Styrene Butadiene Rubber (SBR)

Styrene Butadiene Rubber (SSBR) owing to inferior heat resistance than natural rubber is used in applications such as automotive car tires, industrial rubber, cable, and adhesives. Solution styrene butadiene rubber with low vinyl content provides temperature flexibility at low temperatures, abrasion resistance, and low rolling resistance for products such as tires and low molding parts. Emulsion SBR is blended with other rubbers and finds applications in passenger cars light truck tires and truck re-treading compounds. Other applications of ESBR include conveyor belts, piping, hoses, shoe soles, molded products, tubings, and carpets.

Styrene-butadiene rubber (SBR) has long been a cornerstone in the rubber industry, finding extensive use in various applications. However, one sector stands out for its significant consumption of SBR: the tire and tire products industry.

Market Dominance

Tire and Tire products dominated the SBR market in 2022 on the back of the growing market of the Tire industry globally. Tires are very crucial in ensuring safe and efficient transportation. Forefront innovation, advancement in transportation technology, such as electric and autonomous vehicles, and growing production by the largest tire manufacturers, is boosting the tire industry. Michelin of France achieved rank 1st in largest tire manufacturer globally in 2022 followed by Bridgestone of Japan and Goodyear of the United States. Michelin replaced Bridgestone’s position as the world’s largest tire manufacturer in 2021, Bridgestone was the largest tire manufacturer globally for 11 consecutive years during the period 2010-2020.

To learn more about this report, request a free sample copy - Please click here

In addition to this, driven by the need to meet higher performance and load demands across various end-use applications and sustainability, tire technology is progressing.

The tire industry is also facing some challenges in the form of environmental regulations including fuel efficiency and lower emissions placed on transportation and tire industry. However, the continuous innovation by OEM manufacturers and tire manufacturers and the adoption of new technology to satisfy end-use needs such as fuel efficiency, durability, reliability and performance is changing the challenges into opportunities.

Demand Analysis:

