Polylactic Acid Market Overview

The global Polylactic acid market is set to experience robust growth, with a projected CAGR of 19.4%. This growth is expected to propel the market size to USD 6 billion by 2032, a significant increase from the current value of USD 1.2 billion. The key drivers for this growth include government initiatives promoting the use of biodegradable polymers, bans on single-use plastics, and an increasing awareness among consumers about the importance of sustainable and eco-friendly solutions.

Polylactic acid (PLA), a renewable, odorless thermoplastic polyester is a biodegradable biopolymer which obtained by direct condensation of lactic acid monomers. The major end-use applications include food & beverages packaging, cosmetics packaging, agriculture, automotives, textiles, medical and other niche applications.

Polylactic Acid Demand Supply

In 2021, the global Polylactic acid production capacity was estimated to be about 670 kilo tons, with global Polylactic acid demand of 428 kilo tons. The global capacity utilization rate in 2021 was estimated to be around 64%, which have varied between 60% - 80% in last five years. The double-digit growth in China and global acceptance of biopolymers has led to an increase in demand and eventually the operating rates. However, with several capacities announced in China, the global Polylactic acid operating rates are forecast to decline. With the recent announcement by the U.S. Government of displacing 90% of petroleum-based plastics with recyclable-by-design bio-based polymers over the next 20 years in the U.S. new Polylactic acid and bioplastic capacities can be expected in the long-term forecast.

The global Polylactic acid industry has witnessed several industrial collaborations for technology transfer and commercialization. Amongst some of the investments announced in Asia-Pacific, Total Corbion and Konspec JV has signed an agreement to produce completely biodegradable and compostable plastics in India. The plant will import Polylactic acid from Total Corbion Rayong Polylactic acid plant in Thailand and provide rigid and flexible packaging containers and biodegradable alternatives to plastics. Moreover, to curb plastic pollution and support the single-use-plastics ban initiative in India, Praj Industries has recently announced that they are planning to setup a demo Polylactic Acid (PLA) plant in at Jejuri in Pune, Maharashtra. The company has developed technology to produce Polylactic acid as a part of its Bio-PrismTM portfolio.

