Market Overview

In 2023, the global Terephthalic Acid Market reached a valuation of USD 79 billion, with a growth projected at a CAGR of 3.5% to cross USD 99.5 billion by 2032. This strong growth can be attributed to the growing demand of PTA from applications such as PET resins, films, and fibers.

The global chemical industry is in dynamic landscape, subject to constant shifts and changes. One area that has consistently captured the attention of industry insiders and investors alike is the market for purified terephthalic acid (PTA). This crucial chemical compound serves as a building block to produce various everyday items such as polyester fibres, plastic bottles, and textiles. Understanding the trends and growth drivers in the PTA market is vital, especially in light of the interplay between paraxylene and terephthalic acid prices.

Paraxylene and Terephthalic Acid Prices: A Symbiotic Relationship

Paraxylene and terephthalic acid are intricately linked within the chemical supply chain. Paraxylene, a raw material primarily derived from crude oil or naphtha, undergoes a series of chemical reactions to produce terephthalic acid. This terephthalic acid, when purified, becomes the key component for manufacturing polyethylene terephthalate (PET) resin, a versatile material used in numerous applications.

The prices of paraxylene and terephthalic acid are inextricably connected. A significant fluctuation in the price of one can cascade down the supply chain, affecting the other. For instance, when paraxylene prices surge due to factors like geopolitical tensions or supply disruptions, it can cause terephthalic acid manufacturers to incur higher production costs, leading to an increase in terephthalic acid prices.

Expanding Downstream Capacity in PTA & PET Paints a Bullish Picture for Global Para-Xylene Prices

