Polyether Polyols Market Overview

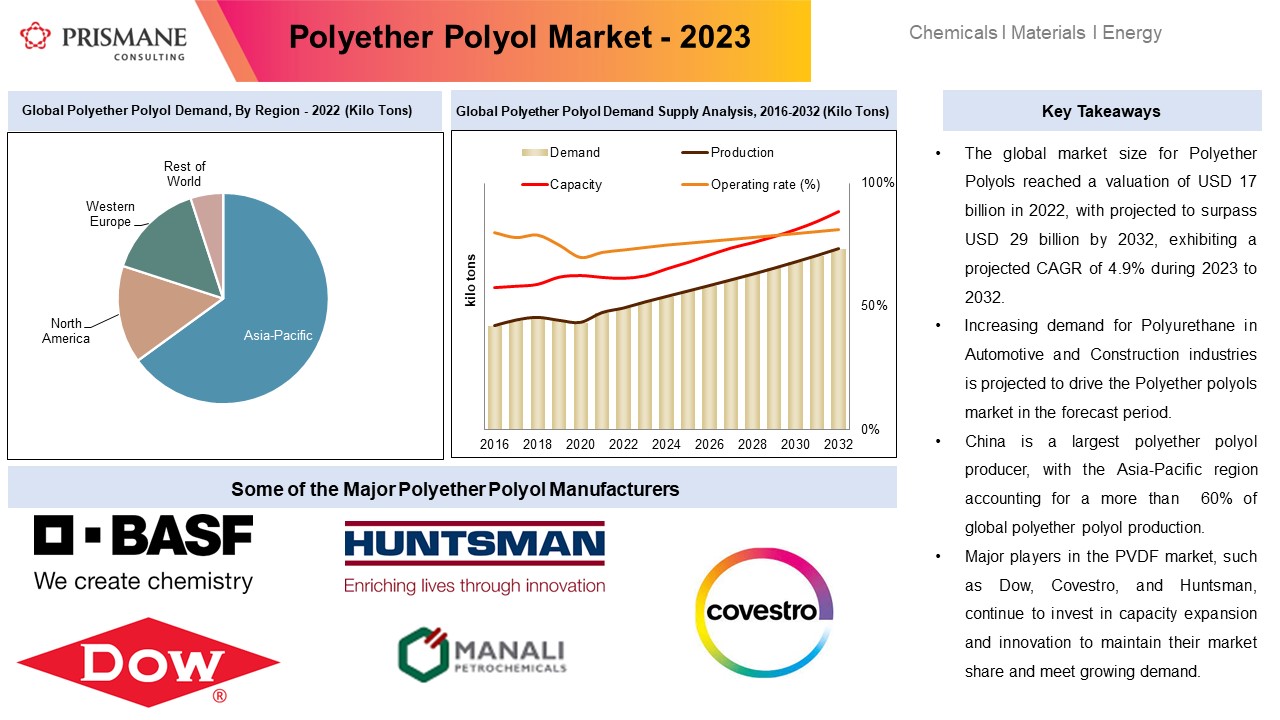

The global Polyether Polyols market size was valued at USD 18.5 billion in 2022 and it is projected to cross USD 29 billion by 2032 at a CAGR of 4.9% during 2023-2032. Polyether polyols are the key raw material used in the manufacturing of Polyurethane Foam (Flexible and Rigid), Adhesives & Sealants, Elastomers, and Surface coatings. The global polyether polyols demand is strongly linked to the performance of flexible foams, polyurethane foam, and rigid foams. Flexible foams find applications in automotive seating, bedding, and furniture, while rigid foams are utilized in construction and household applications.

The global Polyether polyol market experienced a decrease in demand as a result of the COVID-19 pandemic; however, the long-term outlook remains positive as the demand for polyurethane foams is expected to continue to grow in the future, particularly in developing regions, and the industry is likely to recover as the pandemic subsides.

Introduction

Polyether polyols are essential chemical compounds used in the production of various polyurethane products. They are a type of polymeric polyol, characterized by their molecular structure, which contains multiple ether groups. These versatile compounds serve as the building blocks for polyurethane foams, coatings, adhesives, elastomers, and sealants, making them a crucial component in a wide range of industries.

