Distilled thoughts on Cathode Materials

Amidst rising minerals demand and heightened geopolitical efforts to ensure a secure supply, cathode materials are recognized as integral to realizing a green, fair, and inclusive energy transition.

What’s Inside a Lithium-Ion Battery?

According to Department of Energy “A battery is made up of an anode, cathode, separator, electrolyte, and two current collectors (positive and negative). The anode and cathode store the lithium. The electrolyte carries positively charged lithium ions from the anode to the cathode and vice versa through the separator”.

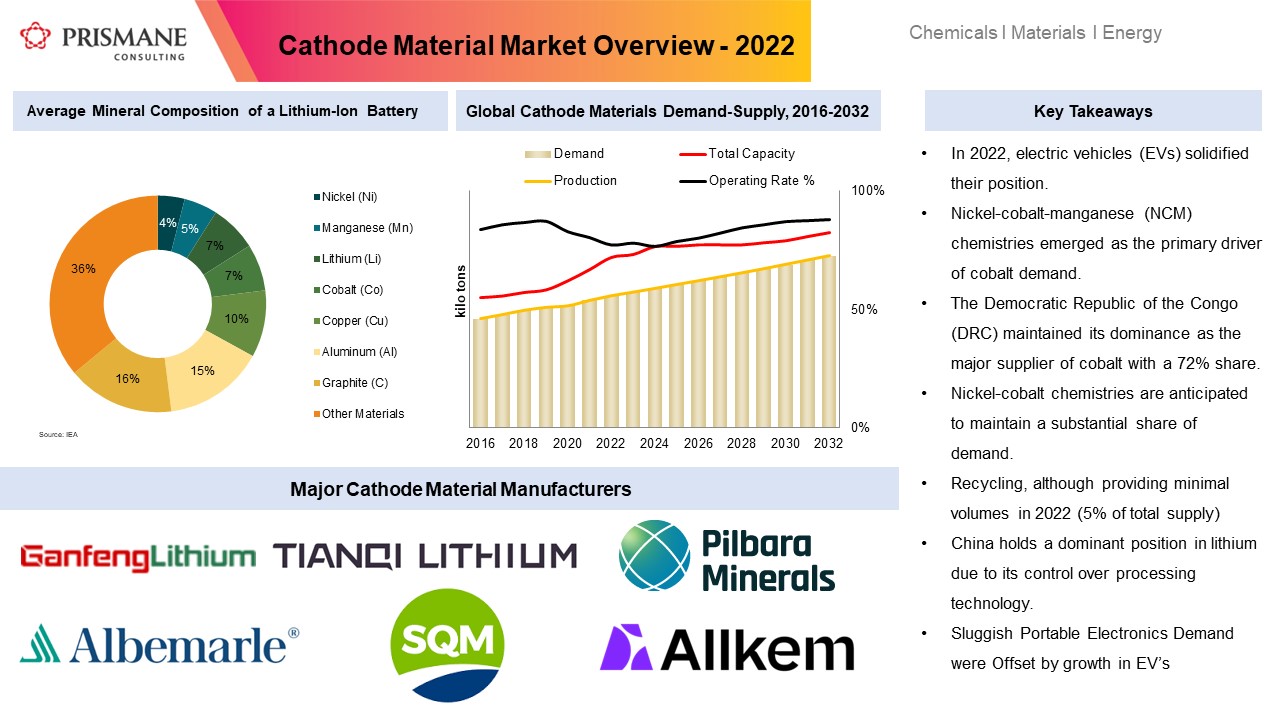

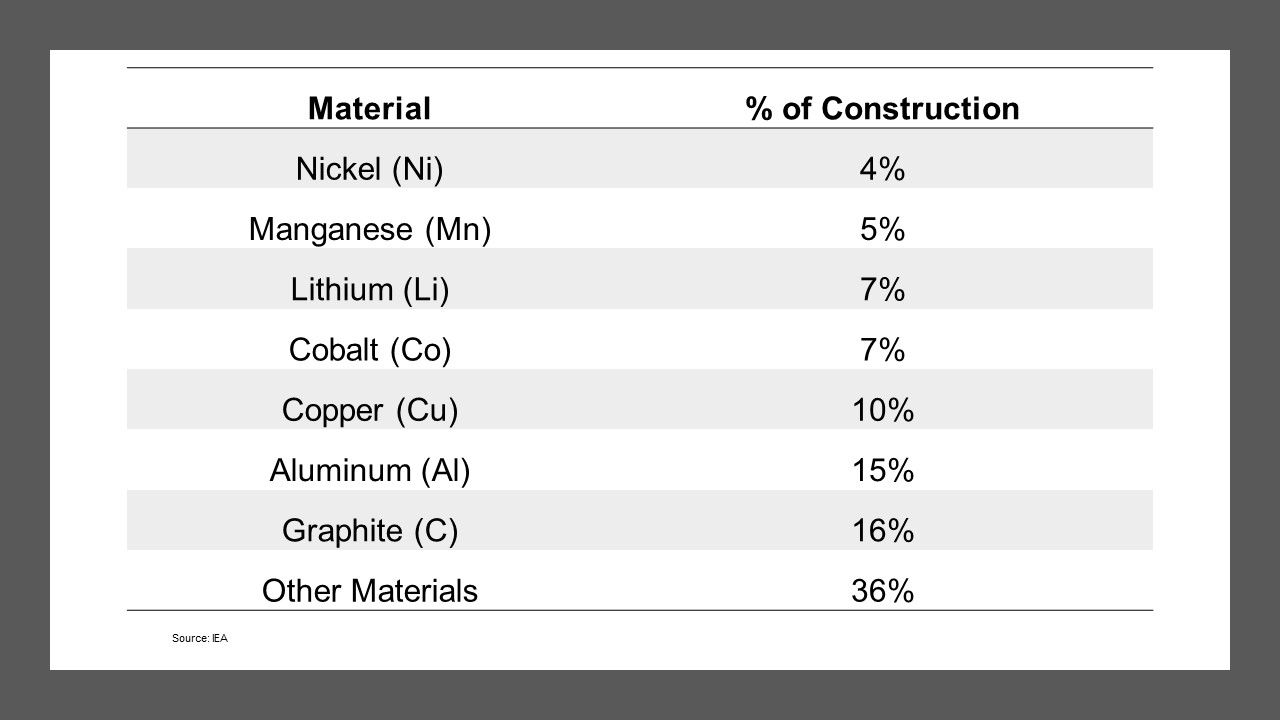

Here is the average mineral composition of a lithium-ion battery:

Nickel, Manganese, Lithium and Cobalt are used as a cathode material, while graphite is used as an anode material in the battery. On an average 25% of the battery construction is made from cathode materials.

2022 was a tale of two halves for the Cathode market; here's how!

Cobalt

In 2022, electric vehicles (EVs) solidified their position as the leading consumer of cobalt, comprising the largest share of end-use demand at 40%, following a notable surge in 2021. EVs, alone responsible for 86% of annual demand growth, overshadowed traditional non-battery applications, contributing only 6% to the growth while holding a 28% share of the 2022 demand. The overall demand for cobalt increased by 13% year-on-year to reach 187 kilotons.

Nickel-cobalt-manganese (NCM) chemistries emerged as the primary driver of cobalt demand, surpassing all other end-use markets. Notably, in 2022, lithium cobalt oxide (LCO) demand no longer held a dominant position in cobalt demand for battery applications. The portable electronics industry, specifically affected by the cobalt-intensive characteristics of LCO cathodes, which constitute almost 80% of the portable electronics market, played a substantial role in this shift.

