Graphite now stands at the forefront of trade tensions between the USA and China. The issue can be traced back to 2018, when the first Trump administration initiated a series of tariffs on Chinese imports as part of the broader trade war, targeting various sectors, including materials like graphite. Under this, the U.S. imposed a 25% tariff on Chinese-made natural graphite. An electric vehicle (EV) battery typically requires about 50-100 kilograms of graphite depending upon its range, and given the immense dependence of U.S. on China for imports, automakers like Tesla petitioned to authorities for exemptions, arguing that it would face significant production disruptions without a reliable and cost-effective supply of this material. The exemption request was successful, and in 2020, the company was granted a tariff exclusion. The U.S. government similarly granted several exemptions to companies in industries where graphite was not easily sourced from other suppliers or where the tariff could undermine its competitiveness.

Earlier last year, the US Trade Representative, under the outgoing Biden administration, proposed a 25% tariff on Chinese natural graphite, beginning 2026. A similar 25% tariff was also proposed on Chinese lithium-ion batteries, from 2024. While the move was welcomed by non-Chinese graphite manufacturers, they expressed disappointment over the relatively low tariff rate and the distant timeline. Arguing that the rates were insufficient to fend off China’s growing overproduction, they added that delaying the implementation to 2026 would squander an opportunity to attract investments outside China. Meanwhile, some of the major automakers raised concerns, urging the agency to either reconsider the proposal or, at the very least, delay its implementation until the domestic industry is better equipped to source graphite domestically.

On the other hand, Chinese graphite production has witnessed a massive surge in the last 3-4 years. From 762 kilo tons in 2020, volumes grew at an annual average rate of 16% to reach over 1.23 million tons in 2023. The increased supply has weighed heavily on production in the West, pressuring costs and margins to the point where it has become increasingly difficult to sustain profitable operations. For synthetic graphite, the energy intensive and complex nature of production has also deterred new investments for decades.

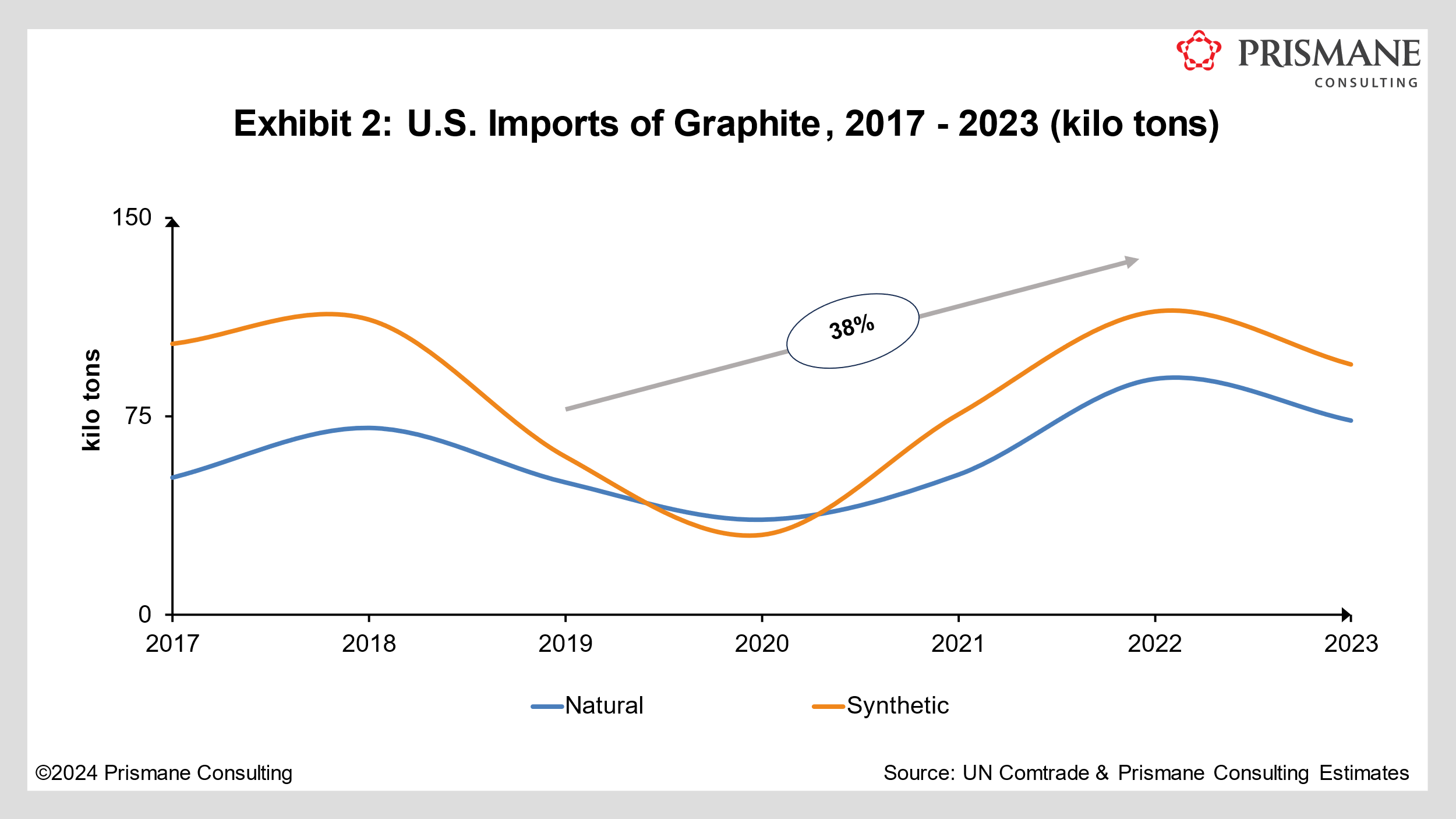

The increased Chinese volumes have found their way into the West; USA saw its graphite imports surging nearly 38% on average between 2019 and 2022. As of December, last year, US graphite manufacturers filed petitions with the federal government on imposing sharp tariff increases on graphite imports from China. Domestic players are now seeking tariffs exceeding 900% to thwart dumped imports of China. Meanwhile, automakers fear this would significantly drive up EV manufacturing costs, with graphite costs nearly doubling from what they currently are.

Incoming President Trump administration has long maintained its stance on imposing heavy tariffs on China. However, the extent of it remains questionable, as the President’s close ally Elon Musk’s Tesla has shared concerns with other automakers regarding its impact on their competitiveness. Despite this, from a Chinese perspective, high tariff rates are expected on Graphite imports.

Replacing the gigantic share of supply that currently resides in China is a major task. However, this presents an opportunity for innovation, localization, and furthering the China Plus One Strategy.