n-Butanol Market Overview

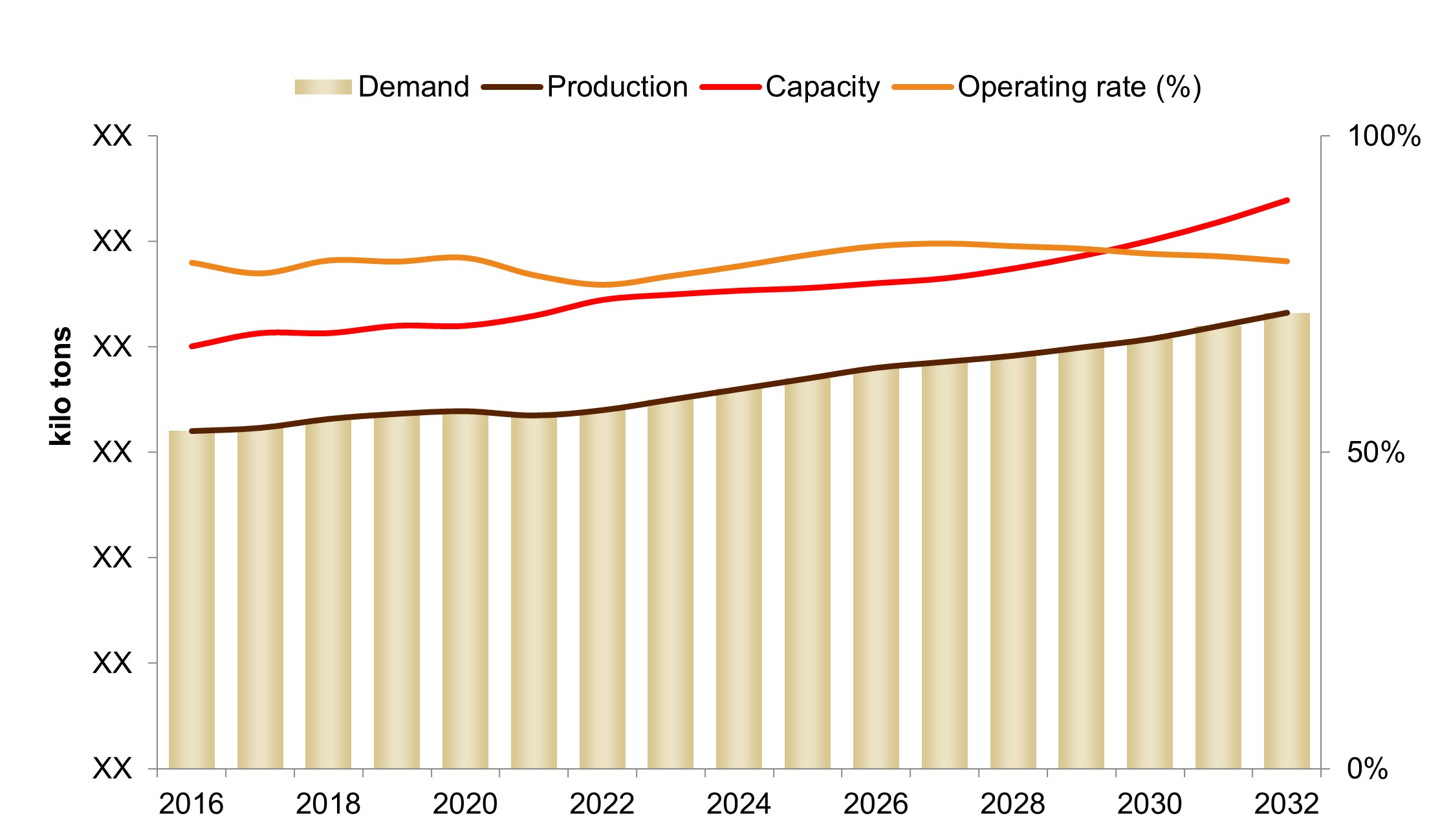

The global n-Butanol demand was estimated to be over 5350 kilo tons in 2022, which has grown from 4350 kilo tons in 2016. N-Butanol market is expected to grow at a CAGR of 3% between 2023 to 2032 owing to its widespread use in coatings or as a resin or solvent. n-Butanol is a less toxic solvent and is used a solvent in paints, coatings, vanishes and dyes, etc which is used to replace aromatic solvents. Thus, the demand for n-butanol will grow with the growth in end use industries like Automotive, Construction, Textiles and Others. n-Butanol is used as an alternative to ethanol for fuel applications and this n-butanol is produced via biomass fermentation to maintain the momentum of moving from hydrocarbon energy sources.

