European Union’s Ban on Russian Carbon Black, & its Subsequent Impact

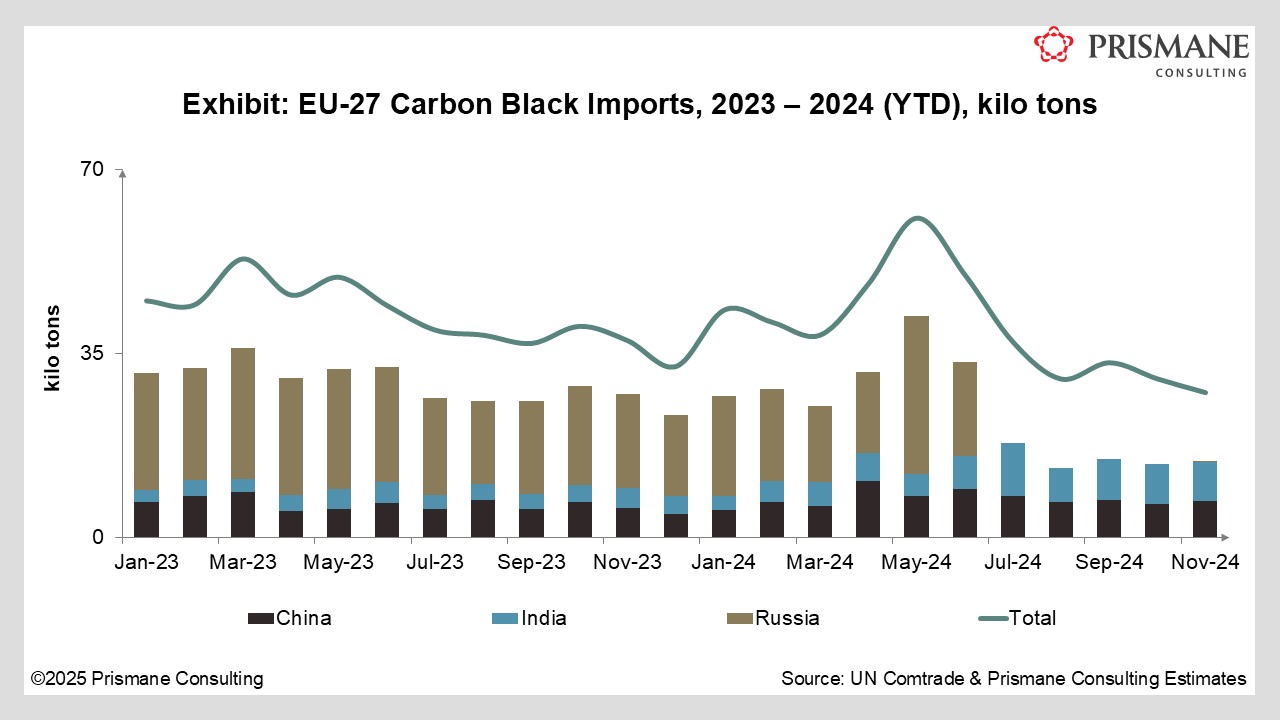

Part of the broader economic sanctions imposed in response to the offensive in Ukraine, the European Union’s ban on Russian carbon black formally came into effect on 1st July 2024 and was subsequently expanded to include Belarussian supply. Initially proposed in 2023, ahead of the contract negotiation cycles, market participants had time to brace for its impact – though not nearly enough to offset the potential supply loss, with Russia, Belarus, and Ukraine collectively accounting for a third of the EU’s carbon black imports. From the initial proposal to the months leading up to the ban, much speculation surrounded its obvious repercussions in the European carbon black market among industry professionals and analysts (you can check my thoughts from December 2023 here. Fast forward to today, and many of those prognostications are now evident (although, spoiler alert, things aren’t as bad as one might’ve expected – more on that later).

For instance, carbon black trade flow shifts told us, from as early as 2022, that Asia was poised to eventually make up for a sizeable proportion of the EU’s import pie by the time the restriction kicked off, especially given the supply additions seen in countries like China and India during the “black swan” years, and with plant run rates in Europe being way off than what they could be. Consequently, in the contract cycles that were negotiated at the start of 2024, European contract cycles saw buyers pivoting from Russia to now China and India.

