India’s Methanol-Acetic Acid Market

Imports constitute for the lion’s share in India’s methanol and acetic acid markets. Domestic methanol production is uncompetitive, making it more financially viable for consumers to source it from outside. As a result, the country’s supply is severely underutilized (at less than 35%), with many plants either completely idle or operating at minimal rates. Deepak Fertilisers and Petrochemicals Corporation (DFPCL), for instance, did not produce any methanol at its Taloja, Maharashtra, facility in 2022 and 2023, citing unfavourable market conditions and cost economics.

Similarly, Gujarat Narmada Valley Fertilizers & Chemicals Limited's (GNFC) three methanol units in Bharuch, Gujarat, have been inoperative for the last two years due to the same factors, with any volumes required for its downstream formic acid and acetic acid facilities met via imports.

Even if India were to fully tap into its domestic methanol supply, imports would still make up more than 70% of the demand. Exhibit 1 illustrates India’s methanol consumption between 2016 and 2023.

India Methanol Market, kilo tons

Indian methanol plants are either natural gas- or naphtha-based. While its high import volumes clearly reflect robust demand, factors such as low natural gas availability in the country, high naphtha prices, and relatively low import prices for methanol have deterred new plant investments.

In November 2024, GNFC made headlines with its announced partnership with INEOS to establish a 50-50 JV for the construction of a 600 kilo tons/year AA plant in Bharuch. GNFC is currently India's sole producer, operating its 100 KT/y facility at the same site. The plant is heavily overutilized: operating rates have consistently exceeded 150% for several years now. Nevertheless, produced volumes are significantly insufficient to meet demand. Exhibit 2 illustrates India’s acetic acid consumption and trade dependency.

India Acetic Acid Market, kilo tons

With demand levels poised to be at least 1.4 times that of current levels by 2028 when the new plant comes online, imports would still represent more than 70% of acetic acid demand – unless other plants are announced.

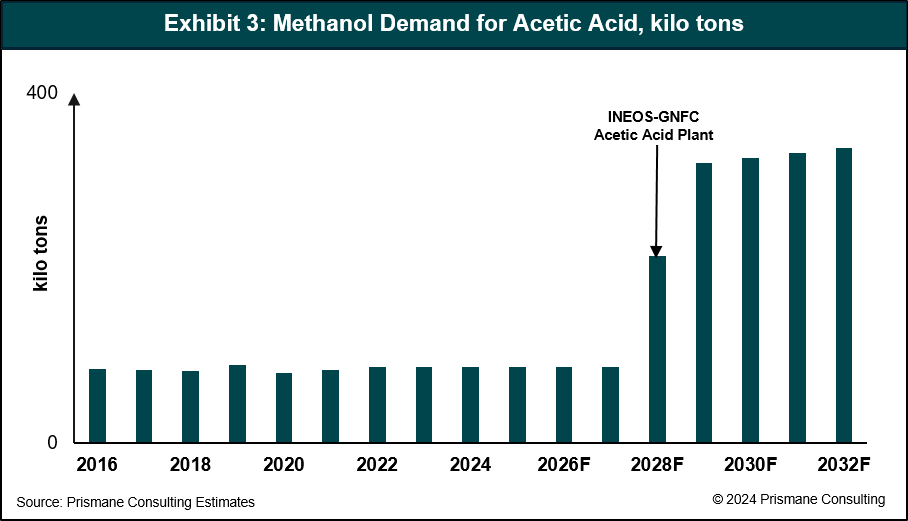

Prismane Consulting posits that, despite anticipated new supply not making much of a dent in meeting domestic demand, India’s methanol & acetic acid markets appear to be at the cusp of an inflection point. Demand for both products is clearly growing at an unprecedented rate. For acetic acid, several developments for downstream applications (take GAIL’s recent decision to revive its Mangalore PTA facility) are being announced. The addition of the new plant is also expected to boost methanol demand, potentially tripling current consumption, as shown in Exhibit 3.

Methanol Demand for Acetic Acid, kilo tons

Overall, based on the data and the prevailing market scenario, the new AA facility could pave the way for new plants and expansions within the value chain in upcoming years.