European Maleic Anhydride Overview

Key end-use industries of maleic anhydride in the European region continued to remain down in the last quarter of 2022. Weaker demand was observed in both construction and automotive markets. Contractors were already facing supply constraints & elevated raw material costs, and the war outbreak further exacerbated this. Higher than usual destocking in Q4-2022 amplified the contraction in the region’s construction & Do-it-yourself (DIY) markets. With banks hiking interest rates, we expect this will exert pressure and could further curb construction activity in the region in 2023.

After three challenging quarters, the European automotive industry slowed modest improvement in Q4-2022, thanks to moderating supply chain issues and recovering demand. This uptick helped maleic anhydride producers in the region offset, up to some extent, the decline seen in construction. Despite a strong finish to 2022, however, Q4 results could not help the region overcome the softening seen during the first half of the year.

According to the European Automobiles Manufacturers Association (ACEA), car registrations in the European Union came in at 9.3 million units in 2022, the region’s lowest since 1993. With the war also restricting wire harness supplies for automakers in the region, the EU passenger car market ultimately contracted in 2022, slipping 4.6% compared to 2021. Germany and Italy posted double digit growths, rising 38.1% and 21%, respectively, as per the association data. Other major markets in the region however, failed to register growth; Spain suffered a 14.1% contraction, while France remained stable.

EU New Car Registrations, 2022 v/s 2021

Euro remained weak against the US Dollar

Currency effects proved to be a net negative for market participants in Europe. Both US Dollar and the Chinese Yuan showed considerable appreciation against the Euro throughout the year. Unlike the US Federal Reserve, appropriate measures to tame inflation came in late from European Central Bank. Together with a sharp rise in commodity prices due to the war situation in Ukraine, this sent the Euro tumbling against the US Dollar. Strong US Dollar also made imports in the region competitive and expensive. Unfavourable exchange rates also negatively contributed to the sales of global producers operating in Europe, offsetting high gains achieved by them in other regions.

Maleic Anhydride Trade Overview

Germany is the largest maleic anhydride exporter in Europe. Maleic anhydride exports from the country stood at 48.3 kilo tons in 2022. Export volumes during the last quarter stood at 11.6 kilo tons. The Netherlands continued to be the country’s biggest maleic anhydride trade partner, importing 2.3 kilo tons in Q4-2022. It is followed by Italy at 1.4 kilo tons. UK, Poland, Spain, & Denmark are other notable maleic anhydride trade partners of the country.

Germany: Monthly Maleic Anhydride Imports-Exports,

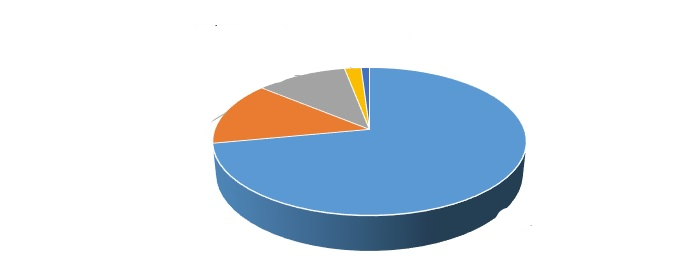

Maleic anhydride imports of Germany stood at 4.3 kilo tons in Q4-2022, a 17% decline compared to the previous quarter. Shipments to the were majorly sourced from China, which accounted for almost 30% of the imported supplies in Q4. USA, Austria, and South Korea were other notable trade partners, responsible for 19%, 17% and 12%, respectively, of the total shipments imported.

German Maleic Anhydride Net Trade, 2022 v/s 2021 (Kilo tons)

Out of the 5.2 kilo tons of maleic anhydride imported by France in the last quarter, nearly 48% came from Germany, while 34% of it was bought from Polynt’s plant in Italy. Small volumes of maleic anhydride was also sourced from South Korea.

Besides domestic supplies, Maleic anhydride imports in Italy were around 2.3 kilo tons or 31% of its imported shipments from Germany. Over 19% of the shipments came in from South Korea, while another 18% of supplies were bought from Global Ispat Koksna Industrija d.o.o. Lukavac (GIKIL)’s 10 kilo tons/annum plant in Bosnia & Herzegovina.

