Weakening demand growth coupled with an oversupply has plagued the Polystyrene industry over the last decade. Through various mergers & acquisitions, PS & EPS producers have managed to survive thus far. Nevertheless, mature markets in the West Hemisphere still remain at risk, amidst slowing demand, plummeting margins, changing consumer preferences, and increasing regulations – all against a backdrop of growing demand, supply, and competitiveness in the East. Western converters of the thermoplastic polymer are increasingly considering other alternatives.

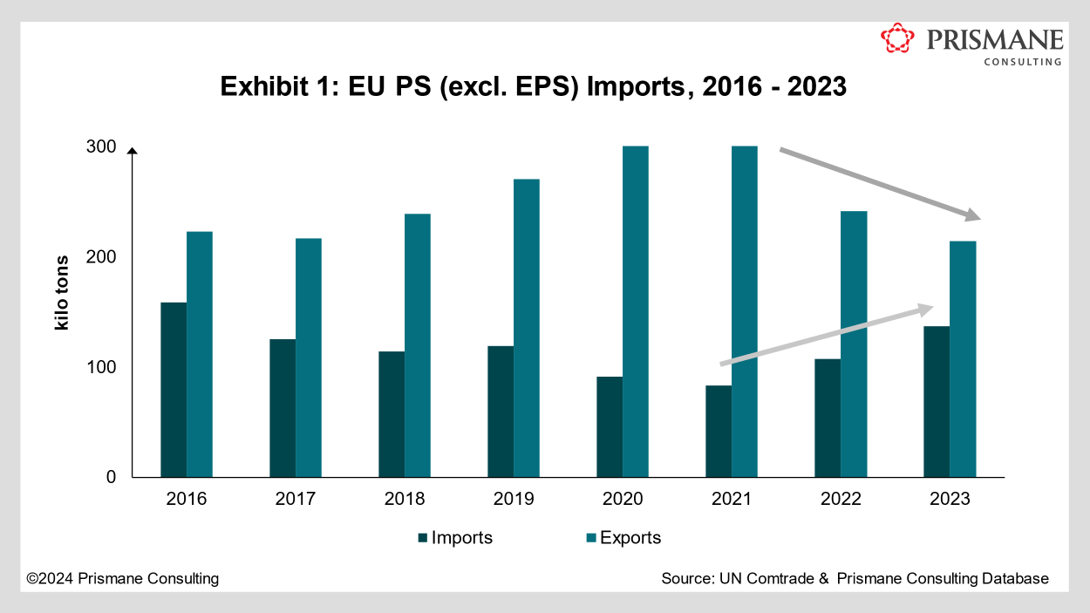

Specifically in the European Union, the influx of Asian imports, coupled with its own struggles with high energy costs and low feedstock availability have weighed on trade dynamics. As illustrated in Exhibit 1, EU imports of polystyrene (excluding EPS) have risen by more than 25% on average since 2021. During the same period, exports have decreased by over 20%. Although the EU has managed to maintain its net exporter status, its net export volumes in 2023 were down by nearly 150,000 tons compared to 2021.

While this has not prompted any closures in the Union (supply has remained unchanged since 2021 besides INEOS’ PS line at Wingles, France, converted to ABS in 2022 and SUNPOR Kunststoff’s 30 kilo tons/year expansion at St Pölten, Austria) so far, there haven’t been any new investments either. Plant utilization rates in the region have also significantly dropped due to lower domestic demand and the cost advantage held by overseas producers with cheaper feedstock. In 2023, global PS operating rates were around 65%.

On the regulatory front, the European Union has introduced significant challenges for the polystyrene industry. In April 2024, the European Parliament approved the Packaging and Packaging Waste Regulation (PPWR), which aims to reduce packaging waste and promote recycling across the entire EU. The broad scope of this regulation means that it will apply universally to all member states, directly affecting demand for PS and EPS products.

For instance, PS demand could further decline as paper-based packaging becomes more favoured. Moreover, the mandatory minimum recycled content for plastic packaging could discourage new investments in the long term. Additional regulations, such as the directive on end-of-life vehicles—which could create opportunities in non-packaging sectors of the polystyrene market—are still in the process of legislation.

What Lies Ahead

China has witnessed a plethora of newly added PS supply in the last 2-3 years, with several more plants slated to add. Excess volumes of the country will likely flow towards ASEAN & India in Asia and in Western Europe and Africa over the forecast. Against a backdrop of its internal production struggles and a weakening demand scenario without potential recovery in sight, EU stands to be one of the biggest losers unless decisive measures are taken to adapt to the changing landscape.

It is crucial that the Union undertakes bold steps to enable transformation, and eliminate bureaucratic hurdles for market participants. Fortunately, some hope exists in the form of the revised Energy Performance of Buildings Directive (EPBD) in 2024, which could revitalize PS and EPS demand in the Union’s construction sector.

To secure a sustainable future for the polystyrene industry in the EU, it is essential to reduce production cost disparities with other regions like North America and Asia Pacific. Becoming more competitive globally will require a combination of regulatory adjustments, strategic investments, and innovations in production methods.