Introduction

Russia plays a pivotal role in the global butyl rubber market, with prominent manufacturers like PAO Nizhnehamskneftekhim and OOO Tolyattikauchuk ensuring a steady domestic supply and significant exports worldwide. However, recent developments, such as EU sanctions set to take effect in July 2024, are poised to reshape this industry.

Russia's Butyl Rubber Exports:

Russian butyl rubber exports have been noteworthy, serving both domestic needs and international demand. Russia is a significant exporter of butyl rubber across the world. Shipments from the country are primarily destined to China, India, Turkey, and South Korea.

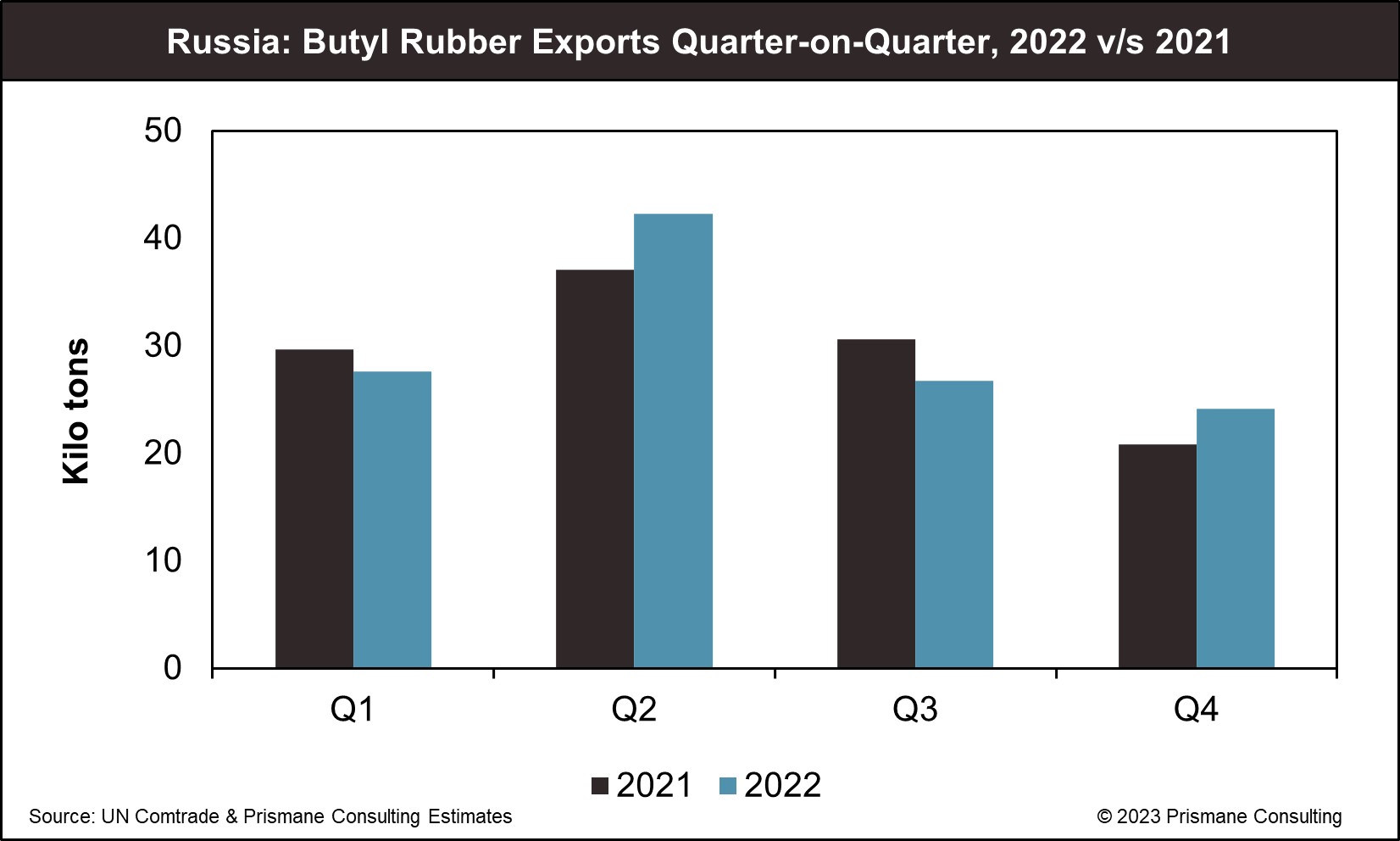

After briefly declining in 2021, Russian butyl rubber exports showed a modest increase of 2.1% year-over-year to reach 120.7 kilo tons in 2022. Export volumes peaked during the second quarter of 2022, amounting to 42.3 kilo tons, following which the same consistently declined quarter-on-quarter to reach 24.2 kilo tons in Q4. Over 84.7 kilo tons of the shipments were sold to China during the year, followed by South Korea at 8.7 kilo tons and India at 5.4 kilo tons.

EU Sanctions and its Implications

Russian butyl rubber is among the critical tyre raw materials announced to be sanctioned by the European Union beginning July 2024. While this would mean reduced exports for Russia, volumes are unlikely to suffer to a large extent partly due to the increased material flows towards Turkey and Asian countries like China, India, and South Korea. China is currently Russia’s largest buyer in terms of butyl rubber shipments, representing a 70% share in 2022.

Nevertheless, considering the majority of supplies imported by the EU come from Russia, there will be implications of an absent Russian supply. In anticipation of the impending deadline, several tyre manufacturers in Europe reported to have already started reducing the reliance of Russian materials in their supply chains, either via augmenting shipments from Asia, or by exploring alternatives. Following a period of tough conditions, supply chains have now largely stabilized, with tyre manufacturers now prepared for any supply risks stemming from the ban or any other related disruptions in the future. Also, unlike in the case of isoprene rubber, the EU also has sufficient domestic butyl rubber supply in the events of a complete ban.

Future Challenges: Risks of soaring costs and uncertainties

Despite these preparations, it will not be smooth sail for tyre makers, primarily due the possibility of prices going up due to expensive raw materials. EU already saw a sharp rise in raw material costs immediately after Russia’s countersanctions after the war. While prices have moderated since, they continue to remain at elevated levels.

In conclusion, Russia s dominance in the butyl rubber market is facing a significant test with the impending EU sanctions. Resilience in the country’s exports, however, is evident in its adaptability, as seen in its diversification to non-EU markets. European tyre makers are also showing resilience by seeking alternative sources. This shift will undoubtedly reshape the global butyl rubber industry in the forthcoming years.

For Further Information on Butyl Rubber Market, Please click here

To View Butyl Rubber Market Sample, Please click here

For more details on Butyl Rubber Market, please contact us at sales@prismaneconsulting.com