Polyether Polyols Capacity Analysis

The global capacity for polyether polyols was estimated to be more than 15,000 Kiloton in 2023. Northeast Asia is the largest market, accounting for more than 50% of the total polyether polyols capacity, followed by Europe and the Americas with 17% and 14% market share, respectively. Dow is the largest Polyether Polyol manufacturer globally, accounting for around 12% of the global capacity, which translated to around 2,000 Kiloton in 2023. Covestro is the second largest Polyether Polyol manufacturer with around 10 manufacturing units located in the Americas, Europe, and several Asian countries. In the Americas, the total polyether polyols capacity was estimated to be more than 2,100 Kiloton in 2023, with an average operating rate in the country stood at 80%. Covestro is the largest manufacturer of Polyether Polyols with three manufacturing units located in Texas and West Virginia with a combined capacity of 570 Kiloton. BASF and Dow are also prominent manufacturers in the US with production capacities of 350 Kiloton and 535 Kiloton respectively. Europe accounted for 20% of the global Polyether Polyols capacity. The Netherlands is the largest manufacturer with Dow Benelux as the dominant producer with a 530 Kiloton plant in Terneuzen. BASF and Covestro operate polyether polyols facility in Germany with a combined capacity of 400 Kiloton. MOL Group is building a new polyether polyols manufacturing unit in Tiszaújváros, Hungary, which is expected to come on stream in 2024 with a production capacity of 200 Kiloton. Northeast Asia dominates the global polyether polyols capacities, with China being the largest polyether polyols producer in the region and globally. The country has over 20 manufacturing plants with the presence of strong manufacturers such as Sinopec Shanghai Gaoqiao, CNOOC & Shell Petrochemicals Company (CSPC), Huntsman Jurong New Ningwu Chemical, and Wanhua Chemical together accounting for 24% of the country’s capacity. South Korea is the second largest producer with a total capacity of 740 Kiloton, with KPX Chemical leading the market with a production capacity of 270 Kiloton, followed by Mitsui Chemicals & SKC Polyurethanes Inc. with 220 Kiloton production capacity. India is seeing significant growth in the polyether polyols market with Manali Petrochemicals Ltd (MPL) increasing their capacity from 50 Kiloton to 150 Kiloton in 2020. Expanded Polymer Systems operates a 24 Kiloton plant in Dahej, Gujarat. The company has ramped up their capacity by 14 Kiloton to cater to the rising demand for polyether polyols in the country. Oceania, Southeast Asia, and the Middle East together accounted for the remaining 8% of the global capacities. In January 2021, Stepan Company purchased INVISTA's aromatic polyester polyol business and associated assets, which included two manufacturing sites, one in Wilmington, United States, and the other in Vlissingen, Netherlands.

Polyether Polyols Demand Analysis

The global polyether polyols demand was estimated to be around 9,000 Kiloton in 2023, which is anticipated to cross 11,000 Kiloton by 2032, growing at a healthy CAGR of 3.9% between 2023 and 2032. The global polyether polyols market experienced significant de-growth in 2020 due to the adverse effects of the COVID-19 pandemic on the global economy and the decline in key downstream sectors such as automotive, construction, and manufacturing. Northeast Asia recorded the highest demand with a market share of more than 45%, owing to the strong presence of various end-use industries such as automotive and construction. China and India are among the fastest emerging economies in the world. Owing to the rising spending power and income level, the end-use industries are growing in these countries, which will positively impact the polyether polyols market.Americas accounted for 17% of the global polyether polyol demand, and it is expected to grow at a CAGR of 3.7% between 2024 and 2032. In the US, polyurethane foams are commonly used in the construction industry as these foams are ideal insulation materials that can be used in wall and roof insulation, insulated windows, doors, and barrier sealants for maintaining a uniform temperature. According to the US Department of Energy, heating and cooling accounted for more than 50% of the energy used in a typical US home, which makes it the largest energy expense for most homes.

Polyether Polyols Market Dynamics

Rising demand for Polyurethane from various End-Use Industries

The versatility and adaptability of polyurethane make it a favored choice across a wide range of industries. As new technologies and formulations continue to evolve, the demand for polyurethane is expected to grow further as industries seek innovative solutions for various applications. PU foams are widely used in the construction industry for thermal insulation in residential, commercial, and industrial buildings due to their excellent insulating properties. Rising energy efficiency standards and the need for sustainable construction materials have boosted the demand for PU foams, which will positively impact the polyether polyols market. In the automotive industry, manufacturers are using PU foams in vehicle interiors and components to reduce weight and improve fuel efficiency. Polyurethane is a common choice for automotive seating due to its comfort, durability, and safety properties. Polyurethane foams are used for sound insulation and vibration dampening, contributing to quieter and more comfortable vehicles. PU foam provides superior comfort and durability for furniture cushions and mattresses, leading to higher demand as consumers seek quality products. Polyurethane foam is used as insulation in the walls and doors of refrigerators and freezers. It helps to maintain low temperatures efficiently and prevents the loss of cold air to the external environment. It is also used in the insulation of air conditioning and HVAC ductwork to minimize thermal losses and improve overall system efficiency.

Polyurethane is used to create seals and gaskets for various industrial equipment and machinery. Its resilience, resistance to abrasion, and ability to maintain tight seals make it valuable in preventing leaks and contamination.

Polyurethane is used to create seals and gaskets for various industrial equipment and machinery. Its resilience, resistance to abrasion, and ability to maintain tight seals make it valuable in preventing leaks and contamination.

Environmental Concerns regarding Polyether Polyols

Polyurethane foam manufacturing faces several regulations from various governing bodies, particularly in North America and Europe. For instance, the US National Emission Standards for Hazardous Air Pollutants (NESHAP) has introduced guidelines for both new and existing polyurethane foam production facilities, where these rules and regulations have been established with the primary goal of significantly reducing hazardous air pollutant (HAP) emissions from all existing sources of polyurethane foam manufacturing, aiming for a roughly 70% reduction from the baseline levels. Prolonged exposure to these harmful emissions can result in adverse health effects, including skin, eye, nose, throat, and lung irritation in humans. These rules and regulations might hinder the polyether polyols market in the forecast period.

Polyether Polyols Pricing Analysis

The global polyether polyols prices were assessed at $2.13/kg in 2023, which has increased by almost 5% compared to the previous year and a 10% increase compared to 2021. Polyether polyol prices are mainly driven by feedstock costs (Propylene) and follow movements in propylene market prices. For Further Information on Polyether Polyols market, Please click here To View Sample on Polyether Polyols market, Please click here For more details on Polyether Polyols market, please contact us at sales@prismaneconsulting.com

For Further Information on Polyether Polyols market, Please click here

To View Sample on Polyether Polyols market, Please click here

For more details on Polyether Polyols market, please contact us at sales@prismaneconsulting.com