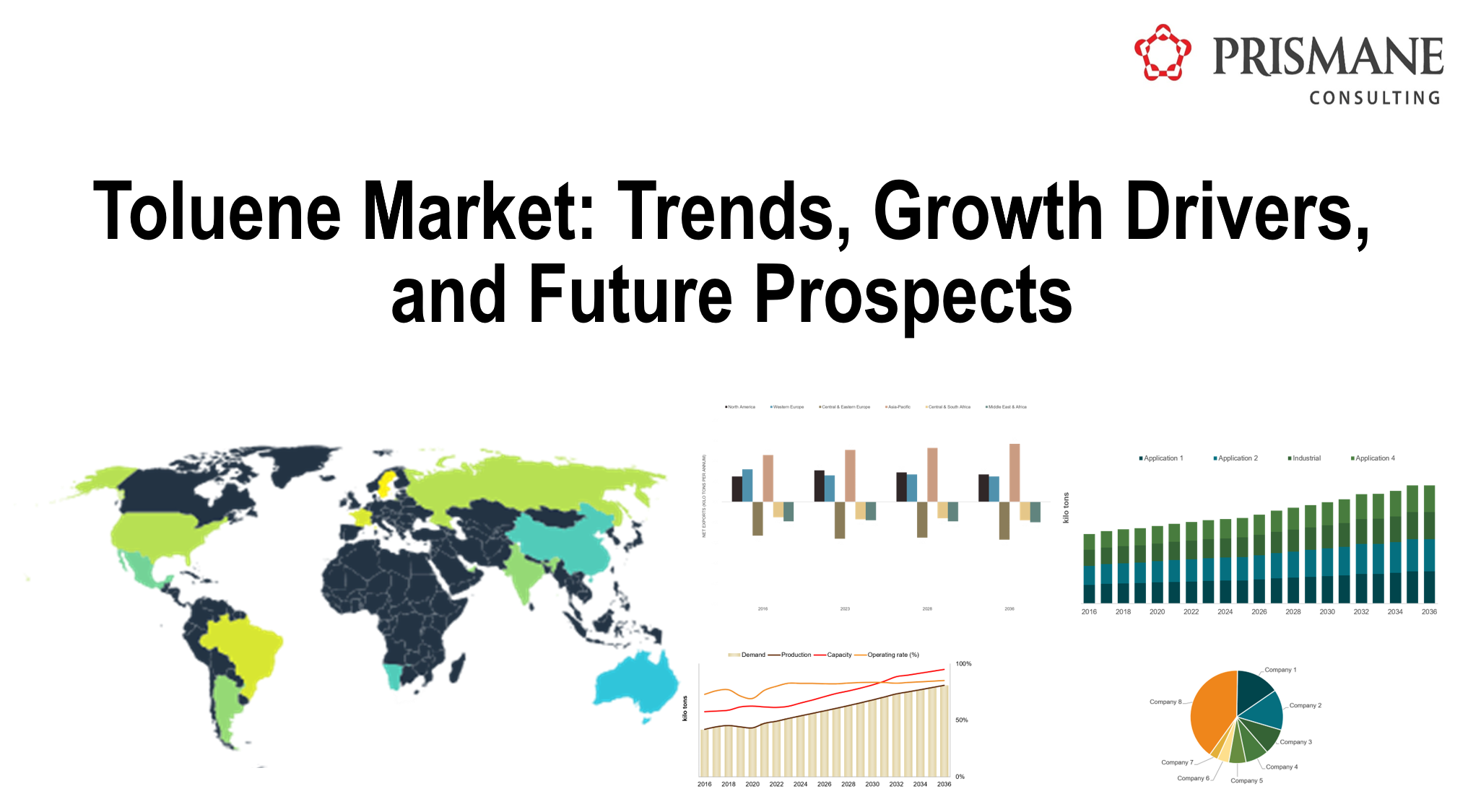

Toluene Market Size

The global toluene market size was estimated to be around $24 billion in 2023, and it is anticipated to witness a CAGR of 2.7% during 2024-2036 to reach $33 billion by 2036 mainly driven by its strong demand in production of benzene, polyester fibers, paints, and other products.

