Polyimide Market Overview

The global Polyimide market was valued at USD 4 billion in 2022 and it has grown at an annual average growth rate of 9% between 2016-2022. The Polyimide market is projected to cross USD 11 billion by 2032, growing at a CAGR 10.8% from 2023-2032. Polyimide demand patterns are dramatically contrasting for different countries and regions. In areas with mature economies, the demand growth for polyimide is expected to remain below global averages, primarily due to the geographical shift of many manufacturing industries (such as electronic and automotive industry) to areas with lower labour costs such as China, India, and Vietnam.

Introduction to Polyimide

Polyimide is a high-performance plastic with good mechanical strength, high heat resistance and excellent dielectric properties. Polyimides are manufactured by a condensation polymerization reaction between aromatic primary diamines and aromatic tetracarboxylic dianhydrides. There are two types of Polyimide Resins, thermoplastic and thermosetting resins. Thermoplastic Polyimide Resins are those resins which can be melted and reformed. Thermosetting resins cure irreversibly when heated and have excellent heat stability. Majority of polyimide is consumed in the form of films & tapes; however, rest is consumed as stock part, coatings & adhesive, composite, and fibres. All these polyimide materials are made from polyimide resins. Most of polyimide resins have captive consumption in integrated plants to manufacture films & tapes and various other shapes whereas; very small quantity is available for direct sale. Generally, polyimide resins are available in form of solid resin powder or in liquid form.

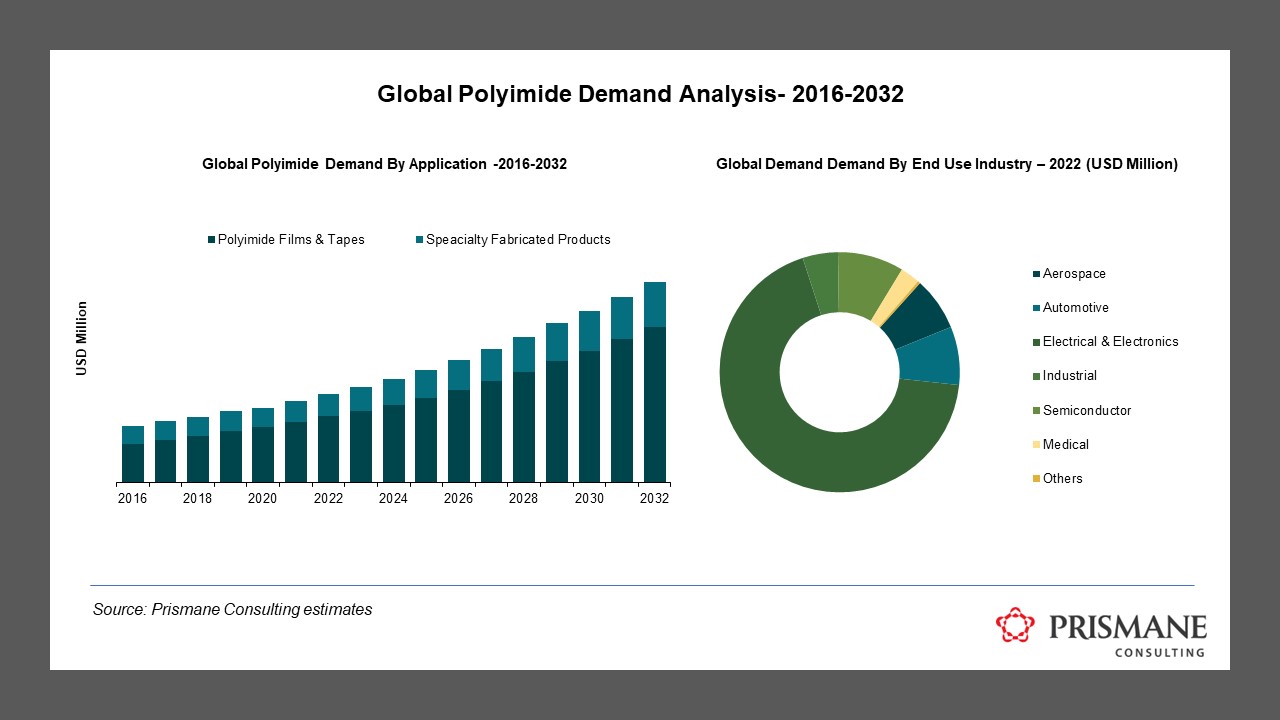

Global Polyimide Demand, By Application, 2016-2032 (USD Million)

Source: Secondary & Primary Research and Prismane Consulting estimates

Polyimide Market By Applications

In terms of Polyimide market by applications, the market is segmented into Polyimide Films & Tapes and Specialty Fabricated Products. Polyimide Films & Tapes accounted for the largest share owing to its widespread usage in various End-Use Industries. The Polyimide films and tapes application will continue to dominate the market in the forecast period, growing at a annual average rate of 11% between 2023-2032. SKC Kolon PI, Dupont, Kaneka, Taimide, and Dupont Toray are some of the leading Polyimide films producers globally.

Polyimide Films & Tapes are widely used in various electrical and electronic applications due its dielectric properties, dimensional stability, high modulus and its matching coefficient of expansion with copper. Polyimide films and tapes are offered in various thicknesses ranging from 5 µm to 50 µm. Polyimide tapes are used for applications that require thermal insulation or electrical insulation properties.

In 2022, Specialty Fabricated Products application accounted for less than 30% of the global Polyimide market and it is further anticipated to grow at a CAGR of 10% in the long term forecast period. Specialty fabricated products have niche applications and comes in customized sizes and shapes. Major specialty fabricated product applications are for the transport belts, space blankets, speaker coils, carrier and sensors.

