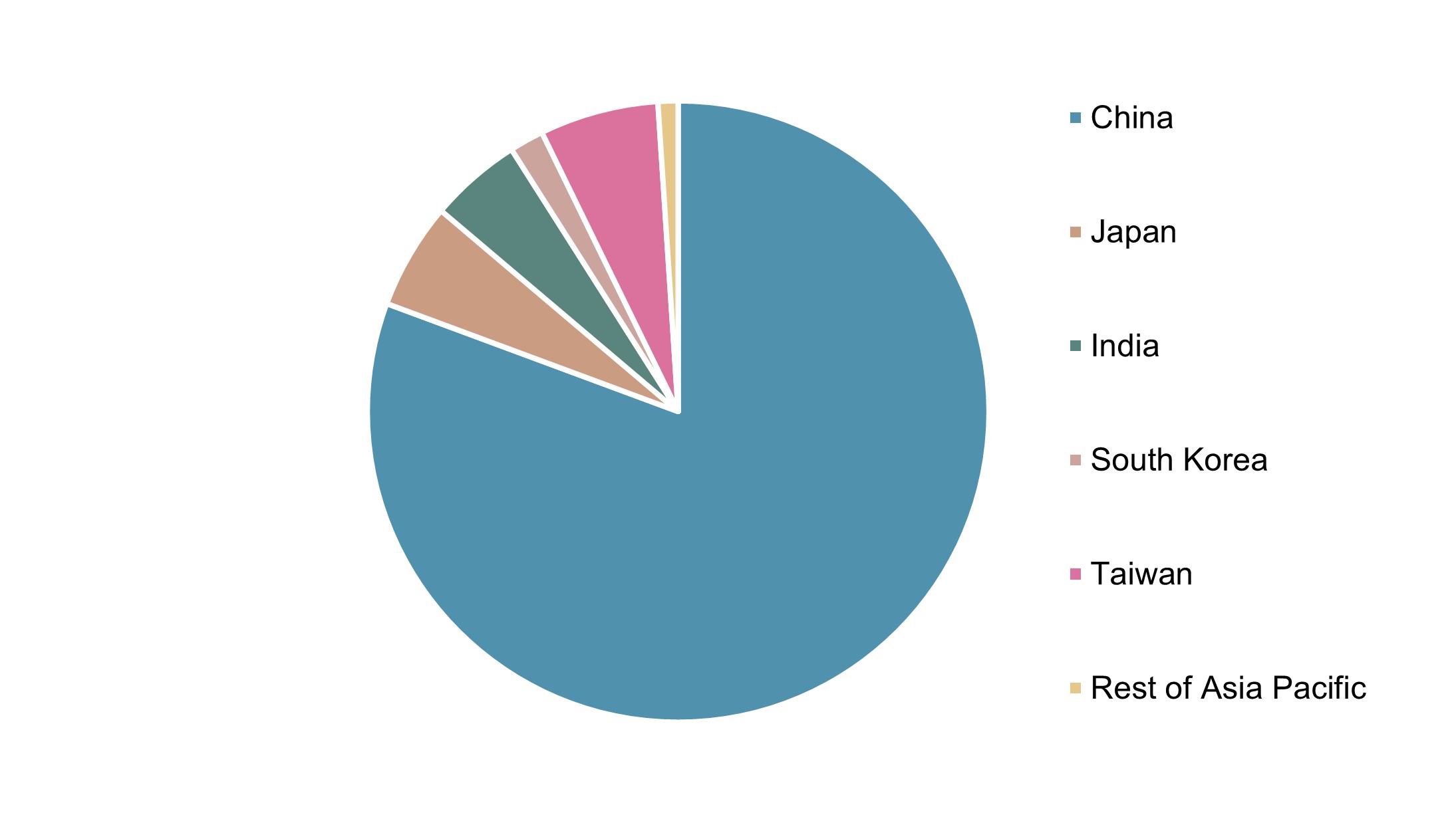

Asia Pacific Maleic Anhydride Overview

Compared to the previous quarter, the Asia maleic anhydride (MAN) market showed modest improvement in Q4-2022, driven by better conditions in the automotive market. Market sentiment was also observed to be better compared to the first half of the year, which was marked by strict lockdowns in China following the COVID-19 outbreak in China’s Shanghai caused by the Omicron variant. The zero-COVID policy stance of the Chinese government dampened the growth momentum of several Asian countries, which struggled with weak export demand along with a lack of intermediate goods supply from the country. Contraction in the construction industry persisted in Q4-2022, as slowdown in China’s real estate market continued. This was amplified by muted consumer spending, which is expected to continue in 2023.

China Monthly Car Production

According to the China Association of Automobile Manufacturers (CAAM), automotive production in China came in at 27 million units in 2022. Meanwhile sales in the country totalled 26.9 million units. Automotive industry in the country faced several issues, including stringent lockdowns, semiconductor supply shortfalls and elevated raw material prices. Effects of this were observed right from the first quarter, with the situation worsening further in the beginning of Q2. Compared to March, production volumes saw a sharp decline of 46.2% as strict lockdowns were ordered following the COVID-19 outbreak in Shanghai. The same recovered the next month however, jumping almost 60% in May. Some declines were also reported in Q4-2022, especially in November. Despite these headwinds, both production and sales grew over the previous year. Domestic automotive production jumped 3.4%, while sales output rose 2.1%, compared to 2021. A modest growth is expected in 2023, with relaxing COVID-19 restrictions and recovering economic conditions.

Japan Monthly Car Production, 2022 v/s 2021

Automotive production in Japan largely remained stagnated in 2022, a small decline of 0.1% as opposed to 2021. Domestic production volumes totalled 7.84 million units, as reported by the Japan Automobile Manufacturers Association (JAMA). Reduction in levels was observed mainly in Q2-2022, with volumes consistently declining for the months of April & May, collectively contracting 46.8%. The same returned to normal levels as volumes rebounded 59.1% in June. While overall production in 2022 remained same compared to 2021, sales saw significant contraction.

