Will Chlor-Alkali Challenges in East India Soon Find Resolution?

India’s caustic soda industry has long revelled in self-sufficiency. Prismane Consulting’s latest chlor-alkali report suggests supply in the nation have witnessed a more than 10% leap year-on-year to reach its present levels, enough to meet domestic consumption. Cheap foreign imports, nevertheless, have always weighed on the industry, threatening margins. Several factors have managed to mitigate these casted shadows in recent years though, from countermeasures like anti-dumping duties to domestic caustic soda manufacturers augmenting their capacities. A supply jump like this has now shrunk the import share in domestic demand to below 5%, the report notes. Albeit from a small base, exports have also concomitantly risen more than 30% year-over-year, maintaining India’s trade status as a net exporter of caustic soda supplies for the third consecutive year.

If India has not been able to fully realise its caustic soda export potential, it is mainly due to the high costs associated with its production. Should this bottleneck be fully addressed, it would pave the way for a more competitive presence of the country in the global market, not to mention increased profits for the stakeholders. Technological advancements and appropriate legislative impetus will be required to achieve this.

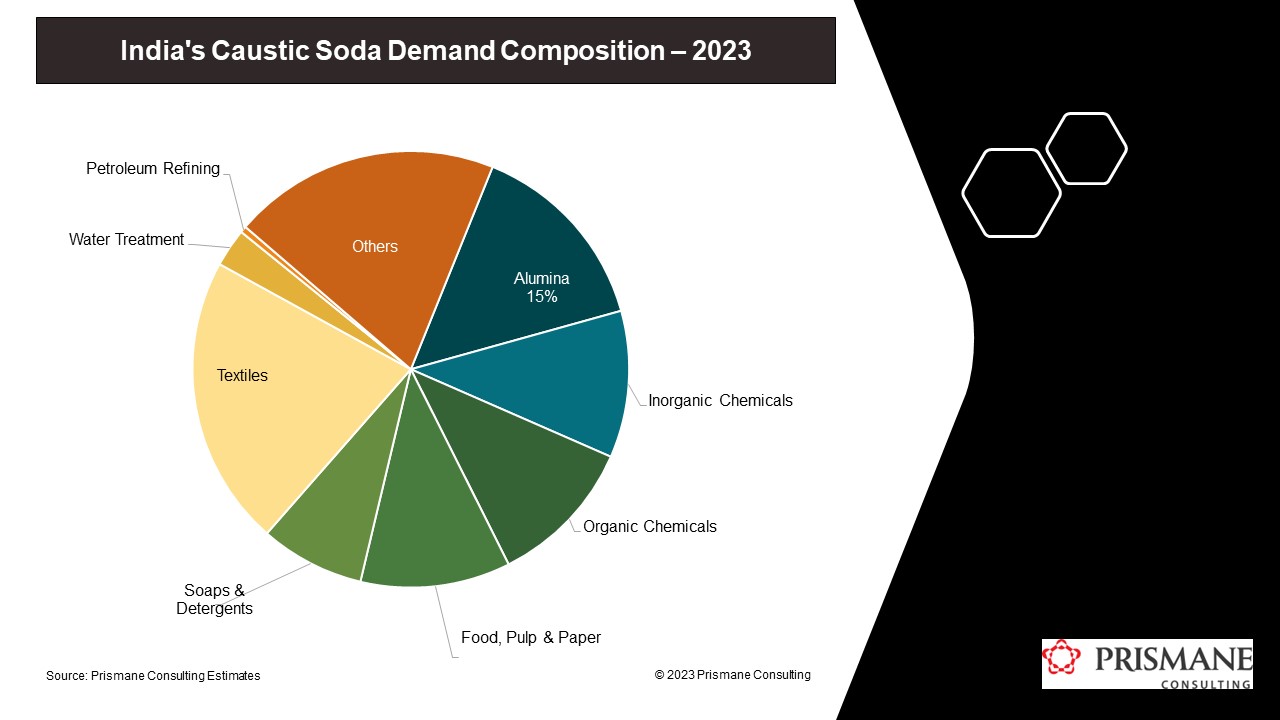

This discourse, however, seeks to shed light on India's internal regional struggles. Majority of the caustic soda production facilities in the country are situated in the Western region, particularly in the state of Gujarat; strategically located there to cater to the sizeable chemical end-use industries across the belt region. Yet, this is inadequate to cater to domestic caustic’s biggest outlet alumina production. As extensively documented in reports by industry players & associations, caustic soda demand is pretty fragmented & dispersed. Notable caustic soda applications include textiles, inorganic chemicals, soaps & detergents, and pulp & paper.

Interestingly, domestic alumina demand is concentrated in Eastern India, which explains the presence of majority of the production supply across the coast. This makes for a tough scenario: with the eastern belt lacking enough suppliers of caustic soda, alumina producers across the region have to inevitably rely on shipments from outside, more preferably via trade routes from Japan and ASEAN countries. Sourcing shipments internally from the western part is challenging; unlike caustic soda flakes, transporting caustic soda lye is difficult due to its high water content.

So far, new vinyl projects from oil majors like Indian Oil Corporation (IOC) in the region has managed, although only up to a limited extent, offset the chlorine deficit. An issue like this would only become more pronounced with inaccessible & insufficient caustic supply against a backdrop of growing alumina demand, in line with the global trends.

Entering 2024, Gujarat Alkalies and Chemicals Ltd. (GACL) hit the headlines in the first week of January, highlighting its commitment to expanding its business by inking a memorandum of understanding (MoU) with Vedanta’s Aluminium Business. Both companies now aim to jointly collaborate on exploring opportunities in the caustic-chlorine & allied sectors, either via contractual mutual arrangements or joint-venture projects. Such a strategic move has the potential to significantly alleviate the core issue: enough caustic-chlorine supplies for alumina would further lessen India’s imports of both caustic and chlorinated chemicals (of which India is a major buyer globally).

Although locations for the collaboration’s upcoming projects are still undecided, it is fair to assume that the domestic alumina sector will likely find some relief. Time will tell on how the imbalance between the two regions will pan out in the forthcoming years.

For Further Information on Caustic Soda market, Please click here

To View Sample on Caustic Soda market, Please click here