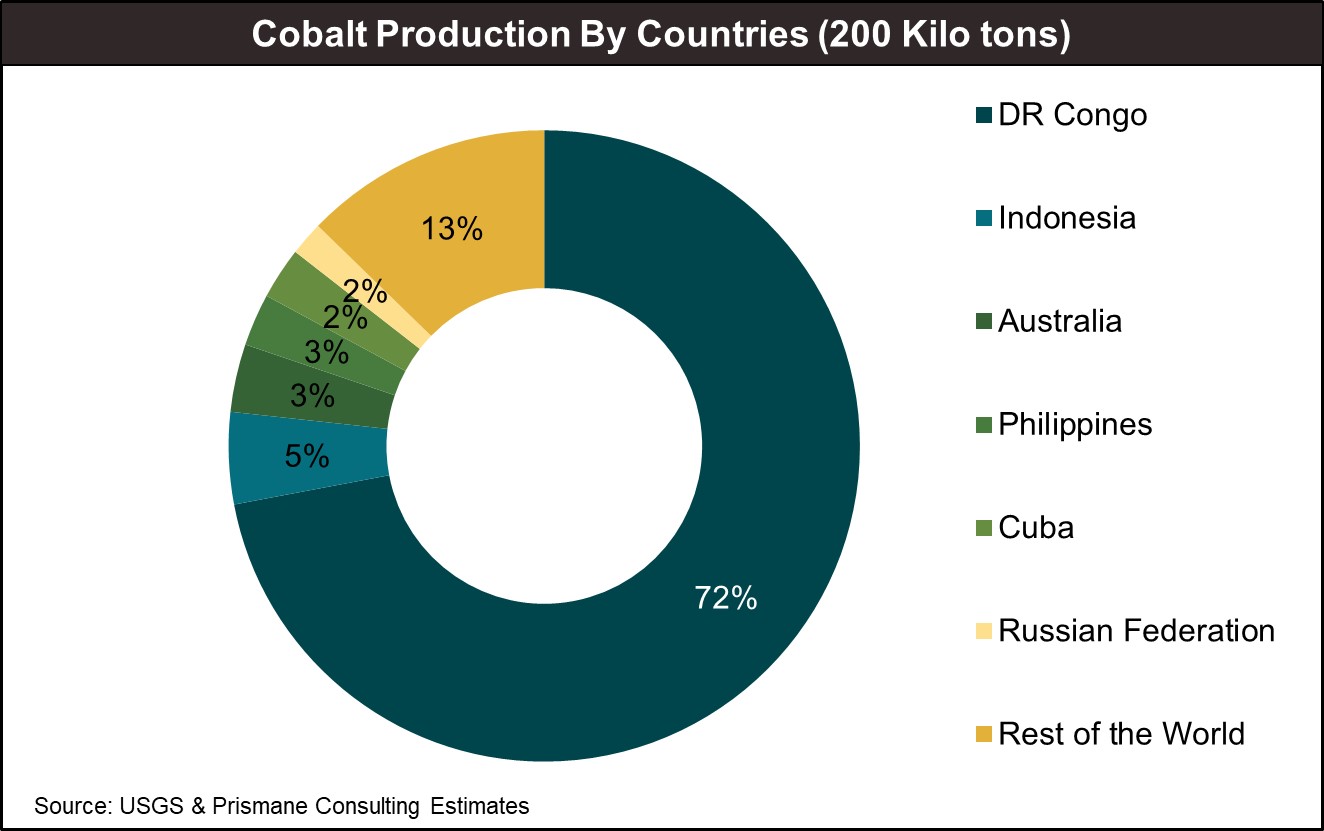

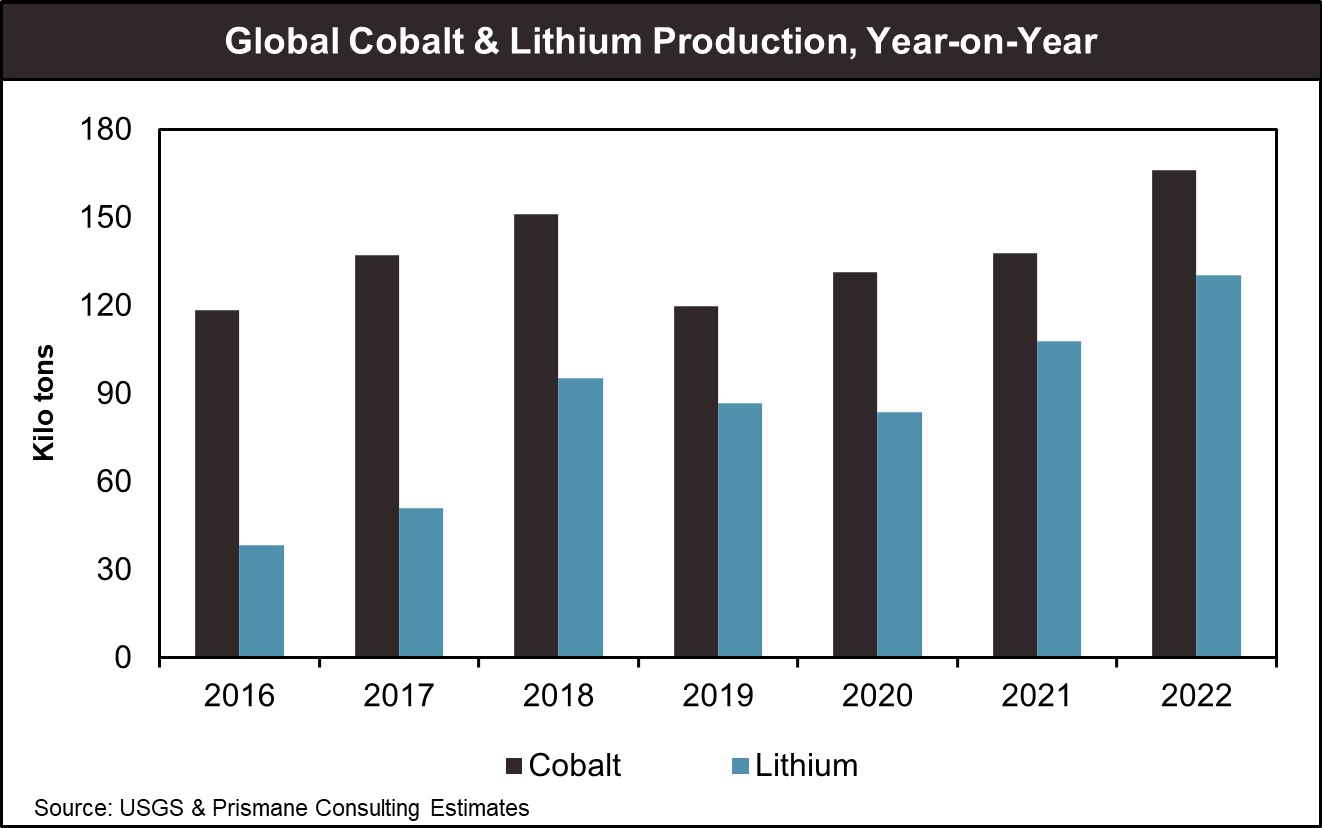

Mined supply expanded at a faster rate in 2022 compared to the previous year (21% versus 14% year-on-year), approaching 200 kilotons. The Democratic Republic of the Congo (DRC) maintained its dominance as the major supplier with a 72% share, contributing to 70% of the annual growth. Indonesia, propelled by the swift development of domestic nickel-cobalt mines and high-pressure acid leach capacity, surpassed established producers like Australia and the Philippines to become the second-largest producer in 2022.

Despite ongoing efforts to substitute cobalt in battery applications, cobalt is projected to remain a crucial raw material for the entire battery supply chain. Multiple cell formulations, mainly NCM and lithium iron phosphate (LFP), will support major end-use sectors, with no single battery cell technology expected to dominate. Nickel-cobalt chemistries are anticipated to maintain a substantial share of demand, reaffirmed by recent announcements from major downstream players, underscoring cobalt s pivotal role in the energy transition.

Looking ahead, demand for cobalt is forecasted to exceed 200 kilotons by 2030, doubling the market size relative to 2022 and approaching 400 kilotons. The DRC is expected to continue playing a significant role, contributing 44% of the growth to 2030, closely followed by Indonesia s rapidly growing cobalt and nickel markets. Recycling, although providing minimal volumes in 2022 (5% of total supply), is anticipated to support 15% by 2030 and over 40% by 2040.

Market conditions have significantly weakened since the peak prices of 2022, and this trend is expected to persist until 2024 due to a surplus in supply. However, in the long term, the demand for cobalt is projected to outpace supply, leading to an increase in prices and stimulating a new wave of investment in the supply side.

Recent policy developments, such as the Inflation Reduction Act (IRA) in the US and the Critical Raw Materials Act (CRMA) in the EU, have reshaped the landscape for major lithium-ion battery growth markets. These policies aim to increase regional supply to meet a greater proportion of demand, impacting the future of cobalt and other battery raw materials markets.

Lithium:

The relationship between China and other Lithium Producing Nations

The global lithium supply is predominantly concentrated among four major producers: Australia (52%), Chile (25%), China (13%), and Argentina (6%). While Australia and the Lithium Triangle (comprising Argentina, Bolivia, and Chile) wield considerable influence over lithium supply, China holds a dominant position due to its control over processing technology. This factor has prompted these nations to export their mined lithium to China for advanced processing and the production of valuable end products.