Global n-Butanol Capacities, By Company

The total capacity for n-Butanol was estimated to be over 6500 kilo tons. n-Butanol capacities are heavily concentrated in Asia Pacific, North America and Western Europe. BASF, DuPont, Oxea, Luxi Chemical Company, Saudi Butanol Company, Formosa Corp are some of the largest producers of n-Butanol globally. Majority of the capacity additions have been in Asia Pacific and very limited changes have been seen in North America. Global operating rates decreased up to 70% due to overcapacity in the China market.

Global n-Butanol Capacity, By Company (Kilo Tons)

Source: Secondary & Primary Research and Prismane Consulting estimates

Regional n-Butanol Market

In 2022, global n-butanol consumption was estimated to be more than 5,300, with the Asia Pacific region leading in demand, accounting for more than half of the global n-butanol demand. Asia Pacific also serves as a significant importer of n-butanol. North America and Western Europe rank together accounts for around 33% of the global n-butanol demand.

The n-Butanol demand in China has been anticipated to grow at a faster rate owing to the strong presence of the Construction and Industrial sector in the country. China has adopted strategies to reduce its imports in the mid-term forecast. The country is expected to turn to a net exporter in the long-term forecast.

Demand for n-Butanol in Western Europe was recorded to be more than 750 kilo tons in 2022, with its consumption in glycol ethers to be the largest end-use, followed by acrylates, acetates and solvents. Germany is the largest consumer of n-butanol in Western Europe followed by France and Spain.

Global n-Butanol Demand, By Region (Kilo Tons)

Source: Secondary & Primary Research and Prismane Consulting estimates

n-Butanol Market, By Applications

In 2022, Butyl Acrylates accounted for over 40% of global n-butanol market, followed by Butyl Glycol Ethers, Butyl Acetate, Plasticizers and Solvents application. Butyl acrylate is utilized in paints, coatings, adhesives, sealants, plastics, textiles, caulking materials and fuel and its derivatives could be used to enhance the impact strength of other acrylic plastics, by incorporating them as impact modifiers. Butyl glycol ethers are known for their excellent solvent properties, making them useful in paints, coatings, and inks. They are also used in cleaning agents, degreasers, and industrial formulations.

n-Butanol Trade Analysis

Asia Pacific stands out to be the largest destination for n-Butanol imports with China being the largest importer globally as well as biggest n-Butanol importer in the region. The country recorded an annual average n butanol import of around 240 kilo tons between 2016 and 2021. South Africa is the largest n-Butanol exporter with more than 108 kilo tons exports in 2021 at an average price of 1.5$/kg. Other major n butanol exporter are Malaysia, USA and Germany with 75 kilo tons, 37 kilo tons and 31 kilo tons respectively.

Average n-butanol Prices By Major Exporting Country - $/Kg

Source: Secondary & Primary Research and Prismane Consulting estimates

n-Butanol Market Dynamics

Rising demand for Coatings

n-Butanol is used for the production of butyl acrylates which is driven by coating application, adhesives and resin modifiers. The rising awareness towards VOC emissions in developed countries has created lucrative opportunities for acrylate esters such as butyl acrylate which will positively impact the n-Butanol market. The trend towards increased regulations will require more environmentally friendly coatings which will favour the n-butanol market. Butyl acrylate is expected to remain the driver for the n-butanol market in majority of the regions.

Recently BASF has started the construction of its new manufacturing complex at its Verbund site in China which includes plants for Butyl Acrylate (BA), Glacial Acrylic Acid (GAA), and 2-Ethylhexyl Acrylate (2-EHA), planned to come onstream by 2025.

Rising demand for biobased n-Butanol

The demand for biobased n-Butanol as a biofuel additive is rising in the transportation industry owing to the reduction of VOC content, greenhouse gas emissions, and volatility in crude oil prices. As a biofuel additive, n-butanol is preferred over ethanol as it includes more energy, better compatibility, less volatility.

According to the International Energy Agency (IEA), the global demand for biofuels is expected to grow by 41 billion liters or 28%, over the period 2021-2026. N-Butanol can be blended with gasoline at higher concentrations, and it is less corrosive than gasoline without changing any fuel delivery mechanism.

Environmental Impact of n-Butanol

N-butanol has several health impacts and environmental threats. The health hazards include dizziness, headache, seizures and unconsciousness. The VOC emissions through butanol-based paints and coatings have a serios impact on the environment. Rules and regulations have been imposed on the usage of high emission paints and coatings. The EU Construction Production Regulation (CPR), DIN EN 16516, and others help in regulating the production of high VOC concentrated N-butanol based coatings. Therefore, major environmental threats and restrictions on the production of paints can hinder the market for n-Butanol.

For Further Information on n-butanol market, Please click here

For more details on n-butanol market, please contact us at sales@prismaneconsulting.com