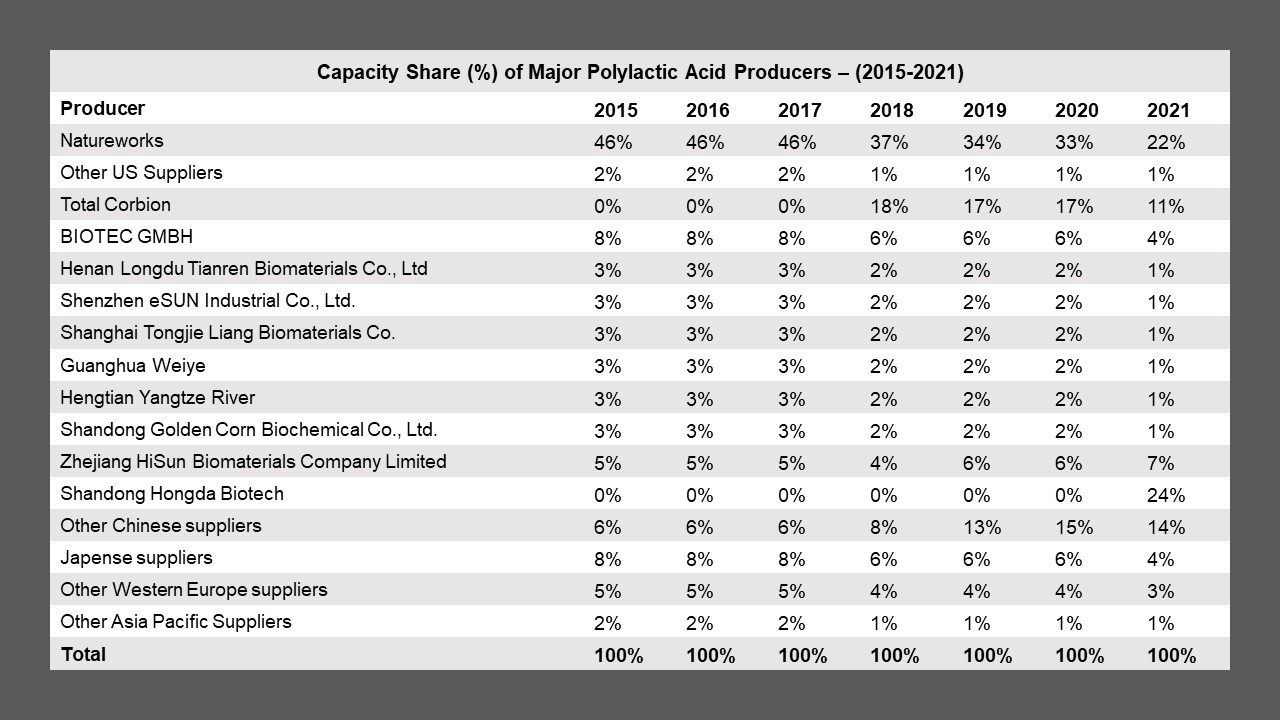

As of 2021, NatureWorks is the largest Polylactic Acid producer globally, having installed capacity of 150 kilo tons in the U.S. The company is also setting up a 75 kilo tons Polylactic Acid facility in Thailand to capture the fast-growing ASEAN and APAC markets. The global Polylactic Acid capacity as per Prismane Consulting’s database stood at 670 kilo tons in 2021. NatureWorks accounted for around 22%% of the global Polylactic Acid capacity market share and has been exporting its Ingeo PLA resins to several countries from its facility in Nebraska, USA.

Total Carbion is another key player having started its 75 kilo tons Polylactic Acid facility in Thailand in 2018 and another PLA facility of 100 kilo tons being constructed in France which is expected to come online by 2024. Several capacity expansions are announced in China with a huge wave of new capacities expected during the 14th 5-year plan of China (2021-2025). The country’s shifting focus towards more sustainable products will provide a big push not only to the Polylactic Acid market but the entire bioplastics / biodegradable polymers market.

Recent Developments in Polylactic Acid Market

In February 2024, Balrampur Chini Mills Limited (BCML), a leading integrated sugar manufacturing company based in India, announced that it will venture into a new line of business to manufacture Polylactic Acid (PLA). With a total investment of INR 2,000 crores (approx. USD 241.1 million) which will invested in phases over the next 30 months, the proposed facility will have an annual production capacity of 75 kilo tons once operational. The plant will be built on a “greenfield site” next to its existing sugar production facility, proximity of which will ensure efficient raw material sourcing, while leveraging the local infrastructure in the plant construction. PLA at the facility will be manufactured via the fermentation of sugarcane into lactic acid.

Besides encouragement from the government in terms of production-linked initiatives for eco-friendly bioplastics, producers are also witnessing increasing PLA demand in India, with renowned companies like Starbucks and Costa incorporating the material in various items like cups, straws, paper cup linings, and stirrers. Major Indian companies like Amul and Aditya Birla are also embracing PLA for manufacturing their end-use products. There is also significant potential for replacing India’s current Single-Use Plastics (SUP) usage with PLA and PLA compounds.

LG Chem signed joint development agreement with ADM to produce lactic acid and polylactic acid in the US with installed capacity of around 150 kilo tons of lactic acid and 75 kilo tons of Polylactic Acid to cater the growing demand of biobased products in the region.

NatureWorks is planning to expand its Polylactic Acid biopolymer production capacity by 10% at Nebraska, USA . The Polylactic Acid capacity expansion is estimated to come online by the end of 2021. The PLA capacity expansion will cater the 3D printing, nonwoven hygienic masks, compostable coffee, tea bags, coated paper and food service ware market.

In January, Futerro, a Belgian Company announced to build a fully integrated production facility of Polylactic Acid with production capacity of 75 kilo tons per year in Normandy, France.

In 2020, Total Corbion PLA announced that it will build a bio-based PLA facility of production capacity 100 kilo tons per annum at Grandpuits, France. The facility was estimated to come online by 2024 to cater the growing demand of PLA resins in Europe. Nevertheless, in June 2023, the company decided not to proceed with the construction of the 100 kilo tons PLA plant at Grandpuits, France.

Bio Valore World built a new production facility of Polylactic Acid biopolymer in Termoli, Italy based on Sulzer Technology with production capacity of 5 kilo tons per annum of Polylactic Acid and 12 kilo tons per annum of PLA based compounds. The plant commenced production of Polylactic Acid in the first half of October 2021.

Natural Materials, Russian Company LLC and Suzler, a Swizz Company signed an agreement in 2021 to build a PLA production facility of production capacity 10 kilo tons per annum in Dubna, Russia. The production is expected to commission in the coming years.

The new manufacturing facility of NatureWorks with production capacity of 75 kilo tons of Ingeo Biopolymer (PLA) is estimated to complete its construction by second half of 2024. After completion of construction, Lactic acid, lactide and polymer will be produced at the new facility in Nakhon Sawan Porvince, Thailand.

For Further Information on Polylactic Acid market, Please click here

To View Polylactic Acid Sample, Please click here

For more details on Polylactic Acid Market, please contact us at sales@prismaneconsulting.com