Pilbara Minerals, the leading independent lithium miner in Australia, exclusively exports its lithium production to China for further processing. Despite this reliance, Australia is approaching Chinese investments cautiously within the framework of its Critical Minerals Strategy. The strategy aims to attract foreign investments totaling 500 million USD. Concurrently, China s influence in the Lithium Triangle is on the rise. In January 2023, a Chinese consortium CATL BRUNP & CMOC (CBC) secured an agreement with the Bolivian government for the construction of two lithium carbonate facilities, facilitating direct lithium extraction (DLE) in the Uyuni and Coipasa salt flats. Valued at 1 billion USD, this marks the first instance of a foreign entity participating in Bolivia s lithium industry. Additionally, Tibet Summit Resources Co. Ltd., a Chinese mining company, announced a 2.2 billion USD investment in lithium mining projects in Argentina s Salta province, with anticipated production ranging between 50 and 100 kilo tons of lithium.

Ganfeng Lithium, a major player in the global lithium market, is set to commence operations soon in the Cauchari-Olaroz deposit, representing another significant Chinese capital project. Furthermore, Chinese companies, including Contemporary Amperex Technology Company Co. Ltd (CATL), Tianqui Lithium, and Gotion High Tech, have disclosed plans to participate in the manufacture and production of lithium batteries in Santiago del Estero.

Chile also witnessed Chinese investment announcements, with plans to establish a lithium industrial park in Antofagasta. Participating companies, Tsingshan Holding Group, Rupia Energy, Battero Tech, and FoxESS, have indicated an initial investment exceeding 2 billion USD. Notably, Tianqui Lithium s acquisition of a 24% stake in Sociedad Química y Minera de Chile (SQM) in 2018 has further solidified China s presence, enabling the export of 80 kilo tons of lithium to BYD over seven years. This strategic move has resulted in 6 billion USD offer and a remarkable 144% increase in SQM s sales, primarily driven by China s dominant position in the EV market and its status as the primary buyer of Chilean lithium.

Sluggish Portable Electronics Demand were Offset by growth in EV’s

In 2022, the cathode market experienced a dynamic landscape marked by initial optimism and robust growth in the EV sector carried over from 2021. The momentum, however, was disrupted by widespread COVID-19 lockdowns in China from March onwards, causing significant disruptions across the lithium-ion battery supply chain, impacting both supply and demand dynamics.

The EV and consumer electronics sectors faced challenges, resulting in a setback for cobalt demand. Concurrently, lithium iron phosphate (LFP) cathodes gained traction in China, influencing market dynamics throughout the year. Despite the challenging second half, cobalt demand exhibited annual growth, albeit at a more moderate rate of 13%, compared to the robust 27% year-on-year growth witnessed in 2021.

Total cobalt demand reached 187 kilotons in 2022, reflecting a notable increase of 21 kilotons from the previous year. Notably, battery applications strengthened their dominance, constituting 72% of total cobalt demand. This signifies a noteworthy increase from 55% in 2018 and 70% in 2021, underscoring the growing significance of cobalt in the evolving landscape of the battery industry. Whereas, Lithium production grew albeit of supply constraints, owing to strong downward demand from EVs.