Hungary, China and Austria were other notable trade partners, collectively responsible for 23% of Italian imports in Q4-2022.

Spain, which imported 3.1 kilo tons in Q4, sourced maleic anhydride mainly from South Korea and Italy.

Russian maleic anhydride exports were idle for the first four months of 2022 and started from May. This can be attributed to the absence of a domestic maleic anhydride producer in the country in the past, which changed following the commissioning of SIBUR’s 45 kilo tons/year plant in 2022. Another maleic anhydride plant from PJSC Tatneft at Almetyevsk is expected to come onstream in 2023, and Prismane Consulting expects this will likely help Russia increase its exports in the coming years.

Russia: Maleic Anhydride Net Trade, 2022 v/s 2021 (Quarter-on-Quarter)

Although risks of production stoppages remained, no major such instances were observed during 2022, as plants continued production. One producer, Huntsman Corporation, reported an operational issue at its maleic anhydride facility in Moers, Germany in Q2-2022, which was resolved in the same quarter. Other factors, however, stood responsible for the decline in supplies. Persistent and inflationary oil & gas prices contracted volumes across several end-use markets. Reduced demand from automotive and construction forced manufacturers to lower plant capacity utilization rates.

Russia switches to being a net exporter in 2022

SIBUR announced the completion of its 45 kilo tons/year maleic anhydride facility at Tobolsk, Russia in April 2022, aiming to cater to the domestic as well as international demand. The company however could not target its major European customers owing to the economic sanctions that followed after the war. Instead, the company sourced its shipments to Turkey, an important trade partner which abstained from sanctions. Notable amounts of maleic anhydride were also sourced to India, and the company expects to further its business with the country.

PJSC Tatneft has announced its plans to construct a new maleic anhydride plant at Almetyevsk, Tatarstan, in Russia, as part of its “strategic initiative in the development of the company”. When completed, the plant will operate with a production capacity of 50 kilo tons/annum. As per the company’s official website, first stage of this project, with production capacity of 25 kilo tons/annum, is planned to be launched in 2023.

Turkish imports set to decrease with onset of new plant

Despite enough demand, Turkey has lacked a domestic maleic anhydride producer. That is however set to change, since TN Maleik Petrokimya announced its plans in June 22 to establish a maleic anhydride production facility in the city of Izmit in Kocaeli province. construction & assembly work at the 50 kilo tons/annum plant has already started, although it is not clear when it will commence production. The new plant will likely help Turkey gradually reduce its imports.

Much to buyers relief, alternative sourcing arrangements made by EU countries brought success, and the region was eventually able to fulfil the target of refilling its gas storage sites to 80% by November. Today, gas storage levels in the EU is near its five-year high and this has helped, up to some extent, push the energy costs down. Stable energy markets are thus expected in 2023. Easing logistical constraints has is also helping producers fulfil orders with lesser lead times. Nonetheless, structural concerns still remain for the long term.

Some good, but mostly bad

Softening consumer demand, together with contractionary outlook for both construction and manufacturing sectors are concerning factors likely to obstruct the growth of European maleic anhydride market. While the pace of inflation has slowed, challenging economic conditions persist, as costs remain elevated, triggering restrictive monetary policy, which, in turn, is negatively affecting market sentiment. Market participants remain unsure on the revival of construction markets.

Partly contributing to this pessimism is the dull demand for architectural coatings, which typically witness an upsurge during spring, as construction activities ramp up. However, that did not happen in Q1 23, as demand remained soft. Construction sector (residential in particular) is expected to decline with elevated mortgage rates. Faltering expectations due to depressing prospects have got producers worried.

Conversely, growth in the regional maleic anhydride market will be driven by the automotive sector, as the industry shows promise with recovering demand & easing supply bottlenecks. Another potential driving factor for the market could be via demand from Asia. With reducing energy prices, exports to Asian markets can likely provide a positive momentum for maleic anhydride.

Overall, despite some small improvements, Europe continues to experience an inflationary environment, with Germany recently entering a recession after reporting two consecutive quarters of negative GDP growth. Considering these factors, Prismane Consulting anticipates a stagnant outlook for European maleic anhydride markets in 2023.

For Further Information, Please click here

To View Sample, Please click here

For more details on Europe Maleic Anhydride market, please contact us at sales@prismaneconsulting.com