India Polycarbonate Market

India’s Strategic Shift: HPL Joins the Fray

Strategic Implications of HPL’s Entry:

- Reduced Import Dependency: Alongside Deepak Chem Tech, HPL’s facility could further offset 30–40% of India’s PC imports, especially for compounders and sheet producers.

- Regional Diversification: The eastern location of the HPL plant adds geographic diversity to India's polymer manufacturing base.

- Technology Transfer and Licensing: Like Deepak’s tie-up with Trinseo, HPL’s move will likely involve partnerships for process technology, essential for market competitiveness.

Import Dependency: A Historical Perspective

India Polycarbonate Imports 2016-2023 (Kilotons)

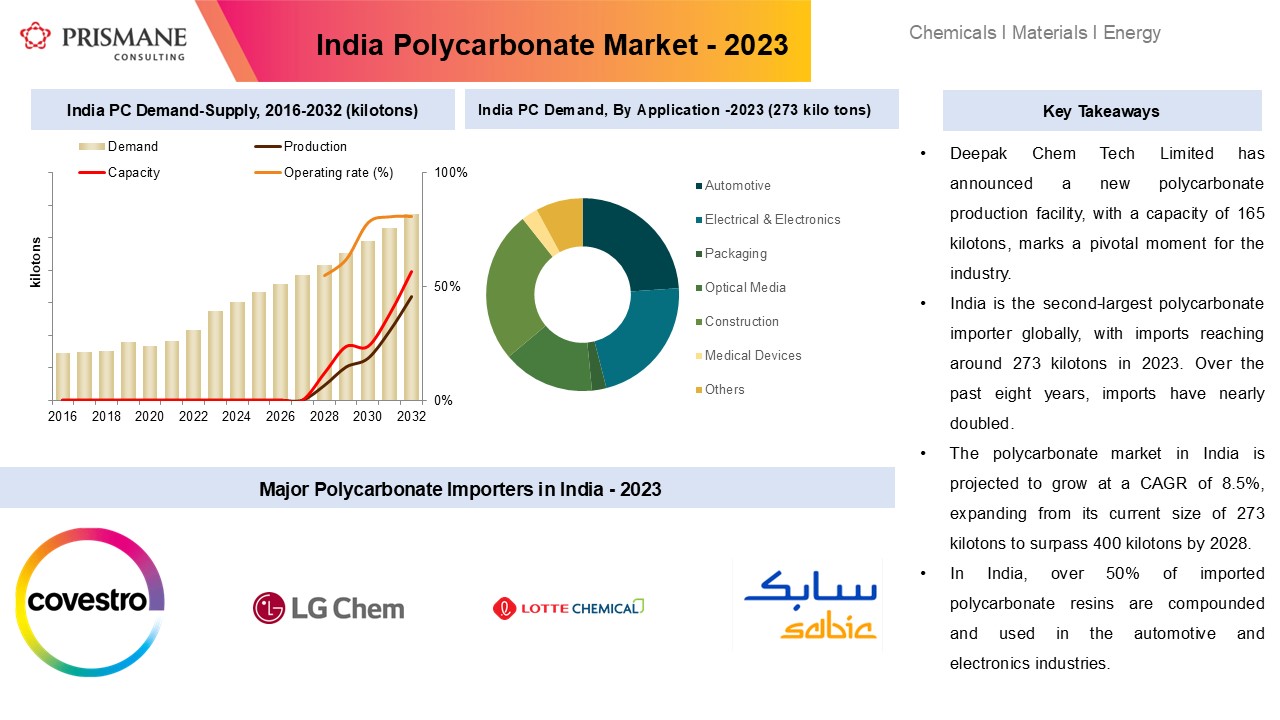

India's polycarbonate imports increased significantly, growing from 183 kilotons in 2021 to 273 kilotons in 2023. This surge can largely be attributed to the expansion of Covestro’s polycarbonate compounding facility. Covestro India currently dominates the polycarbonate compounding market, operating a production facility in Greater Noida. The company expanded its capacity in early 2022 to meet the rising demand for compounded plastics, particularly in the automotive and electrical & electronics sectors. To support this growth, Covestro India imports polycarbonate in its primary form, primarily sourced from its facility in Map Tha Phut, Thailand.

Domestic Polycarbonate Production: A Strategic Shift

The announcement of a new polycarbonate production facility marks a turning point. With a capacity of 165 kilo tons per annum, this plant is expected to

- Reduce Imports: The new Polycarbonate production could offset up to 30-40% of imports.

- Enhance Competitiveness: Lower costs for domestic OEMs, making Indian products more competitive globally.

Competitive Landscape

The entry of a local producer will not much to the existing polycarbonate market structure dominated by multinational giants like Covestro, SABIC, Lotte, and LG Chem. In the coming years price competition and quality benchmarks will define the future landscape.

Conclusion

The polycarbonate market in India is projected to grow at a CAGR of 8.5%, expanding from its current size of 273 kilotons to surpass 400 kilotons by 2028. The additional production capacity set to come online by 2028 is expected to have a limited impact on existing market players, as it will largely cater to captive use for polycarbonate compounding. Furthermore, this capacity expansion will only partially reduce imports by 30–40%. Meanwhile, China is poised to add over 600 kilotons of new polycarbonate capacity by 2028, enabling it to offer more competitively priced exports to neighbouring countries.

In India, over 50% of imported polycarbonate resins are compounded and used in the automotive and electronics industries. Companies such as Covestro India, for instance, source resins from their facilities in Thailand to supply compounded polycarbonate to leading OEMs in these sectors. Additionally, around 100 kilotons of polycarbonate are imported annually to support the production of polycarbonate sheets and other applications. While the domestic polycarbonate capacity boost is a step forward, significant reliance on imports and global competition will continue to shape the Indian polycarbonate market in the coming years.

Prismane Consulting Launches Innovative WHO SUPPLIES WHO Database

Prismane Consulting is proud to announce the launch of its latest product, designed for companies eager to uncover critical supply chain insights. The WHO SUPPLIES WHO database is a comprehensive tool that provides detailed information about suppliers and consumers across major plastics and chemicals markets.

Backed by seven years of meticulous research, our team has leveraged strong industry connections to ensure the accuracy and reliability of the data. Through robust primary interviews with industry professionals across each node of the value chain, we have compiled a verified and insightful database that tracks the consumption patterns of key importers and exporters in the industry. This new offering is a game-changer for businesses seeking to make data-driven decisions, optimize their supply chains, and gain a competitive edge.

With WHO SUPPLIES WHO, companies can navigate market dynamics with confidence and precision. At Prismane Consulting, we remain committed to delivering actionable insights and innovative solutions.

Our experience and expertise position us as a trusted partner for global businesses. This launch is another step in our mission to empower organizations with the knowledge they need to thrive. To know more email, us at sales@prismaneconsuting.com