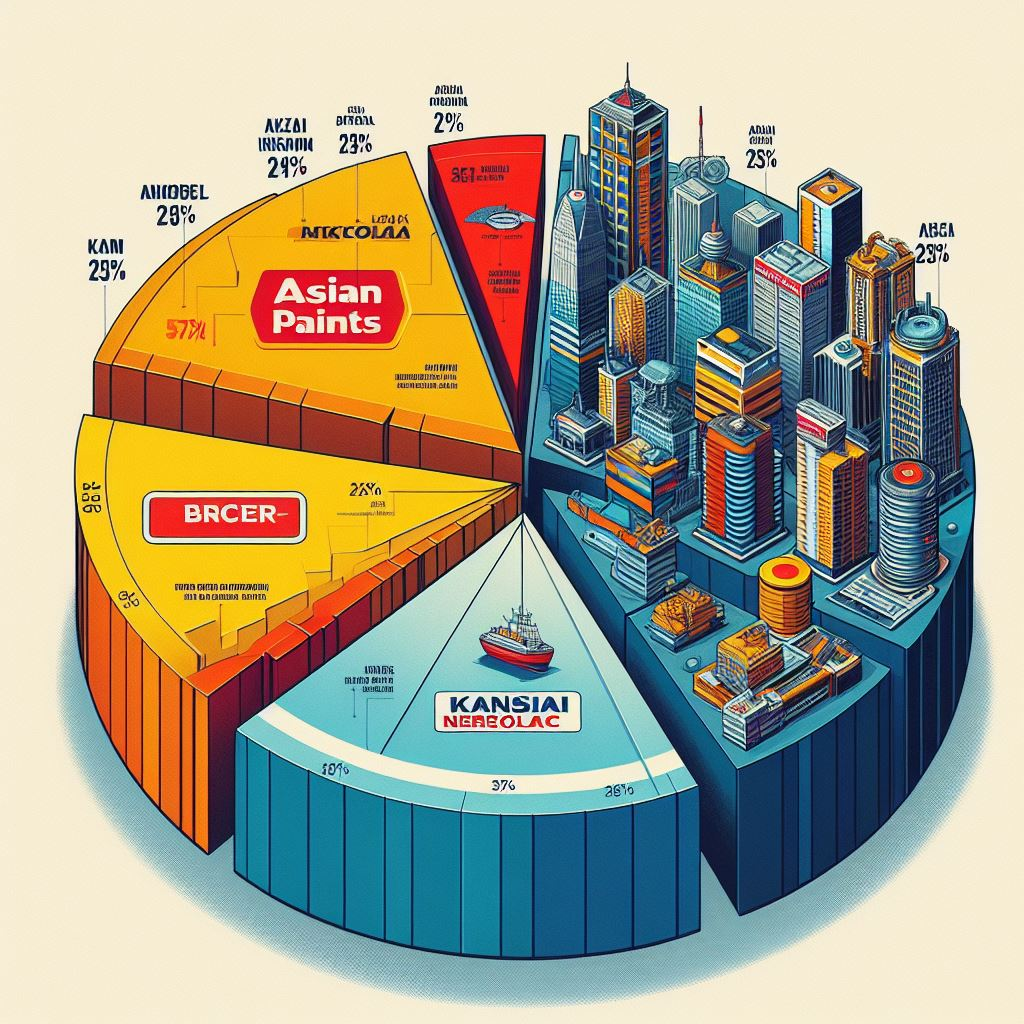

Macro shifts have been underway in the Indian paint industry in recent years, with several new players entering the space. Entrants like JSW, Pidilite Industries, and Grasim Industries already are market leaders in their respective businesses, generally allied with the paints sector or the overall construction industry. Frontrunners in the oligopolistic organized paint industry have thus far managed to maintain their market shares and keep threats at bay, leveraging entry barriers like brand equity and distribution networks. Strengthening these two aspects via continued innovations & efforts, each member of the quartet (Asian Paints, Berger Paints, Kansai Nerolac, and Akzo Nobel, collectively commanding a substantial 80% market stake) has managed to co-exist and carve out their own specific niche. This has maintained stable pricing practises in the sector, with no destructive wars.

Wary of this, new entrants have strategically ventured into the market, leveraging their own industry strengths like brand recognition, robust distribution channels, and scalability to disrupt established niches and gain a piece of the pie. Grasim Industries, for instance, which forayed into the business in January 2021, doubled its initial INR 5,000 crore investment to bring onstream its six architectural paint plants with a collective annual production capacity of 1.33 million litres. Three of these facilities, each in Panipat (Haryana), Cheyyar (Tamil Nadu), and Ludhiana (Punjab) with a total capacity of 0.63 million litres were commissioned in February 2024, with others, each in Kharagpur (West Bengal), Chamarajanagar (Karnataka), and Mahad (Maharashtra) slated to add in phases during FY 2025.

This is undoubtedly an audacious initiative. When completed, total annual capacity of the company will be greater than the capacity of the second, third, and fourth players put together. Bringing onstream these six facilities will catapult Grasim to the second spot behind Asian Paints, which has a capacity of 1.75 million litres/annum. Coming in with deeper pockets, Grasim Industries has the advantage of bringing onstream such fully automated and integrated world-class plants in far lesser time, unlike other market players.

Distribution is King

Inaugurating its brand “Birla Opus”, manufactured products will be available to consumers in the states of the commissioned plants by March 2024. By July, Grasim effectively aims to sell products in all major cities with a population of over 1 lakh, and post commissioning of the remaining three facilities, will be sold in all towns with populations of around 50 thousand. This will be realised via the extensive network the company has established even before the launch, registering over 300 thousand painters and contractors in just six months. With already 3,500 dealers onboard, the company targets to reach 50,000 dealers with a 95% penetration by March 2025.