According to the Japan Automobile Dealers Association and Japan Light Motor Vehicle and Motorcycle Association, automotive sales in the country stood at 4.2 million units, down 5.6% as opposed to the prior year, with declines seen in both standard and mini cars. This can be attributed to prolonged semiconductor shortage during the year, forcing manufacturers to either trim or suspend production. Compared to 2021, Toyota reported a 12.4% decline, while Honda witnessed a 2% decline in sales.

China: Maleic Anhydride Net Trade, 2022 v/s 2021 (Quarter-on-Quarter)

In terms of exports, China is the largest maleic anhydride exporter in the Asia. Maleic Anhydride Export volumes of China between October and December in 2022 totalled 29 kilo tons. Turkey represented nearly 25% of maleic anhydride shipments leaving China, making it the largest importer. India was the second largest trade partner, accounting for 12% of total Chinese exports. Nearly 14% of maleic anhydride shipments were bought by countries in the European Union, mainly Denmark and Italy.

China: Top 5 Export Maleic Anhydride Partners, 2022 (169.3 Kilo Tons)

Domestic supplies are insufficient for Japan, and the country is a net importer of maleic anhydride. The country imported 11.6 kilo tons of supplies between January and December in 2022. Half these supplies were sourced from South Korea, followed by 26% from Taiwan and 18.4% from Malaysia.

India exported 133 tons of maleic anhydride supplies between January to December 2022. The Netherlands accounted for the majority of the bought shipments, followed by UK. IG Petrochemicals (IGPL) is the sole maleic anhydride manufacturer in India, operating its 7.6 kilo tons/year plant at Taloja, Maharashtra.

South Korea is another major maleic anhydride exporter in the region. Export volumes of the country in Q4-2022 totalled 12.6 kilo tons. India represented the highest volume of exported shipments, with a share of nearly 20%, followed by Netherlands, Spain, and Germany at 13.4%, 13% and 12%, respectively. Turkey and Italy are other notable partners, collectively representing a 19% share.