Global Polyimide Demand, By End Use Industry, 2022 (USD Million)

Source: Secondary & Primary Research and Prismane Consulting estimates

Polyimide Market By End Use Industry

The End-Use Industries for Polyimide Resins are Aerospace, Automotive, Electrical, Industrial, Semiconductor & Solar, Medical and Others (Packaging), etc. Electrical & Electronics segment constituted for the largest demand accounting for over 70% of the global Polyimide market followed by Semiconductor & Solar application accounting around 11%. Polyimide are used in the electrical & electronics industry as it offers superior electrical characteristics, especially in high-end applications. It also provides Thermal stability at high-temperatures and High dielectric strength. Flexible printed circuit, specialty fabricated products and other high-end engineering applications are some of the direct applications of polyimide films and products which consumes major share of the Polyimide demand.

Automotive and Aerospace together account for around 15% of the global Polyimide market. Polyimide are also commonly used in the Aerospace industry owing to its light weight, durability and temperature resistance and are used in Ground Systems Engineering (GSE) applications such as temporary & permanent tiedowns, FOD control, harness wrap, blanket closeouts, and thermal radiation sinks.

Global Polyimide Demand, By Region, 2022 (USD Million)

Source: Secondary & Primary Research and Prismane Consulting estimates

Polyimide Demand By Region

The global Polyimide market size was valued at $4 billion in 2022, and is poised to reach $11 billion by 2032, registering a CAGR of 10% from 20323-2032.In 2022, Asia Pacific accounted for the largest share in the global polyimide market on the back of presence of strong Electrical & Electronics industry in the region. The polyimide market in Asia Pacific is projected to grow at a CAGR of 11.3% between 2023-2032 owing to strong presence of Electrical & Electronics and semiconductor industry which is expected to boost the Polyimide demand. North America is the second biggest polyimide market accounting for more than 15% of the global market followed by Western Europe. Central & Eastern Europe, Middle East & Africa and Central & South America together accounts for less than 5% of the global polyimide demand.

Polyimide Market Dynamics

Drivers: Rising Polyimide Demand from Various End-Use Industries

Polyimide offer excellent properties, including high thermal stability, tensile properties and exceptional chemical resistance, making them a viable alternative to glass, metals and steel in the several industries. Polyimide is renowned for its exceptional thermal stability. It can withstand temperatures ranging from -200°C to 300°C without any degradation. This property makes it ideal for applications in aerospace, automotive, and electronics industries where exposure to extreme temperatures is common.

They are used in several automotive parts such as fuel lines, brake hoses, and electrical insulation as PI films offer excellent resistance to chemicals, heat, and abrasion, which makes them ideal for use in automotive applications.

Polyimide are used in aircraft because of their low weight-to-strength ratio, these resins can be molded into complex shapes that are resistant to both chemicals and UV light, making them ideal for use in aerospace applications.

Polyimide Film is also suited for flexible printed circuits with good high-temperature resistance and moderate thermal expansion. As a result, polyimide sheets are commonly used in the electrical & electronics industry. Polyimide are also used to manufacture printed circuit boards (PCBs), semiconductor devices, and other electronic components.

In the medical industry, Polyimide is used for medical tubing such as vascular catheters for the burst pressure resistance, flexibility and chemical resistance.

PI Films are usually used as a dielectric substrate in flexible solar cells owing to their high thermal stability, toughness and flexibility. PI films are used to manufacture solar cells with maximum efficiency and as substrates in thin films such as a-Si and CIGS photovoltaic applications owing to their high thermal stability.

Restraints

Presence Of Several Alternatives in The Market

There are a number of other polymers including polyethylene terephthalate, polycarbonates, PTFE and LCP that are competitive materials of polyimide. Polyester Films (PET Films) are widely used as an alternative to PI Films as they provide good dimensional stability, resistance to moisture and clarity. PET films are often used in applications such as packaging, labels, etc and are more affordable as compared to Polyimide films. This cost advantage makes them an attractive choice for applications where high-performance Polyimide properties are not critical. PET films are known for their flexibility, which can be advantageous in applications requiring conformability or where bending and flexing are common.

High Costs of Polyimide

Polyimide is an expensive material to produce compared to some other polymers. Despite having attractive properties for electrical and electronics applications, polyimide being a super engineering plastic is way more expensive compared to other commodity plastics. This puts it at some disadvantage.

Polyimides can be challenging to process due to their high melting points and limited solubility in common solvents. Specialized equipment and processing techniques are often required, increasing manufacturing complexity and costs.

Du-Pont / Toray Du-Pont, SKC Kolon (PI Advanced Material), Kaneka, Taimide, Ube Industries and Pingmei Shenma Group are some of the leading manufacturers of Polyimide globally.

SKC Kolon announced that the company will supply PI films to Taiwan’s Asus for its foldable notebook. These films will be used as cover windows and protective films for their ZenBook 17-Fold OLED. The company also supplied PI films to Lenovo for their foldable PC ThinkPad X1 Fold in late 2020.

Taimide Tech has expanded the applications of its PI films from flexible PCBs (FPCBs) to heat-dissipation materials, electric vehicle-use batteries and others.

In 2021, Kaneka Corporation developed “PixeoTM 1IB”, a super heat-resistant polyimide film for high-speed, high frequency 5G.

For Further Information on the Polyimide market, Please click here

To View Sample on the Polyimide market, Please click here

For more details on the Polyimide market, please contact us at sales@prismaneconsulting.com