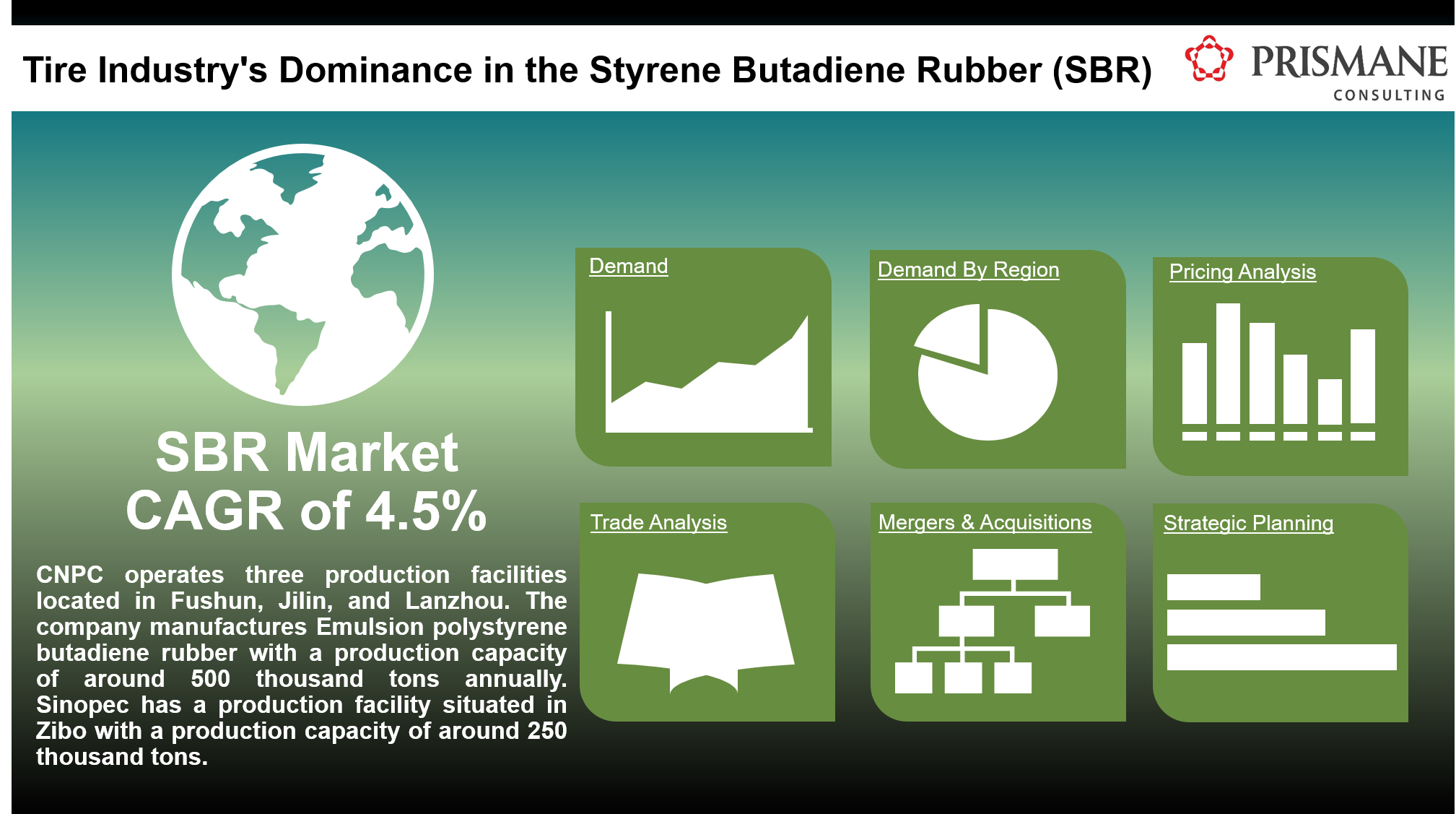

The SBR market is estimated to grow at a faster CAGR of 4.5% in the forecast period on the back of growing development in eco-friendly tires. Recently, Hankook Tire and Kumho Petrochemical signed a memorandum of understanding, MoU to develop eco-friendly tires using solution-polymerized styrene-butadiene rubber, eco SBR. Kumho Petrochemical will provide recycled Styrene Monomer for the production of eco-SSBR. The company aims to commercialize SBR material by 2026.

Asia-Pacific dominated the SBR demand in 2022. The demand in the region is driven by the large automotive industries. China was estimated to be the largest consumer of SBR in the region in 2022 driven by high demand from automotive production. China is the largest market for the automotive industry. In addition to this, China is also the largest market for the tire industry globally in terms of volume and value. The country has been the largest producer as well as consumer of tires globally since 2005. In 2021, the country produced around 902.5 million tires with a year-on-year growth of 12% from around 807 million of tires in 2020.

The tire industry of the country is growing driven by the sale of new automotives. The rapid development of electric vehicles caused growth in sales of energy passenger vehicles which further drove the tire demand in the country. However, owing to anti-dumping tariffs imposed by the West, the tire market of China declined in 2017. In response, to the industry decline, the government of China released Tire Industry Entry Standards in 2017 to increase the entry barrier for manufacturers.

Major SBR Producers in China

China is a significant producer of Styrene Butadiene Rubber (SBR), with major players including:

- Sinopec

- China National Petrochemical Corp (CNPC)

- Bridgestone

- Zhejiang Petrochemical

- Baling (No known website)

- North Dynasol Synthetic Rubber Co., Ltd.

CNPC operates three production facilities located in Fushun, Jilin, and Lanzhou. These companies are key contributors to China's SBR market and play a crucial role in meeting domestic and international demand for this rubber product. The company manufactures Emulsion polystyrene butadiene rubber with a production capacity of around 500 thousand tons annually. Sinopec has a production facility situated in Zibo with a production capacity of around 250 thousand tons.

To learn more about this report, request a free sample copy - Please click here

North America accounted for a significant demand for SBR globally in 2022. The demand for SBR in North America is driven by growing tire production in the region. The stagnant growth of the automotive industry for the past recent years is limiting the demand for SBR in tires and related products while the growing sale of new automobiles is driving the market in the region. The demand in applications such as mechanical products, footwear, and adhesives is poised to experience faster growth than demand in tire production in the forecast period.