Premium on Local Carbon Black Amid Supply Chain Disruption

While this could be viewed as a win-win for EU buyers and Asian producers and lose for EU producers, the situation is more complicated. First, amid logistical disruptions following the war, there were several EU buyers that did not wanted to extend their supply chains and increase shipping friction. Local supply thus became more prized, with several tire consumers willing to pay the premium for reliable, domestically produced material. Second, adding Belarus to the ban only effectively removed another competitor for EU, sole producer Omsk.

Thus, despite increasing Asian imports, EU producers managed to partially fend off headwinds by competing on reliable supply assurance and cost. Another reason why increased shipments from the East didn’t cause as much havoc was due to muted carbon black demand in the region, which really began in the second half of 2022, persisting all the way through 2023. On the supply utilization front, reduced Russian shipments helped EU operating rates to climb from the high 70s in 2022 to the mid-80s in 2023.

Tire Sector Downturn

Meanwhile, the tire industry has been going through its own restructuring. In March 2023, Hankook Tire & Technology, the 7th largest tire company globally, suffered a devastating fire at its Daejeon facility in South Korea, destroying its second production line and 210,000 tires. Instead of rebuilding the site, Hankook decided to pivot its investments to other regions expansions were subsequently announced in USA and Hungary.

From an Asian standpoint, producers saw the ban as a significant opportunity to increase their footing in Europe. Several brownfield and greenfield investments were announced by players in China and India, with volumes strategically targeted to address increased EU enquiries.

The optimism was short-lived, however. Following sanctions, Russia subsequently began shipping volumes to Turkey, China, India, and ASEAN at discounted prices, pressuring local margins. To put things into perspective, just in India, Russian cargoes represent a third of its average annual imports: that’s 1.5-2.5 KT of monthly imports on average. Nevertheless, Asian producers remain optimistic and aim to offset margin pressures by targeting the European carbon black market.

External supplies from Asia are enough to meet the EU’s import needs, and it is unlikely that producers in the West would make significant investments. In this context, only the “supplier” has changed. Both North America and Europe saw limited carbon black investments during 2023-2024. Market participants emphasize the need for serious commitments from tire customers and prospects of a high internal rate of return (IRR) to be able to drive new investments in these regions. While there have been investments aimed at more sustainable carbon black production, the material remains relatively costly and is unlikely to address the needs of price-sensitive tire markets in Asia, rendering them useful only for niche outlets locally.

Tire imports are arguably the biggest issue facing carbon black markets in the West today. While shipments performed relatively well in 2024, there has been persistent contraction in tire production due to sluggish sales, profitability pressures, and increased imports. Restructuring efforts have further exacerbated this. For instance, in November 2024, Sumitomo Rubber Industries (SRI), the parent company of Sumitomo Rubber North America, announced its decision to cease tire production at its Buffalo, New York facility in the USA, blaming the “deterioration of productivity and profitability” in the North American market.

By manufacturing high-quality, costly tires, producers in the West are increasingly losing market share to cheaper, lower-quality tires—especially given the prevailing inflationary pressures. A growing set of tire consumers today are prioritizing lower upfront costs over durability or fuel efficiency, and domestic manufacturers must thus adapt to this shift. They must also maintain high utilization rates to ensure competitiveness.

Concluding Thoughts: What This Means for Carbon Black Markets

Russian and Belarussian carbon black volumes are sanctioned, and Ukraine is under war. There isn’t enough supply between EU producers to offset the loss of a third of the supply, and these volumes have thus been largely replaced by imports from China and India. Nevertheless, repercussions of the ban were mitigated to some extent, by muted demand in EU and some tire consumers prioritising local volumes.

Looking ahead, several key factors must be considered. First, Chinese and Indian producers bringing onstream bouts of new supply to address European carbon black markets must grapple with volatility in transportation costs and focus on ensuring reliable supply. They must also address the prospect of cheaper cargoes from Russia entering their countries. Further, China’s carbon black is coal-based, unlike petroleum-based elsewhere. This leaves China dependent on its steel industry, which is currently grappling with cheaper imports. This, exacerbated by its recent hiccups in the real estate sector, is likely to weigh on steel production and will ultimately impact carbon black output, rendering its volumes uncompetitive.

In Europe, limited investment in new capacity means that external supplies from Asia will continue to flow in to meet carbon black demand. To remain competitive, domestic producers should focus on ensuring quality supply available locally. Players must also ink long-term commitments with tire manufacturers to invest in augmenting capacities and growing sales.