Malaysia exported 6.8 kilo tons of maleic anhydride in the last quarter of 2022. India is the country’s biggest trade partner, constituting 43% of the shipments exported during the period. Singapore bought 23% or 1.6 kilo tons of shipments, while Saudi Arabia imported nearly 12% of the total shipments. Malaysian exports increased in 2022 owing to recent production capacity expansion of TCL Industries’ Kemaman plant. Together with BASF Petronas’ (now acquired by the PCG Group) 113 kilo tons/annum maleic anhydride plant (was previously shut down) expected to start production again, the country is expected to further increase its exports and reduce import dependency from 2023.

Asia Maleic Anhydride Supply

In July 2022, Wanhua Chemical Group in China announced that Clariant will supply catalysts for its 200 kilo tons/annum maleic anhydride plant at Yantai, Shandong Province. Maleic anhydride produced at the facility will be used in the production of PBAT (polybutylene adipate terephthalate), an important raw material used in the production of biodegradable plastics. With China gradually eliminating the use of non-biodegradable plastics, the company expects this to boost the demand for biodegradable plastics. The plant is scheduled to commence operations in 2023.

In 2022, China experienced a series of plant closures, mainly attributed to ongoing financial losses. These closures encompassed numerous benzene-based plants, as benzene-based operations constitute the majority of plants in the country. Additionally, butane-based producers also faced economic setbacks due to stringent lockdown measures and the overall slowdown of the economy. Consequently, these producers contemplated reducing their plant operating rates.

In 2022, Indian PSU - IGPL announced its plans to expand its existing maleic anhydride capacity to 9.1 kilo tons by 2024. A new maleic anhydride plant has also been proposed by the Indian Oil Corporation Limited (IOCL) to be constructed at Panipat, with a production capacity of 120 kilo tons/year. However, the project is still awaiting its stage-1 approval, following which the plant will be commissioned in 54 months.

Petronas Chemicals Group (PCG) announced in June 2022 that it signed an agreement with its joint venture company BASF Petronas Chemicals to acquire its maleic anhydride plant at Gebeng, Kuantan in Malaysia. With a production capacity of 113 kilo tons/annum, the plant was previously shut down by BASF Petronas as part of its “product portfolio realignment exercise”. PCG aims to upgrade and repurpose the plant to produce better quality maleic anhydride suited for the pharmaceutical and food industries. This is involve performing a detailed assessment initially which the group expects to complete by Q1 2023 and start production following approvals by Q1 2025. Despite the absence of the plant, Malaysia was able to export significant quantities of maleic anhydride to other countries, sourced from TCL Industries’ plant at Kemaman, which underwent capacity expansion in 2022.

Asia Maleic Anhydride Demand- Future Outlook

Market sentiment in key end-use industries of maleic anhydride in Asia was mixed during the year; both construction and automotive industries in the region were generally positive but subdued. Geopolitical uncertainties and COVID-19 related restrictions had an evident impact on real estate developments in China, deteriorating with each quarter. Conversely, with public and private construction picking pace, infrastructure activity rose incrementally quarter-on-quarter and showed positive growth signs in other emerging areas like India & ASEAN.

Producers in the region anticipated a market recovery in 2023, especially in China following the Lunar New Year. At the time of this writing, no such demand uptick has yet materialised in China, and recovery is proving slower than expected as elevated interest rates continue to depress markets in the country, especially for construction. Nevertheless, encouraging factors like relaxing restrictions and picking up of order intakes have producers remaining hopeful for better conditions in China during the rest of the year.

Better conditions in China would also help drive the maleic anhydride demand in other Asian markets, which currently suffer from pressing issues like depreciation of local currencies against the US dollar and weaker performance of trading partners in Europe. Reduced bottlenecks for automotive components, favourable monetary policies, and improving consumer confidence are other driving factors likely to help producers in the region in 2023.

For Further Information, Please click here

To View Sample, Please click here

For more details on Asia Pacific Maleic Anhydride market, please contact us at sales@prismaneconsulting.com