Toluene is a colorless liquid with a pungent odor derived from petroleum and natural gas. It serves as an important solvent and building block in various applications. Toluene is used as a solvent in paints & coatings, and adhesives.

Toluene Market Drivers

Rising demand for Toluene Diisocyanate (TDI)

Toluene plays a significant role in the production of Toluene Diisocyanate, a chemical used primarily in the production of polyurethanes. Polyurethanes are used in a wide range of applications, including furniture cushions, insulation, coatings, adhesives, and automotive parts.

The rising demand for TDI from various end-use industries such as automotive, building & construction, furniture will further drive the toluene market in the upcoming years. During the forecast period, TDI application is anticipated to witness a CAGR of 3.6% between 2024 and 2036.

TDI serves as the main raw material in the manufacture of polyurethanes which are primarily used for flexible foams which are further used in furniture, automotive cushioning, packaging material, etc. TDI is used in polyurethane coatings for automotive refinishing, wood finishes, and high-performance anti-corrosion coatings. In the automotive industry, polyurethane is commonly used to reduce the weight of the cars which helps in improving the fuel efficiency of the vehicle. An average car uses 60 pounds of polyurethane material. It is also used in the manufacture of car seats, bumpers, interior ceilings, dashboards, and bumpers.

-In 2023, Wanhua increased its TDI capacity by 250 kilo tons at its Fujian plant to cater the rising demand in the country.

Growing demand for PET fibers

Toluene serves as a key raw material in the production of xylene, which is crucial for the synthesis of terephthalic acid (TPA). Xylene is used as a feedstock in the production of TPA, an important material used in the manufacturing of PET fibers. Through oxidation processes, toluene helps to enhance the quality of terephthalic acid, improving its suitability for polymerization in PET production.

PET or polyethylene terephthalate is characterized as a tough thermoplastic resin that is used in production of products such as pouches, canes, bottles, films & sheets and others. They are colorless and are very lightweight in nature and these plastics are considered as re- usable in nature because they don’t percolate any chemicals and are safe for the human as well. These plastics are extensively used in industries such as electronics, food and beverage, healthcare, consumer goods and others.

-Indorama Ventures Public Company Limited announced the opening of the largest PET recycling plant in partnership with Coca-Cola Beverages in October 2022, with the goal of recycling approximately 2 billion additional used PET (polyethylene terephthalate) plastic bottles in the Philippines each year.

-In the 2nd half of 2022, Alfa SAB de CV resumed the construction of their integrated PTA-PET plant in Corpus Christi, Texas, which is a JV between Indorama Ventures and Far Eastern New Century.

While the affordability of producing PET fibers has led to widespread consumer adoption, it has also resulted in a low barrier to entry. Consequently, the market has become highly fragmented, with numerous active producers. More than 90% of the PET fiber supply resides in the Asia Pacific region, primarily concentrated in China & India. Capacities in Americas and Middle East & Africa are other producers, collectively representing a 5% share.

Growing Demand from End-Use Industries

The increasing demand from end-use industries, particularly the automotive and industrial sectors, is a key driver of the toluene market. In the automotive industry, the continuous growth in vehicle production has led to a rise in the need for high-quality chemicals, including toluene, which is used in fuel additives, adhesives, and coatings. Toluene is manufactured during the production of gasoline and is also used as an additive to improve the octane rings which are essential in race cars and other automobiles.

Toluene is essential in improving fuel performance, enhancing engine efficiency, and reducing emissions. As automotive manufacturers develop more advanced technologies, there is a growing requirement for toluene-based products that offer better fuel stability and improved overall performance.

Similarly, in the industrial sector, including manufacturing, construction, and chemical processing, toluene plays a critical role in the production of paints, coatings, and solvents. It is used as a solvent in the production of lacquers, paints, and industrial coatings that are vital for machinery, infrastructure, and consumer goods. With industries adopting more advanced manufacturing processes, the demand for toluene is expected to grow, further driving the market's expansion.

