Introduction to Methyl methacrylate (MMA)

Methyl methacrylate (MMA) is an ester of methacrylic acid, widely employed in polymethyl methacrylate (PMMA) production, which is further used to make sheets and molding & extrusion products. Other applications include acrylic surface coatings and polymer modifiers. Polymethyl methacrylate production represents more than half of the global Methyl methacrylate consumption.

Polymethyl methacrylate shows excellent resistance towards water, alkalis, dilute acids, and aqueous inorganic salts. It is primarily used in molded & sheet-extruded products. While molded PMMA products are used in vehicle parts, consumer goods, and electrical appliances, sheet-extruded products are used in lighting, displays, and glazing.

More than a quarter of Methyl methacrylate consumed globally is molded & extruded. Since both Methyl methacrylate and Polymethyl methacrylate primarily find applications in the construction and automotive sectors, their demand growth tracks GDP and is also significantly influenced by global economic conditions.

Global Methyl methacrylate Capacity Overview

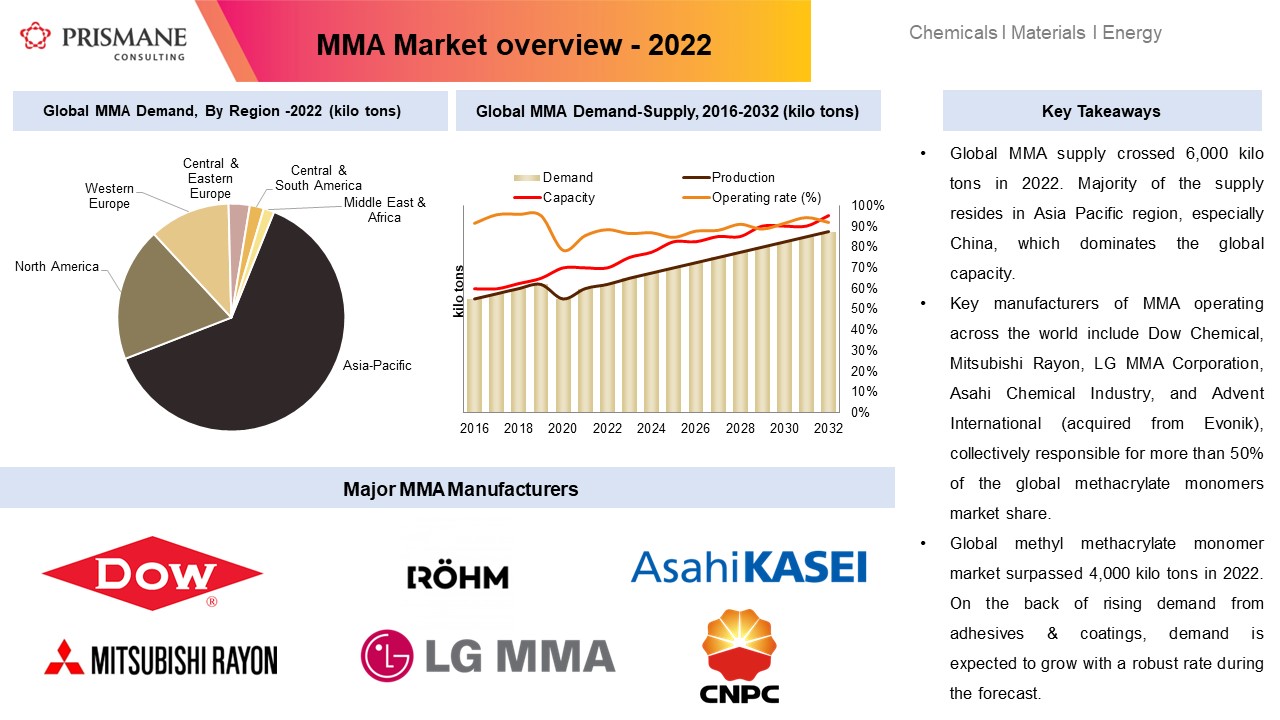

Global methyl methacrylate supply crossed 6,200 kilotons in 2023. The majority of the supply resides in the Asia Pacific region, especially China, which dominates the global capacity. The region continues to see new supply additions, driven by rising domestic demand. Asia Pacific followed by North America and Western Europe. The Middle East has emerged to be another Methyl methacrylate producer in recent years, intensifying the market competition. These include Saudi Methacrylates Company’s 250 Kiloton/annum plant at Jubail Industrial City, and Petro Rabigh’s 50 Kiloton/annum plant at Rabigh, both located in Saudi Arabia and started operations in 2018.

Methyl Methacrylate Market Overview

The global methyl methacrylate monomer market surpassed 4,100 Kiloton in 2023. On the back of rising demand for adhesives & coatings, demand is expected to grow with a robust rate during the forecast. Besides supply, China also dominates the global methyl methacrylate market, representing a nearly one-third share. With increasing domestic supply, China has gradually reduced its import dependency and is expected to change its status to a net exporter in the coming years.

Overall, the global methyl methacrylate market has been shaped by several factors, including growth & contraction in automotive and construction sectors over the years, COVID-19 impact, supply additions and shifting trade flows in China and the Middle East, high-interest rates and economic uncertainty following the Russia-Ukraine war.

Methyl Methacrylate Capacity Analysis

Methyl Methacrylate Prices

Methyl methacrylate prices in the United States averaged at USD 2000/ton in 2023, reflecting the demand decline amid soaring inflation. The fall in the prices can also be attributed to the decline in the prices of feedstock acetone cyanohydrin. Stable to soft demand from the automotive and construction sectors also pushed methyl methacrylate prices down in Europe. While soaring energy and raw material costs in the aftermath of the Russia-Ukraine war prompted domestic manufacturers to bring about price hikes, this was short-lived as buyers' growing preference for sourcing cheaper shipments from North America and Asia Pacific ultimately forced producers to bring prices down.

In China, methyl methacrylate prices were assessed at USD 1905/ton in 2023, amid a slowdown in domestic demand. Prices continued to remain bearish, driven by weak market conditions and consumer sentiment, following a period of strict lockdowns ordered in the beginning of the year. Better conditions in the Polymethyl methacrylate industries during the later part of the year ultimately pushed prices slightly up.

For Further Information on Methyl methacrylate market, Please click here

To View a Sample on the Methyl methacrylate market, Please click here

For more details on Methyl methacrylate market, please contact us at sales@prismaneconsulting.com