Global Styrene Supply Overview

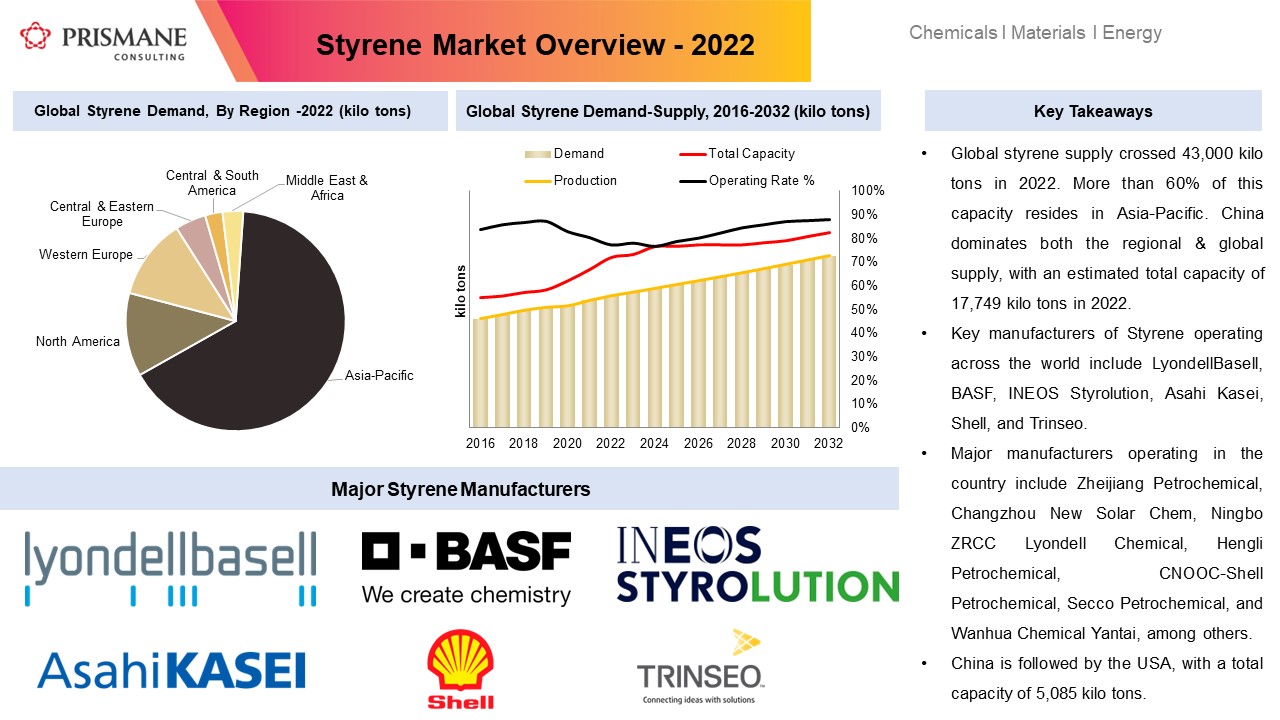

Global styrene supply crossed 43,000 kilo tons in 2022. More than 60% of this capacity resides in Asia-Pacific. China dominates both the regional & global supply, with an estimated total capacity of 17,749 kilo tons in 2022. Major manufacturers operating in the country include Zheijiang Petrochemical, Changzhou New Solar Chem, Ningbo ZRCC Lyondell Chemical, Hengli Petrochemical, CNOOC-Shell Petrochemical, Secco Petrochemical, and Wanhua Chemical Yantai, among others.

Styrene Market by Country

China dominates the global styrene market followed by the USA, with a total capacity of 5,085 kilo tons. Styrene in the country is produced by five manufacturers: LyondellBasell, CosMar (SABIC & Total Joint-Venture), Americas Styrenics, INEOS Styrolution, and Westlake Chemical. Canada is another major styrene producer in the North America besides USA. The country houses a production capacity of 920 kilo tons/annum, split between INEOS Styrolution’s plant at Sarnia, Ontario, and Shell Canada’s Scotford facility.

Post the closure of Trinseo’s plant at Boehlen, BASF is now the sole manufacturer of styrene in Germany, operating its 550 kilo tons/annum plant at Ludwigshafen. Netherlands is the largest manufacturer in the Western European region, with a total production capacity of 2,200 kilo tons/annum. LyondellBasell jointly operates the largest facility in the region with Covestro, with a capacity of 700 kilo tons/year. ELLBA, a joint venture between Shell and BASF operates its 550 kilo tons/year facility at Moerdijk. Shell also independently operates a 450 kilo tons/annum plant at Moerdijk. Meanwhile, Trinseo operates its only styrene unit at Terneuzen, which, the company is in talks to shut down as well.

South Korea, Japan, and Taiwan are other major manufacturers besides China operating in the Asia Pacific region. Total styrene production capacity in South Korea stood at 3,395 kilotons/annum in 2022, split between five manufacturers. Hanwha Total Petrochemicals, a joint venture between Hanwha and Total, is the largest producer, operating its 1,050 kilo tons/annum plant at Daesan. Formosa Chemicals & Fibre is the largest manufacturer in Taiwan, with its 1,320 kilo tons/year plant at Mai Liao.

India lacks domestic styrene producers and relies completely on imports to meet its demand. However, that is set to change. Indian Oil Corporation Ltd (IOCL) has announced that its styrene facility at Panipat, Haryana will be put into operation by 2026-27. The plant will have a production capacity of 387 kilo tons/year.

Supply glut in Asia weighing on Global Consumption, Impacting Trade Flows & Pressuring Prices

A plethora of new plants have added in China in recent years, with more slated to add in the near future. Styrene expansions in the country have lengthened the global supply by more than 3 million tons in 2022, worsening the supply glut situation Asia-Pacific is already grappling with. Supply outpacing the demand is greatly pressuring the global styrene industry, with producers increasingly seeing challenged economics. In December 2022, Trinseo announced the shutdown of its 300 kilo tons/annum plant at Boehlen, Germany, owing to new plant additions and high energy costs. Several producers in China have been forced to curtail their operating rates, in an attempt to match the market dynamics.

New capacities are also impacting trade flows across the world. Since China is a major styrene importer, new plant additions could spell major trouble for regular exporters to the country. Implications of this are already visible: Chinese imports have shown consistent decline year-on-year between 2020 and 2022, plummeting from 3,347 kilo tons to 2,072 kilo tons.

Weak demand from downstream sectors have left prices to plummet to new levels. In China, spot prices were assessed at USD 1075/MT in 2022, down from USD 1230/MT in 2021. In Europe, prices and margins are expected to recover, with Trinseo’s plant taking off 300 kilo tons of capacity. Spot prices in the region have climbed USD 50/MT to USD 1136/MT.

Styrene Markets: What lies ahead.

Overall, lengthening styrene supply paints a complex picture: Asia has significantly reduced its imports from USA. Less export demand has left USA to require fewer supplies of raw material benzene, which it imports from Asia. Increased capacities in China have left producers in Europe to struggle for cost-competitiveness. High energy costs are further exacerbating the situation, with one producer Trinseo considering shutting its remaining plant in Netherlands as well, marking its exit from the styrene production business. Market in the region is expected to witness such restructuring efforts in the years to come, as producers struggle to survive.

Meanwhile, heavy plant maintenance periods that styrene plants go through is expected to be an offsetting factor for styrene supply glut in the forthcoming years, even potentially lending the much-needed support to prices.