Russia is the largest polyisoprene rubber manufacturer in the world, responsible for more than half the global supply. Producers in the country include Nizhnekamskneftekhim (NKNK), Sintez-Kauchuk (Sterlitamak), and Tolyattikauchuk, (subsidiary of SIBUR). Russia is also the largest exporter of polyisoprene supplies in the world; and constitutes for the biggest share in EU imports.

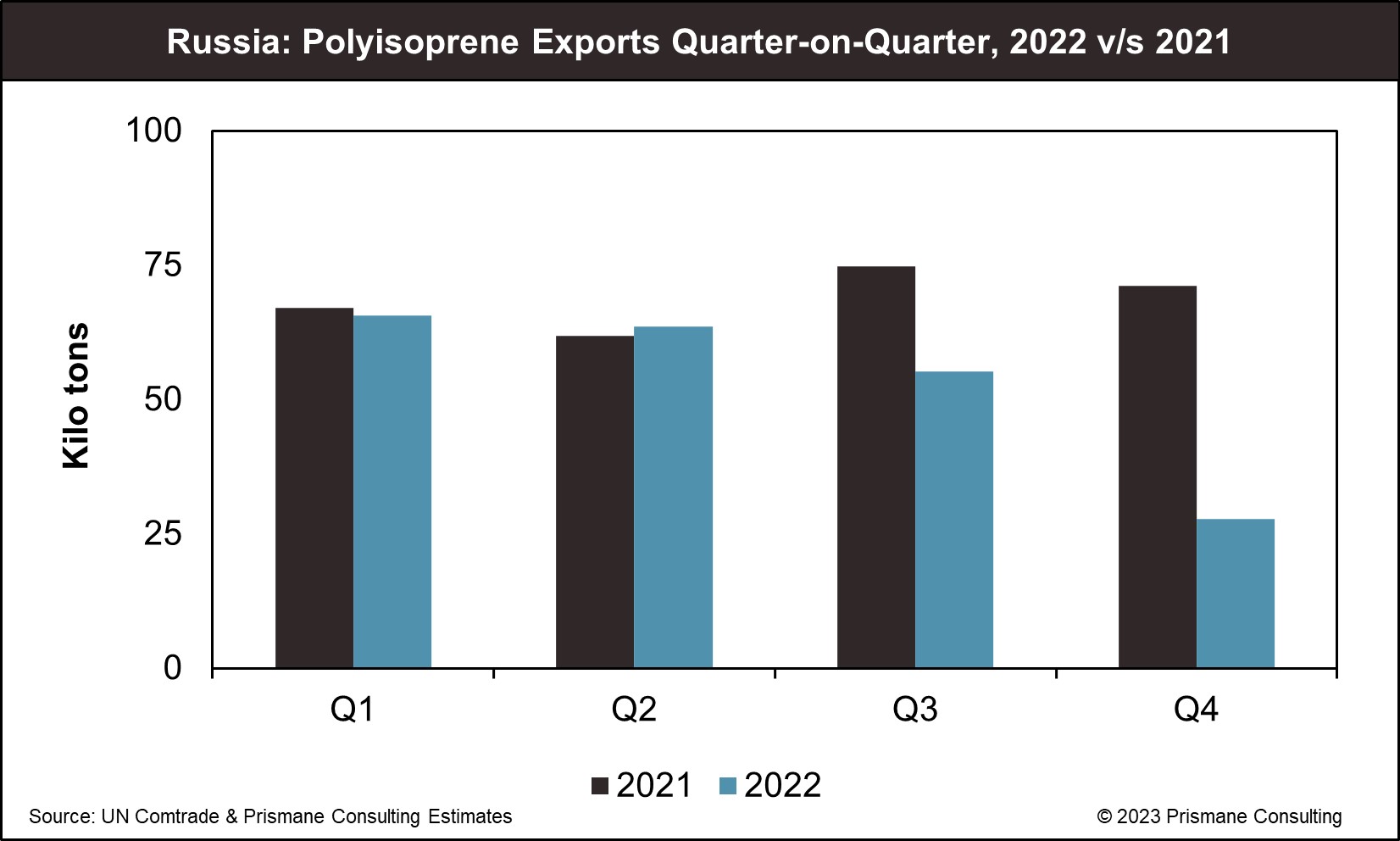

However, the Russian polyisoprene export landscape has encountered turbulence in recent times. Trade indicates a substantial year-on-year dip of nearly 23%, resulting in volumes plummeting to 212.2 kilo tons in 2022. Diminished exports of the country can be partly attributed to EU’s strategic shift, reducing its reliance following the conflict in Ukraine. Meanwhile, supplies from Asian countries including China and Japan has steadily increased.

A year since the Russia-Ukraine war started, the European Union announced a new round of sanctions against Russia in February 2023. Among these measures is a ban on Russian imports of critical tyre manufacturing materials, including carbon black and isoprene rubber, set to take effect in July 2024.

Imports of isoprene rubber into the EU is thus not directly prohibited currently, but this will have interesting implications on the market dynamics and the trade flows as the deadline approaches. Firstly, tyre makers in the EU will increasingly seek to reduce their dependence on Russian supplies. This would mean augmenting the consumption of alternatives like natural rubber. This will be easier said than done, however, in part because materials like polyisoprene are hard to substitute. Further, EU has relied on Russian imports for many years, and any attempts to build extra supply to replace the same have not materialised.

Secondly, we might see strong restocking of Russian isoprene supplies by tyre manufacturers ahead of the impending deadline, aiming to consume those for the rest of 2024. Russia is thus likely to see a momentary spike in its exports. However, players in the EU will then have a short window before stocks run out in 2025: secure enough supplies from Asia, increase consumption of substitute materials, or build domestic supply.

Besides these factors, the EU is also facing another issue with respect to the sanctions: all countries have significantly limited imports from Russia except for Poland. Poland has always been a major trade partner in this regard; the country was the largest importer of isoprene supplies in the EU until 2021. However, even in Poland, imports saw a stark 32.5% decline in 2022, causing the country to slip to become the second-largest trade partner of Russia.

From a Russian standpoint, exports will suffer from the ban, although not to the extent players in the EU would expect. Diminished imports from the region will be partially offset by increased supplies to other countries. These include China, Turkey, Mexico, and Brazil, who have seen a surge in their imports from Russia of late. China, which notably has not participated in any sanctions against Russia, surpassed Poland to become the largest import partner of the country in 2022 and is likely to continue increasing its share of Russian imports.

Overall, consequences from the potential polyisoprene ban will have widespread ripple effects in the trade dynamics of Europe: EU member states must urgently prepare for a future with an absent Russian supply, while Russian exports will continue to decline year-on-year in 2023, as they look to increase supplies destined to its alternative buyers. This shifting landscape will undoubtedly reshape the global polyisoprene rubber industry in the years to come.