Toluene is also used in the electrical & electronics industry as a raw material for polystyrene. Polystyrene is used to manufacture computer hosing, packaging material, appliances, etc. Consumer appliances use polystyrene foam as insulation, while its rigid form is used for housings and casings. In electronics, it is also used for housings and casings.

Toluene Market Challenges

Volatility in Crude Oil Prices

A major restraint in the toluene market is the volatility in crude oil prices. Toluene is primarily derived from crude oil by the catalytic reforming of refinery steams. Approximately 15% of the toluene manufactured is separated out of pyrolysis gasoline during the production of ethylene and propylene, around 4% is from separation of coal tar, and less than 1% is recovered as a byproduct of styrene manufacture.

Fluctuations in global crude oil prices can result in unpredictable production costs, which will affect the overall market for toluene. When crude oil prices rise, the cost of refining toluene also increases, leading to higher prices for products that rely on toluene, such as paints, coatings, adhesives, and fuel additives. This unpredictability can act as a restrain on the profitability of toluene producers, especially during price surges, as it becomes difficult to pass on these increased costs to end customers without affecting demand.

Crude oil prices can limit market growth by discouraging investment in new production technologies or the expansion of toluene manufacturing capacity, as companies remain cautious about potential economic instability in the oil markets.

Presence of Alternatives for Toluene

Manufacturers of paints and coatings frequently face the challenge of identifying suitable alternatives to certain raw materials. Toluene is an aromatic hydrocarbon, utilized in the formulation of paints and coatings due to its excellent solvency properties. However, its use has been gradually decreasing as concerns over environmental and health impacts grow.

Toluene is classified as volatile organic compounds (VOCs) – which readily evaporate into the air and contribute to air pollution. Their release into the atmosphere can have detrimental effects, including the formation of ground-level ozone, which is a significant component of smog. In addition to their environmental impact, these solvents pose health risks to humans. Short-term exposure can lead to symptoms such as headaches, dizziness, and nausea, while prolonged or high-level exposure may result in more severe health issues, such as liver and kidney damage.

As a result of these concerns, there is a growing demand for alternative solvents in the paint and coatings industry. Substitutes for toluene include cyclohexane, methylcyclohexane, n-heptane, and n-octane. These alternatives can offer similar solvent capabilities but often with lower toxicity and a reduced environmental footprint.

-Cyclohexane is a saturated hydrocarbon that is considered less harmful than aromatic hydrocarbons. It can dissolve a wide range of substances and is used in some formulations as a replacement for toluene.

-Methylcyclohexane is another saturated solvent with properties like cyclohexane, offering good solvency but with a somewhat lower environmental impact compared to aromatic hydrocarbons.

-n-Heptane and n-Octane are aliphatic hydrocarbons with low toxicity and relatively low environmental impact. These solvents are often considered safer alternatives in formulations where strong solvency power is necessary.

The adoption of these alternatives is part of a broader effort to improve the sustainability of paints and coatings, however, it will lower the demand for toluene and negatively impact the market.

Environmental and Regulatory Challenges

Increasing environmental regulations and concerns over the environmental impact of petroleum-based toluene pose a significant restraint to the toluene market. Governments and environmental agencies worldwide are implementing stricter regulations to limit the use of harmful chemicals and reduce carbon emissions associated with petroleum-derived products. These regulations often require toluene manufacturers to adopt cleaner and more sustainable production processes or develop bio-based alternatives. While the shift toward eco-friendly toluene offers new opportunities, it also demands considerable investment in research, new technologies, and raw materials, which can be a barrier for smaller producers or those with limited financial resources.

The adoption of sustainable chemicals, including biodegradable and renewable toluene alternatives, is a growing trend. However, these alternatives often face challenges related to performance, cost, and scalability. Bio-based toluene may not yet match the performance of its petroleum-based counterpart in all applications, such as in high-performance coatings or solvent formulations. Additionally, the higher cost of producing eco-friendly toluene could deter manufacturers from switching from traditional sources, as it may lead to increased product prices and reduced competitiveness in the market.