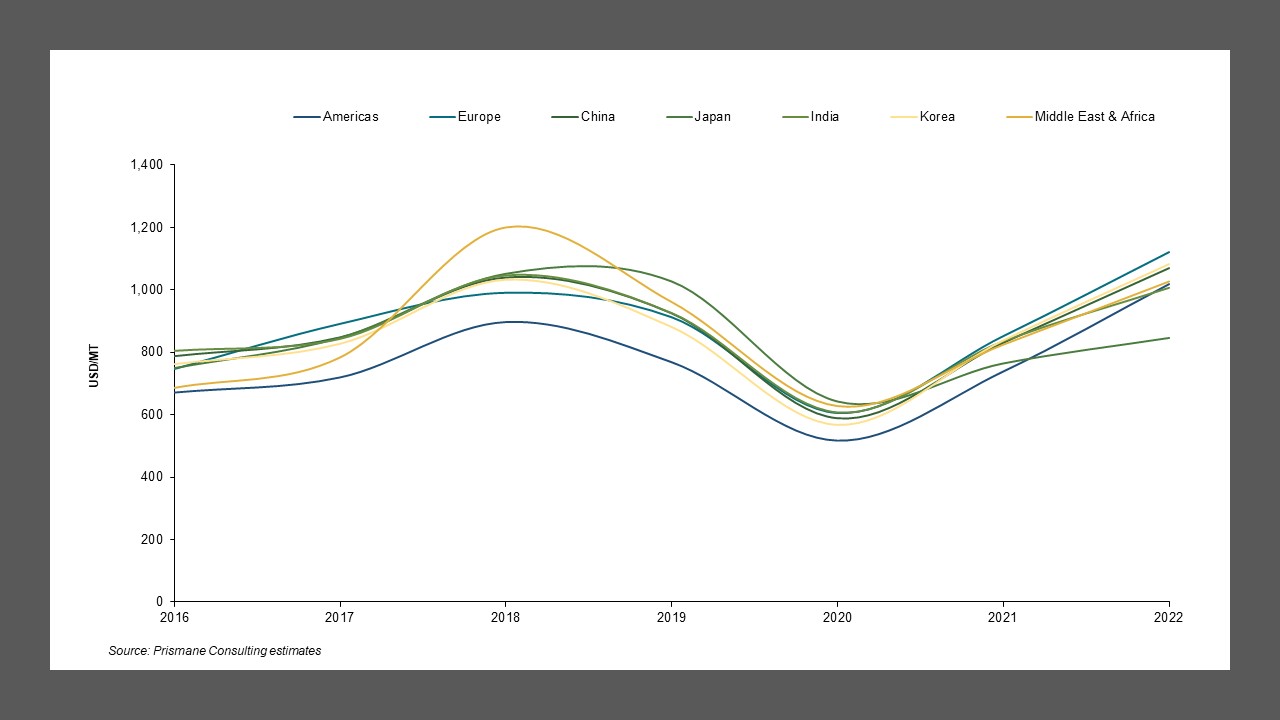

Para-xylene spreads narrows temporarily on firmer feedstock and huge capacity additions in China. The downstream PTA fundamentals remain fragile, making prices to drop. The average para-xylene prices in USA during 2019 were 897.15 USD/tons and has since declined to 738.10 USD/tons in 2021. The prices in China in the same period have declined from 924.86 USD/tons to a low of 780 USD/tons. Amid the downtrend in para-xylene prices and narrowing spreads, the operating rates were reduced by producers of para-xylene and downstream PTA. Although operating rates and prices stabilized from 2021 to 2023, new integrated PX-PTA capacities and new PET facilities were brought onstream in China.

The short-term forecast for Asia Pacific is unfavourable, as new Asian PTA capacity of around 35 million tons will continue to come online till 2026, pressuring margins in other parts of world. The new capacity-particularly in Mainland China squeezed operating rates globally, which began to fall from H2-2019. PTA producer, Hengli Petrochemical has brough its line 4 of 2,500 kilo tons in the march-April 2020, further line 5 was started in mid of 2020. Dushan Energy also brought its phase 2 of 2,500 onstream in 2020.

Purified Terephthalic Acid Market Trends

Currently PTA is under pressure amidst increasing supply, although emerging signs of support from PET industry for PX-PTA

The PTA market has weakened in 2020 as huge supply has brought on stream, although weak upstream PX prices amid mega expansion in China. However, downstream expansions in PTA and PET mainly in China, is providing support, resulting in strong rebound in PX prices.

China’s PTA installed capacity has increased by about 4,760 Kiloton in 2021, to stand at 80,610 Kiloton in 2022, according to Prismane consulting capacity database. Two more new PTA plants each with the capacity of 2.5 million tons, will be brought on stream by Hengli Petrochemical, with line 6 expected to be online in the end of 2023, and line 7 is anticipated by 2024. Meanwhile, Zhejiang Yisheng Petrochemical’s No. 2 plant has completed expansion in mid-2021. Fujian Petrochemical is planning to expand its existing plant of 4.5 million tons by 3 million tons new facility, expected to commence operations by 2026.

Indian Oil Corp.’s 1.25 million tons plant in Odisha is slated to start by 2024. Meanwhile, Reliance Industries Ltd. is expected to start in PTA plant in Mid-2024, further expansions are planned at the same facility, totalling, 3 million tons of new capacity, slated to commence operations by 2026. JBF Industries PTA plant has started operations in 2022. Other major expansion is underway by Haldia Petrochemicals of 2.5 million tons, slated to start by 2025.

Potential Swing in Trade Movements

With China now self-reliant in PTA, other manufacturers in the region should dynamically discover new markets.

Australia, Philippines and Vietnam are attracting market attention, thanks to its strong PET and polyester industry growth, and lack of domestic PTA producers. Vietnam has brought onstream a 450 Kiloton of new PET facility in 2018, with over 300 kilo tons is expected to be online by end of 2026, based on Prismane Consulting Database.

In the USA, demand of PTA is forecast to remain flat in near-term. Nevertheless, USA PTA producers are anticipated to witness a relatively increased prices due to rising PX pricing. The average prices of PX in USA has increased to 1019.05 USD/tons.

Corpus Christi Polymers LLC (JV between Alpek, Indorama and Far Eastern) has again postponed the startup of its new 1.1 million tons PET and 1.3 million tons PTA facility, both projected to commence operation by 2025.

In Europe region, PTA demand has dwindled amidst weak domestic PET market, slowdown in economy, and competition from Chinese manufacturers. Consequently, PAT producers in the region are operating facilities at lower production rates. The PTA market in the region is eroding, for instance, Alpek recently acquired a PET facility from Lotte Chemicals UK Ltd., announced a force majeure for the supply of PET from its facility in Wilton, amidst a lack of raw materials supplies. This facility, with a capacity of 220 Kiloton, was operating at a lower production rate because of narrow profit margins, mirroring the situation at other PET Resin plants in Europe.

For Further Information on Terephthalic Acid market

To View Sample on Terephthalic Acid market, Please click here