Global capacity for bio-based polymers is expected to register double-digit growth over the next five years, compared to low single-digit growth for fossil-based polymers. These include asset investments in EMEA, specifically in France, China, India, Thailand, Taiwan, and the UAE. Driven by these investments, the share for bio-based polymers in the total polymer capacity is expected to increase from its current 1%. Legislative impetus, sustainability shift, and increasing consumer awareness is augmenting demand for bio-based polymers.

Today, bioplastics has a myriad of different outlets across different end-use sectors, from packaging to consumer goods to fibers, automotive, and agriculture. Packaging remains, by far, the largest segment, responsible for nearly half the consumed bioplastics volumes.

By material type, Polylactic acid (PLA) dominates current bioplastics supply, and also accounts for majority of the upcoming capacity additions. Per Prismane Consulting Database, more than 80% of PLA capacity resides in China (as of 2024). The country represents a 65% share in world consumption currently. PLA supply in China is growing at a robust pace: new investments in the country are expected to propel its capacity from current 0.8 million tons to more than 2.5 million tons, just over the next two-three years. Government support has been key in driving these investments: from resources to incentives, China has introduced several legislative policies in the last four years. However, while these measures have supported industry growth, the market has now become heavily oversupplied, with utilization rates dropping to the 30s. The absorption of some capacity due to the demand surge will likely only partially offset the issue, as more assets are scheduled to add over the forecast.

Outside China, Thailand will get its second PLA plant, a 75 kilo tons/year fully integrated facility at Nakhon Sawan Province by NatureWorks, scheduled to commence production in H2 2025. The plant will address various outlets in the Asia Pacific, such as flexible packaging, tea bags, nonwovens for hygiene, 3D printing, and compostable coffee capsules & food serviceware. The country became a PLA producer in 2018, with the start of TotalCorbion’s 75 kilo tons/year Rayong facility in October.

In India, Balrampur Chini Mills Limited (BCML) recently laid the foundation of the country’s first PLA plant at Kumbhi, Uttar Pradesh, with an annual production capacity of 80 kilo tons. The facility will be strategically located to its existing sugar factory. The company will aim to capture the outlets currently addressed by Single Use Plastics (SUP). Plant construction will take approximately 2.5 years.

Middle East & Africa is expected to get its first PLA manufacturer, with Emirates Biotech announcing its foray into the business by setting up the world’s largest facility – a 160 kilo tons/year plant built in two phases at Abu Dhabi in the UAE. It will use plant-based feedstock to manufacture PLA. Project construction is expected to begin in 2026, with commencement in early 2028.

Belgian company Futerro aims increase its footing in Europe by establishing a 75 kilo tons/year PLA facility at Port-Jérôme, in the Normandy region of France. The company recently raised over EUR 12 million for the construction of the new bio-refinery, targeting production by 2027.

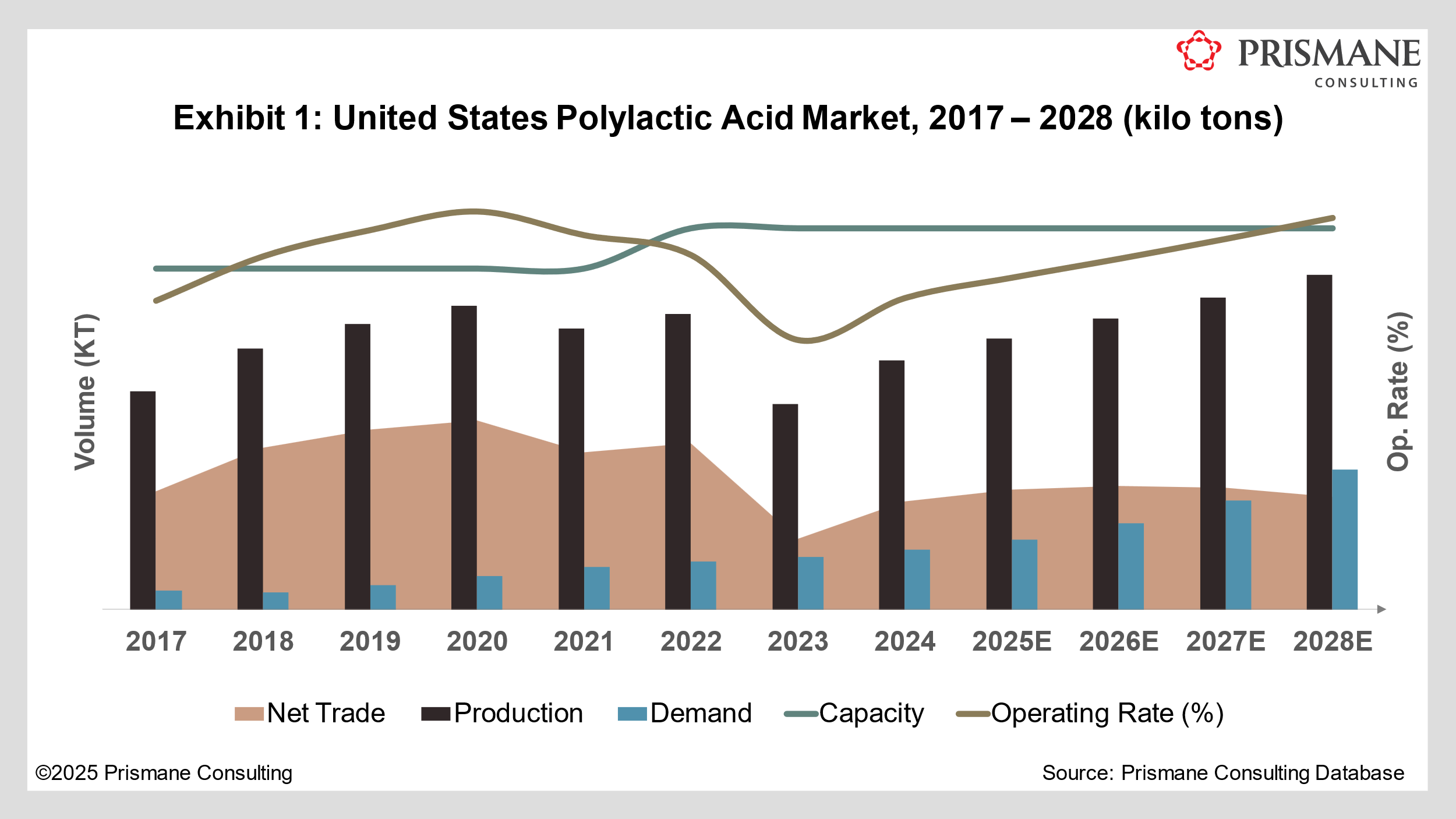

What do these investments mean for the U.S market? Besides NatureWorks undertaking a 10% expansion of its facility at Blair, Nebraska, the country has seen no other PLA capacity investments in the last decade. While ADM and LG Chem had previously announced a joint-venture to set up a 75 kilo tons/year facility at Decatur, Illinois, it was announced in October 2024 that the project would not move forward owing to high construction costs. Exhibit 1 illustrates the PLA market in the USA from 2017 to 2028.

(0) Comments

Leave A Comment