EV Market Highlights

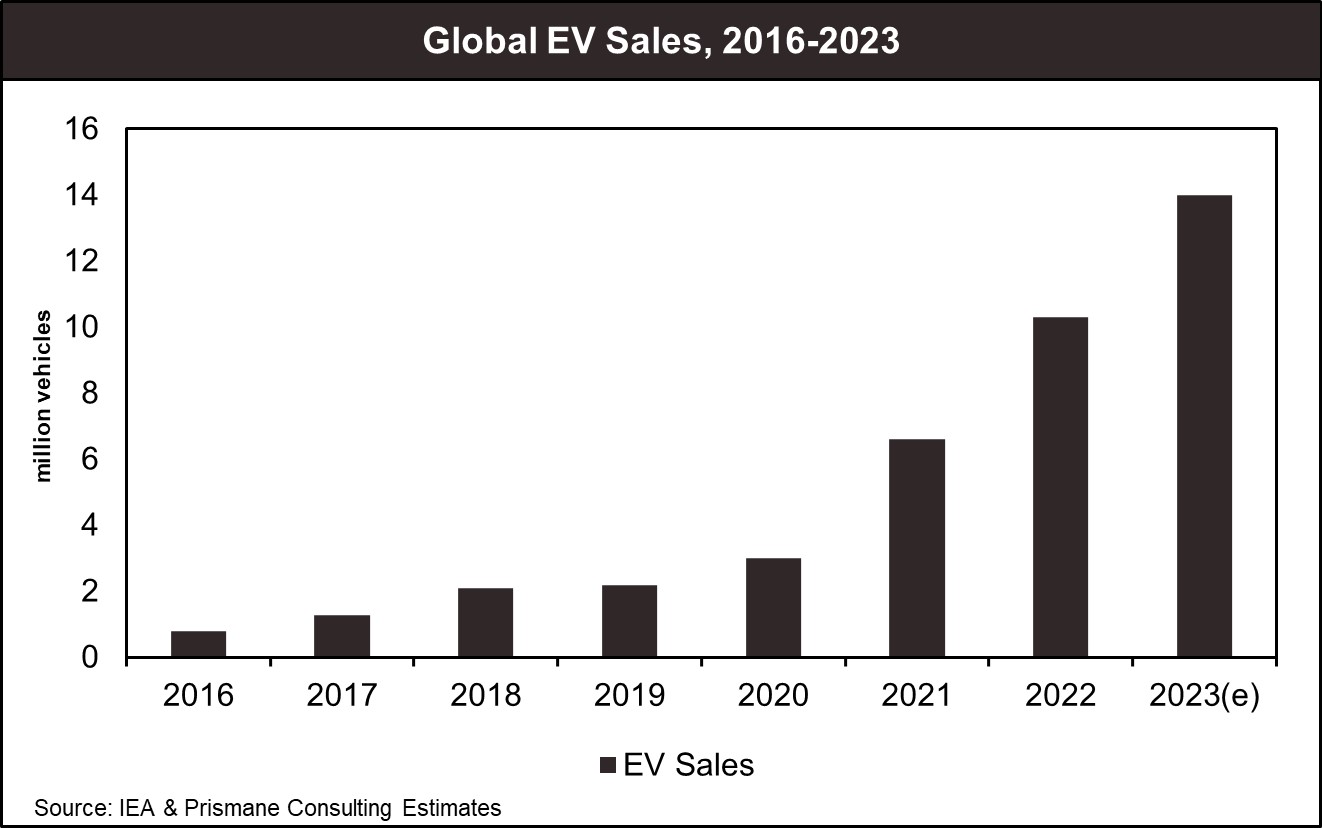

In 2021, the electric vehicle (EV) sector was in close competition with portable electronics, but it has now emerged as the predominant consumer of cobalt and lithium, constituting 40% of the total demand for both minerals. This percentage is on an upward trajectory. Cobalt demand from the EV sector increased by 33% year-on-year, reaching 74 kilotons in 2022, compared to 56 kilotons in 2021. Global EV sales experienced growth, surpassing 3.8 million units in 2022, exceeding the entire global market in 2020, and reaching 10.3 million units. Battery electric vehicles (BEVs) contributed significantly, accounting for nearly 80% of overall EV sales growth. The total EV penetration rate rose from 8% in 2021 to 13%. Electric car sales set new records, and this momentum is expected to persist through 2023, with over 2.3 million units sold in the 1Q-2023, representing a 25% increase from the same period last year. Anticipated sales for electric cars in 2023 are 14 million units, reflecting a 35% Y-o-Y rise. The second half of the year is expected to see accelerated new purchases, potentially resulting in electric cars comprising 18% of total sales for the entire calendar year. National policies and incentives are anticipated to play a crucial role in boosting sales, and the possibility of a return to high oil prices seen last year could further motivate prospective buyers.

Landmark EV policies are aligning with climate ambitions, influencing the outlook for EVs positively. Market movements and policy efforts in major markets support a promising outlook for EV sales. According to the International Energy Agency s Stated Policies Scenario (STEPS), the global projection for the share of electric car sales, based on existing policies and firm objectives, has increased to 35% by 2030, surpassing the previous outlook of less than 25%. In these projections, China remains the largest market for electric cars, capturing 40% of total sales by 2030 in the STEPS. The United States is expected to double its market share to 20% by the end of the decade, driven by recent policy announcements, while Europe is set to maintain its current 25% market share.

For Further Information on Cathode Materials market,

To View Sample on Cathode Materials market, Please click here