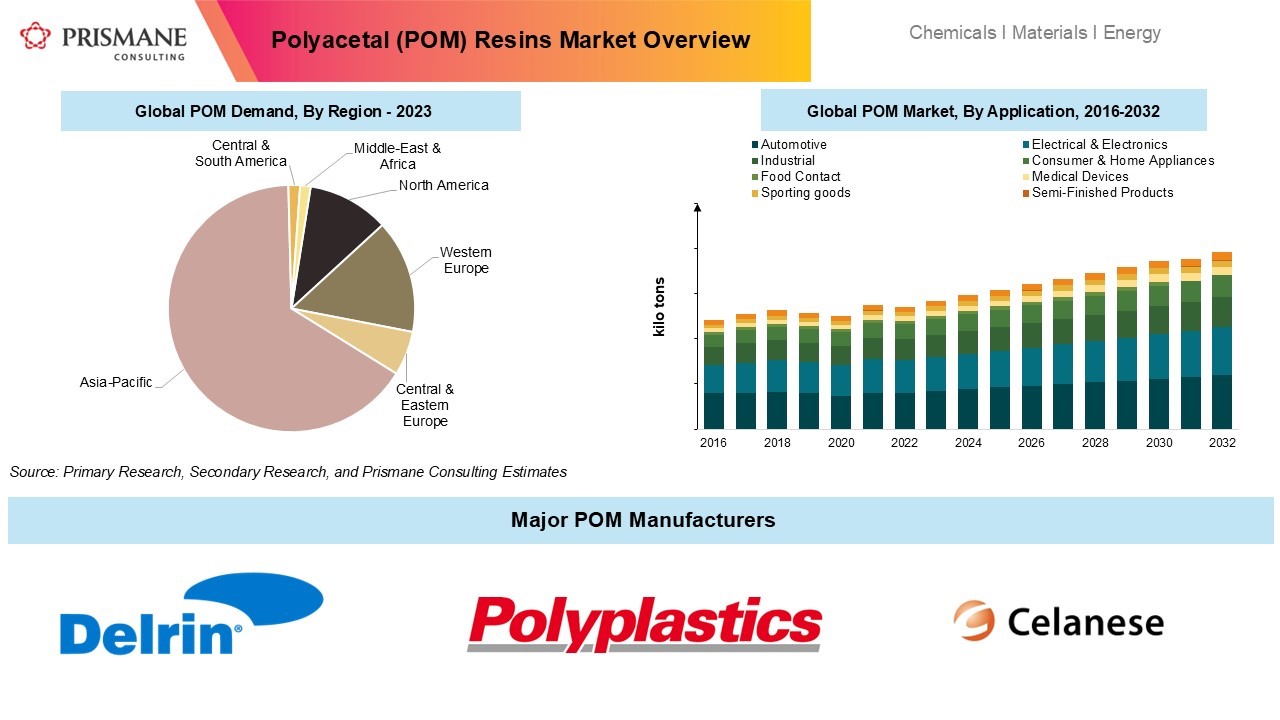

China has been the largest market for polyacetal (POM) resins for several years now. From constituting for a third of global demand a decade ago to currently representing more than half the pie per Prismane Consulting Database, demand for the thermoplastic in the country has been driven by production growth in automotive and electronics sectors – two of the market’s biggest drivers. With an annual average growth rate of 5%, China’s POM consumption has effectively doubled since 2010.

China also dominates POM production, housing more than a third of global supply. Typical plant sizes in the country range from 20 to 60 kilo tons. However, domestic supply utilization has remained relatively low, with average run rates just above 50% over the past decade. As a result, imports play a significant role, fulfilling more than half of the domestic demand. Supplies are sourced from South Korea, Malaysia, Taiwan, USA, Germany, and Japan. Saudi Arabia and Thailand are other notable exporters.

Over the years, this shift towards China—and other Asia-Pacific regions—has led to a series of supply expansions and consolidations. New capacities and expansions have been witnessed in South Korea, Malaysia, Thailand, and Saudi Arabia. China itself has witnessed various plant developments: While companies like Shanghai Pacific, Shanxi Lanhua, Xinjiang United Chemical, and PetroChina Jilin have shuttered plants, others, including Kaifeng Longyu Chemical, Lunan Yankuang, Tangshan Zhonghao, Yuntianhua Group, and Tianjin Soda Plant, have commenced production.

Through its JV company PTM Engineering Plastics (Nantong) (with other partners Mitsubishi Gas Chemical Company, Korea Engineering Plastics and Ticona), Polyplastics had been a key polyacetals manufacturer in China, having commenced production at its Nantong, Jiangsu facility in October 2005. Alongside Delrin (part of the Jordan Company) (formerly owned by DuPont), and Celanese, the company is among the top three POM producers globally, with manufacturing facilities in Japan, Taiwan, and Malaysia. Celanese held a 45% share in Polyplastics, before it divested its entire equity to JV partner Daicel in 2020.

Chinese POM supply fell in 2021, when Polyplastics’ plant in the North District was directed by the Nantong Economic Development Zone authorities to suspend operations. Consequently, the 60 kilo tons plant ceased production in March. Import volumes during the year reached an all-time high of 374 kilo tons, a 13% jump year-over-year.

Immediately thereafter, Polyplastics announced that it would build a new POM facility in Nantong, this time in its South District under new entity DP Engineering Plastics (Nantong) Co., Ltd. The new facility will be its largest, with an annual production capacity of 150 kilo tons. The first phase of production, with 90 kilo tons began operations at the end of last month, with Phase II expected early 2026.

What does this mean for the POM market?

Once completed, the plant would be among the largest POM production facilities in the world, alongside Celanese’ Frankfurt facility in Germany and BASF-Kolon’s JV innoPOM’s plant at Kimchon, South Korea. While China has traditionally relied on imports to meet substantial part of demand, Polyplastics “entering” with even greater supply will likely decrease some volumes, and pressure global producer margins.

For a market that is poised to reach 1,500 kilo tons by next year, Polyplastics’ new facility is strategically positioned to cater to China’s increasing demand. The Nantong plant, along with the company’s 25 kilo tons plant in Kaohsiung, Taiwan, will help meet this demand, shorten lead times, and reduce transportation costs. Additionally, Polyplastics plans to leverage next-generation methanol as a raw material, and address newer applications such as medical uses, beyond the traditional automotive and electronics markets.

Conclusion

Over the course of the last two decades, the market shares of both Europe and North America have shrunk considerably, despite them continuing to be the second and third largest markets, respectively, for POM. Asia Pacific, especially China, has been the primary benefactor of this lost share, and now controls nearly 70% of the global market. While Polyplastics, TJC, and Celanese continue to be the top three producers globally, they have also seen decline in market share.

Strategic alliances & partnerships, along with some capacity rationalizations will thus be crucial in navigating the choppy waters that remain ahead.