European Commission Imposes Provisional Anti-Dumping Duties

Following a petition filed by the Epoxy Resin Producers Alliance in June 2024, alleging the dumping of epoxy resins from China, South Korea, Taiwan, and Thailand into the European Union, the European Commission launched an anti-dumping investigation on 1st July 2024. Eight months later, it announced the imposition of provisional anti-dumping duties (ADDs) on shipments from these countries. The duties range between 10.8% to 40.8%, with major affected exporters including Sinochem Group (40.8%), Aditya Birla Chemicals (Thailand) (32.1%), Jiangsu Sanmu Group (24.2%), and Chang Chun Plastics (10.8%). Excluding certain pre-impregnated fabrics and blends, the duties are applicable to all resins with over 35% epoxy content used in adhesives, coatings, and composites. The measures will last six months before the final ruling will be made to update any changes (if applicable).

Ongoing Anti-Dumping Investigation in the USA

In the U.S., the Department of Commerce initiated an ADD investigation in April 2024 on epoxy resins cargoes originating from China, South Korea, India, Taiwan, and Thailand, following a petition by Olin and Westlake Corp. Final dumping and injury determination are expected in March- April 2025.

Epoxy resin is a key material in the manufacturing of paints & coatings, electronics, and composites. Domestic producers argue the protectionist measures as a necessary step to secure and strengthen supply chains for paints & coatings manufacturers, not to also mention the margin pressure they are witnessing. China has, in recent years, has bought substantial capacities for epoxy resins, which is then being “unfairly traded” in the EU and U.S. markets. Countries like China, which has also installed significant capacity for raw materials like epichlorohydrin, sell subsidized volumes in neighbouring Asian countries, allowing manufacturers there to produce epoxy resins at relatively lower prices to being shipped to the West. This has forced Western manufacturers to slash prices in order to keep their facilities operational, and regaining lost market share has become extremely difficult.

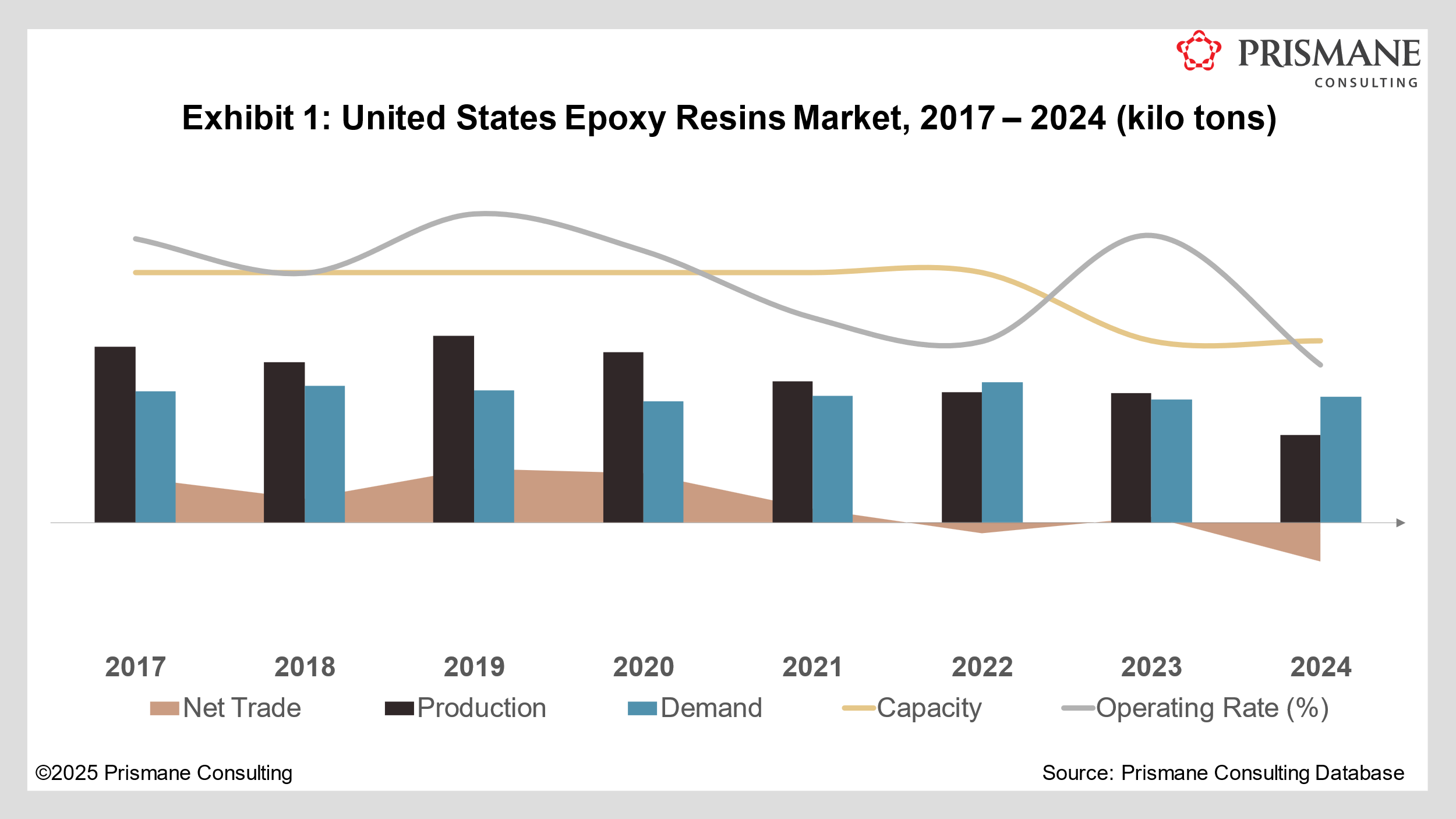

Exhibit 1 and 2 illustrate epoxy resin markets for USA and European Union between 2017 and 2024.

Epoxy Resins Market: How Did We Get Here, and What Lies Ahead

Things really began going downhill for the epoxy resin's supply dynamics in the West in 2021 when ripple effects from the COVID-19 restrictions spurred a surge in demand for paints, coatings, and electronic materials. This coincided with winter storm Uri hitting the USA, forcing then-producer Hexion (now owned by Westlake) and Olin to declare force majeures at their epoxy resin facilities in Texas, effectively taking off more than 85% of the country’s supply. As a result, prices skyrocketed.

Scrambling to find reliable supplies, consumers like PPG Industries struggled for a good two years before being forced to seek alternatives in the Asia Pacific. For producers in countries like China, this was a major opportunity to enter the market, amid their own dwindling domestic sales amid slowing buying activity. As a result, Asian suppliers were able to penetrate the Western markets to the point where several consumers became heavily reliant on them for more than half their material needs.

Concurrently, however, increased logistical troubles – including shipment delays and mounting freight costs – began to strain supply chains, lengthening lead times for consumers. Local supply thus remained prized, and domestic producers continued price hike undertakings each year. Asian cargoes have, nevertheless, continued to increase sequentially, with decreasing shipping costs and oversupply in their home markets.

Fast forward to today, and Asian shipments represent a sizeable share in EU and U.S. imports. Domestic producers allege enough injury to margins and ask for a “level playing field”. The success of these protectionist measures will be key to maintaining healthy output in both regions.