India CPVC Market Analysis

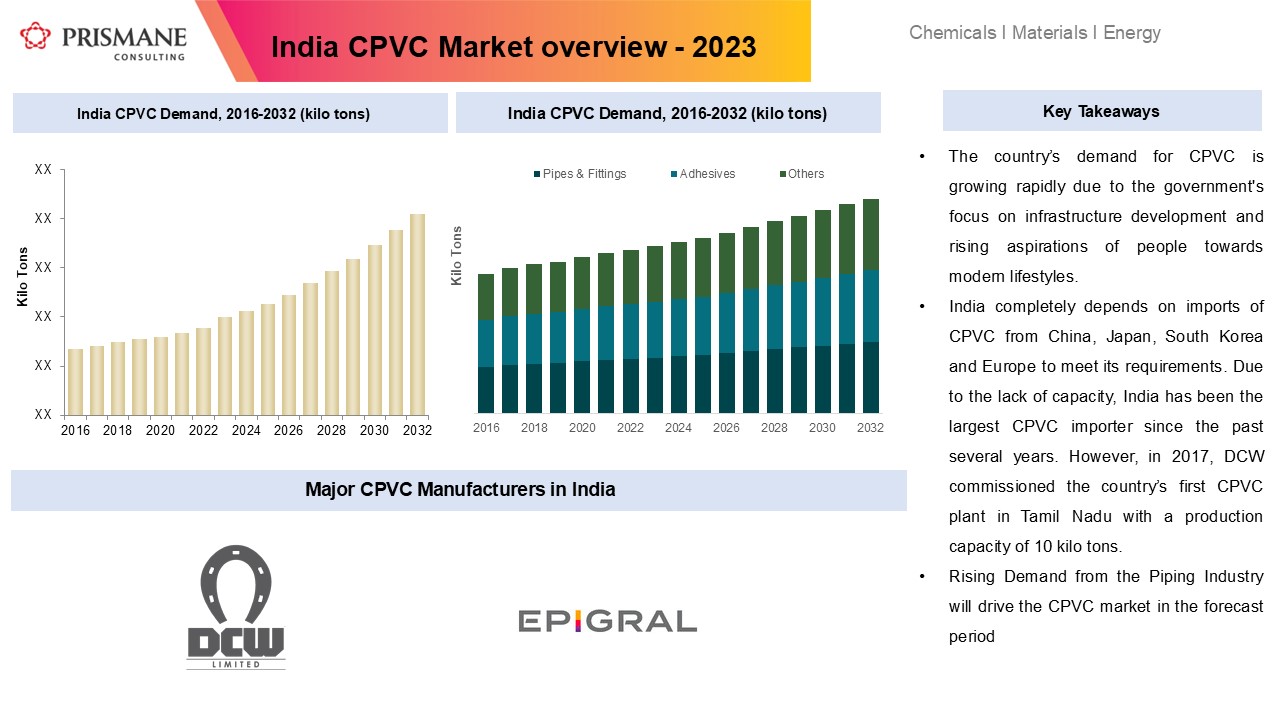

The CPVC market in India was valued at USD 0.36 billion in 2023, and it is anticipated to cross USD 1.0 billion by end of 2032 registering a CAGR of 11.6% during 2024-2032. The country’s demand for CPVC is growing rapidly due to the government's focus on infrastructure development and rising aspirations of people towards modern lifestyles.

India is amongst the largest consumers of CPVC resin, primarily in the form of plumbing pipe and fittings, and growing needs for clean water in all residential and commercial buildings will drive continued growth. With rapid urbanization and infrastructural development across India, there has been a rising demand for homes and commercial spaces equipped with modern amenities. This has led to a surge in demand for reliable and efficient plumbing systems, making CPVC resin an essential material.

Chlorinated Polyvinyl Chloride

CPVC is a type of thermoplastic manufactured by heating of Polyvinyl Chloride (PVC) resin with gaseous chlorine reaction in the presence of a catalyst. CPVC has higher chlorine content of more than 60% compared with 56-57% for PVC which makes it suitable to handle higher temperatures, higher water pressures, lower contamination, and appropriate for drinking water.

CPVC shares most of the features and properties of PVC, but also has some basic differences. CPVC is readily workable, including machining, welding, and forming. Due to its excellent corrosion resistance at elevated temperatures, CPVC is ideally suited for self-supporting constructions where temperatures up to 200 °F (93 °C) are present. The ability to bend, shape, and weld CPVC enables its use in a wide variety of processes and applications.

India CPVC Import Scenario

India completely depends on imports of CPVC from China, Japan, South Korea and Europe to meet its requirements. Due to the lack of capacity, India has been the largest CPVC importer since the past several years. However, in 2017, DCW commissioned the country’s first CPVC plant in Tamil Nadu with a production capacity of 10 kilo tons.

In 2023, the CPVC monthly imports ranged between 8 kilo tons to 15 kilo tons. Recently, the Directorate General of Trade Remedies has imposed antidumping duties on CPVC imports from China and South Korea.

In China, a definitive anti-dumping duty has been imposed on CPVC resin at USD 790 per ton and for CPVC compounds from China at USD 605 per ton. Similarly, in South Korea, the anti-dumping duty for CPVC resin stood at USD 593 per ton and for CPVC compounds, USD per 792 ton. The reason for the prices differences between CPVC resin and CPVC compound is because the compound might be further processed or manufactured, which could be seen as a different product category.

