuzen, the Netherlands, in November 2023 – effectively marking its exit from SM manufacturing. The company now relies on external volumes to support its downstream styrenic operations. The situation is similar in North America, where INEOS Styrolution announced plans to permanently shut down its 430 kilo tons/year plant in Sarnia, Canada, by mid-2026 due to unfavourable cost economics.

Meanwhile, fearing a potential ban on chlorohydrin-based production by authorities, Chinese producers began shifting towards the Propylene Oxide (POSM) route. Today, the country has its own POSM technology. China has traditionally been the world’s largest SM importer, and following complaints from local producers, the government slapped anti-dumping duties (ADD) on SM shipments originating from South Korea, Taiwan, and USA for five years beginning 2018. The ADD was extended for another five years in June 2024.

This shift, coupled with an oversupply situation, has seen excess Asian material finding its way into other parts of the world. After excess Chinese material flooded the South Korean market, domestic producers like Hanwha TotalEnergies and Yeochon NCC filed complaints to impose ADD in April 2024. However, these complaints were later withdrawn in August 2024.

Recent trends indicate that EU has become a major recipient of excess SM supply from Asia. In 2023, the EU’s net SM imports surged to nearly 400 kilo tons. Despite sanctions, large volumes from Russia and Iran are still making their way into the European market through intermediaries like Turkey and the Middle East, raising concerns about the effectiveness of the EU’s restriction policies.

Concurrently, weak market sentiment and growing uncertainty have also contracted SM consumption volumes, much to producers’ disappointment. The tightening regulatory environment has only exacerbated this issue, with more bureaucracy adding to the woes.

What Lies Ahead

Given the current state of the EU Styrene market, further capacity consolidations are expected in the near-term. If this happens, the EU could face a significant widening of the net deficit in SM imports. Should the EU’s import share grow to represent a substantial portion of its domestic consumption, any disruptions in global logistics could lead to severe supply chain challenges. Even minor delays would likely result in price hikes and increased market volatility.

SM situation isn’t exactly great for oversupplied China either supply overhang has led to plummeting utilization rates in the country. This excess supply is expected to flow into Southeast Asia, which has now become the new epicentre of the SM market, having overtaken China as the world’s largest importer. USA will continue to remain relevant in the Western Hemisphere – its exports are likely to increase further despite the influx of Chinese shipments.

As my viewpoint for EU ABS industry stated, unless structural issues in the European Union are not addressed, the outlook for the chemical sector remains bleak. Stringent regulations have continued to deter investments, and the industry needs bold leadership to tackle the challenges of low feedstock availability and high costs. The EU’s ability to thrive in the global Styrene market will depend heavily on its efforts to streamline bureaucratic processes, encourage innovation, and attract new investments. A key focus area should also be towards advancing the region’s construction sector, as this will help drive demand for key products such as expanded polystyrene (EPS), which has wide applications in the building and insulation sectors.