Distribution is a major entry barrier in India’s paint industry. The presence of an extensive distribution network is as important as the quality of the product, primarily since contractors and painters are the key decision influencers for end consumers when it comes to choosing the right paint. Grasim can ride on the existing vast distribution network of its subsidiary UltraTech Cement which sells white cement and “putty”, tapping into those cement customers for its paints business. That way, Grasim’s paint business will be an extension of its white cement business, enabling it to produce core ingredients in-house.

New Market Entrants: Eye of the Storm or Storm in a Teacup?

Market sentiment with regards to Grasim’s entry has been mixed: some have hailed it to be the Indian paint industry’s “Jio” moment, while others contend that it won’t affect the sector’s profitability. Both perspectives are supported by sound reasoning. A supply influx of this magnitude, which will increase the industry’s total capacity size by 40%, is a bold move, and Grasim appears to have ventured in with due diligence. Bringing onstream just three of its six facilities in the first year has propelled it to the third place in the top supply rankings. Post commissioning of the remaining plants over the next 1-2 years, Grasim will effectively dethrone the second player (unless Berger expands its capacity). Additionally, the company’s Phase 2 expansion will add another 0.5 million litres per annum. Adopting an expansive approach, the company is targeting a wide-scale launch across both North (Delhi, Punjab, Rajasthan, and Haryana) and South (Karnataka and Tamil Nadu) Indian markets. Although not at this scale, historical precedents similar to this have proven successful before; via strategic geographical expansion, companies like Nippon Paints and Indigo Paints have managed to capture market share.

Source: Prismane Consulting Database

That said, distribution will not be hunky-dory for Grasim. Creating a vast & diverse supply chain takes time to replicate. While the Aditya Birla Group is no new name in Indian markets, extensive branding investments and continuous product innovation will remain essential in furthering brand development. Grasim seems to be cognisant of this, and plans to be generous with margins and offer incentives to woo dealers. The company is also providing advanced and compact tinting machines for free, in order to aid in dealer profitability. Despite these proactive measures poised to make a difference, Grasim’s target of adding 50,000 dealers by FY 2025 seems a daunting task. Should the company achieve this target, it will be catapulted to the third place in terms of dealer network size, trailing behind Asian Paints, which currently has the largest network with over 150,000 dealers.

In terms of revenue, Grasim aims to achieve profitability within the next three years, targeting a sales figure of INR 10,000 crores. Considering the challenges the company will face like initial cash burn to gain market share and the competitive landscape, this also seems a bit of a stretch.

Unorganized Paint Sector: Savior or a Victim in the Face of New Market Entrants?

Irrespective of however you slice the data, it is clear that there will be losers. Prismane Consulting believes the unorganised decorative paints sector is more likely to bear the brunt of it, with existing giants eyeing to capture a pie piece to retaliate and maintain market shares in the face of new entrants. On the flip side, new entrants will also aim to target initial market share from this pool to establish footing. While its share has contracted over the last decade post regulatory reforms like the demonetisation and GST, the unorganised sector still represents 23% share in the market, with strong foothold in tier III/IV cities and rural areas.

Source: Prismane Consulting Database

Comprising over 2,200 small and medium-scale firms, Indian unorganised decorative coating manufacturers typically operate 1-2 manufacturing facilities and primarily serve regional markets. A select few majors, with revenues exceeding INR 200 crore, maintain a presence in more than two states and boast strong distributor networks.

Valued at INR 16,000 crore in 2023, the unorganised decorative coating market is projected to augment at a compounded annual growth rate of 8.6% over the forecast. Products offered by companies in the space are comparatively lower priced, yet provide far better margins to dealers & distributors compared to their organized counterparts. Existing and new market players with a strong financial flexibility might attempt to thwart this unorganised sector dominance via competitive pricing.

Concluding Thoughts & Looking Ahead

Asian Paints, Berger Paints, Kansai Nerolac, and Akzo Nobel have long dominated the Indian paint industry, commanding a significant portion of the market share. Entry barriers have effectively shielded these key players from threats thus far. However, recent years have witnessed heightened competition, marked by the emergence of new entrants already established as industry giants in related sectors. These companies can scale big, come with deeper pockets, and also possess a vast distribution network that they can leverage. Consequently, large bouts of new supply have entered the market, with more slated to add in the forthcoming years. The industry, known for its price stability, now teeters on the brink of price wars, leading to inevitable margin erosion and causing apprehension among market participants.

For new entrants, venturing into the industry offers a dual advantage: not only do they gain access to a lucrative market, but they also enhance their size, scale, portfolio, and profitability.

All eyes are now on the unorganised sector, which has historically held a considerable market share. Manufacturers within this segment must prepare for a dual onslaught from both existing and new players, which will enter with competitive pricing strategies. Any entrant with strong financial flexibility and a pan-India dealer network in allied products stands to capture a larger market share. Small manufacturers with an annual revenue between INR 1-5 crores will be among the most vulnerable during this shift.

Although a cloud of cautiousness surrounds the market, some remain optimistic, asserting that there is enough room for everyone to grow. Companies like the JSW Group, for instance, have demonstrated remarkable growth since entering the market five years ago, outpacing industry growth by fivefold. This suggests that the structured paint industry remains relatively untapped, and newcomers are poised to gain ground. Further, paint sector generally grows 1.5 times its GDP, and with the economy in comparatively better health, rapid urbanisation, and rising disposable incomes, the future holds promising market prospects.