India CPVC Trade Monthly 2022-2023 (kilo tons)

Recent Developments in the Indian CPVC Market

In India, Epigral and DCW are the sole CPVC resins manufacturers of CPVC resins. There are several expansions lined up in the upcoming years, to cater the growing CPVC demand in the country. Huge, announced investment aligns with India’s Atmanirbhar Bharat and Make in India initiatives, which aim to boost resourcefulness and reduce the country’s CPVC import dependency.

Up until 2022, DCW was the sole manufacturer of CPVC in India. The company signed the technology license agreement with Arkema – one of the four players globally with a technology patent. With this technology tie-up, DCW in FY 2017 set up a CPVC manufacturing plant with an installed capacity of 10 kilo tons of CPVC resin and 12 kilo tons of CPVC compound at Sahupuram, Tamil Nadu.

In April 2024, Epigral Ltd. (previously Meghmani Finechem) has expanded its CPVC resin capacity at its Dahej facility in Gujarat by 45 kilo tons, reaching a total capacity of 75 kilo tons. This expansion will make Epigral’s facility the world’s second largest CPVC resin plant at a single location. The company is further planning on doubling their CPVC capacity, to reach 150 kilo tons, by 2026. This expansion will make Epigral the largest CPVC resin manufacturing facility in the world.

Following the similar trend, DCW Limited, a leading specialty chemicals company has allocated Rs. 140 crores for the expansion of CPVC resin production capacity from 20 kilo tons to 50 kilo tons.

Reliance Industries Limited has announced their plans to build a new PVC and CPVC plant at Dahej and Nagothane, with a combined capacity of 1500 kilo tons. The plants is slated to start production by 2027.

Lubrizol and Grasim Industries have started the construction of their 100 kilo tons CPVC resin plant in Vilayat, Gujarat. The plant is the single largest CPVC resin production plant globally, mainly built to cater the demand from piping applications and to reduce the import dependency of CPVC from other countries.

To learn more about this report, request a free sample copy - Here

CPVC Market Drivers

Rising Demand from the Piping Industry will drive the CPVC market in the forecast period

CPVC is widely used across various applications, including pipes and fittings, adhesives and coatings, among others. It is preferred over PVC due to its superior resistance to corrosion at higher temperatures, better chemical resistance, and its ability to be bent, welded, and shaped. These qualities make CPVC ideal for a range of applications such as scrubbers, ventilation systems, and tanks.

Currently, the Indian plastic pipes market is valued at Rs 400 billion with organized players accounting for more than 50% of the market. More than 55% of the CPVC pipes are used for plumbing uses in residential and commercial real estate, 35% by agriculture and 10% by infrastructure and architecture projects.

In the historical period, the plastics pipes grew at an annual average rate of 10%, and it is forecast to grow at a CAGR of 12% between 2024-2036, led by the rising government spending on irrigation activities, WSS projects (water supply and sanitation), urban infrastructure and replacement demand.

CPVC is commonly used for water piping systems in residential and commercial construction due to its ability to withstand corrosive water at temperatures ranging from 40°C to 50°C or higher. It is used in a variety of applications, including hot and cold-water plumbing, fire protection, chilled water piping, hydronic systems, and many industrial piping needs.

Organized players in the CPVC market have progressively increased their share, driven by product portfolio expansion, brand recall, and strengthened distribution channels. As a result, the market share of organized pipe manufacturers has risen from approximately 50% in FY 2010 to around 80% in FY 2023.

Over the past decade, the CPVC pipes segment has penetrated at a fast pace in India as it grew at almost double the rate of PVC piping growth. There has been an extensive shift from metal pipes to CPVC pipes in plumbing applications, hot & cold-water distribution and construction industry. Rapid urbanization which increases use of hot/cold water, water outlets per unit of house, BIS norms, and trend of high-rise buildings will lead to CPVC growing faster than normal PVC pipes for plumbing applications, in turn leading to progressive market dynamics for CPVC resin manufacturers in India.

Moreover, as awareness about water conservation and safety increases, CPVC pipes are becoming a more sustainable and eco-friendly option compared to traditional materials. This shift towards modern plumbing solutions aligns with the broader trend of people adopting more advanced and comfortable lifestyles, where the availability of clean, safe water is a top priority.

Government initiatives such as the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), Accelerated Irrigation Benefits Programme (AIBP), and the Command Area Development and Water Management Programme have supported growth in the irrigation sector which will in turn have a positive impact on the India CPVC market.

High Costs of CPVC pipes & Presence of Alternatives for CPVC

CPVC goes through an additional chlorination process, which enhances its properties but also increases production costs. Hence, CPVC typically costs more than PVC which will act as a possible restraint in the CPVC market. On an average, CPVC can be 40% to 60% more expensive than PVC, depending on the diameter and type of pipe.

Installation costs also vary between PVC and CPVC. Although both materials are relatively easy to work with, but CPVC often requires the use of specific solvents and cements that can be more expensive than those used for PVC.

The CPVC market faces intense competition from standard materials such as Copper, PVC, and steel pipes. A new emerging alternative has entered the market, Cross-linked polyethylene (PEX) which are a popular alternative to traditional copper and PVC pipes for residential and commercial plumbing systems. They are flexible, easy to install, and resistant to corrosion, making them an attractive option for many applications.